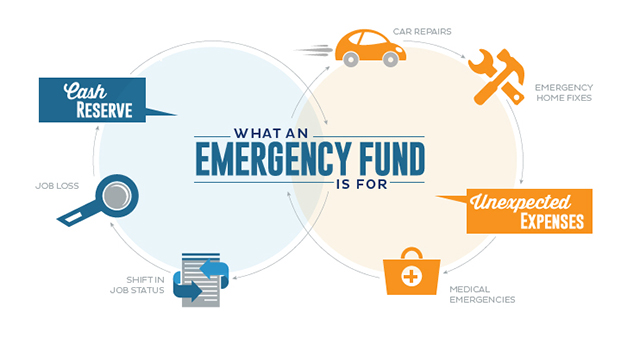

A loss of your job, a cut in income, an unforeseen expense—are all situations that call for access to funds that can help you tide over the shortage of income. You cannot forecast emergencies and unplanned expenses, but you can estimate what you need to take care of your regular expenses, including loan repayments. Ideally, you should prepare to set aside funds to cover at least 3 to 6 months of expenses. In the absence of an emergency fund, you would be forced to borrow, or liquidate existing investments—maybe even at a loss. Your credit score will take a hit with the additional debt. Paying off the debt will be a drain on your income and delay all your other investment plans for a long time.

The investment for emergency funds should ideally be liquid, with a high degree of safety and stability in returns. This is not an investment where the investor should look at maximising returns.

A savings bank account ticks all the right boxes. It provides high degree of safety and you can withdraw the funds without restrictions.

A money market mutual fund scheme is also a good choice.

One good option would be to ladder the investments. Laddering is done by splitting the total funds into segments, as it is unlikely that you will need the entire amount at the same time.

The first tranche is invested for liquidity, in a product like the savings account, so it can be withdrawn at any time. If your income is unstable and often not enough to meet your essential expenses, then you may need more of your funds in the first tranche as you are likely to fall back on it more often.

The second tranche can have slightly longer holding periods such as short-term bank deposits and ultra-short term mutual funds. They earn better returns and can also be withdrawn at short notice.

The last category can be investments with longer holding periods for better returns, as you are likely to have more time to liquidate these, and you may not have to sell at a loss if the values were down or to avoid a penalty on early withdrawal.

Estimate the amount you need in your emergency fund and use your savings first to build it.

The emergency fund is not for you to spend as you please. It is for use in an emergency or to meet essential expenses. If you use the fund at any time make sure you replenish it as soon as possible. As your income and expenses go up, your emergency fund requirement will also change and you will have to top the fund periodically. The emergency fund is your primary protection against vagaries of your income.