A balanced fund is a type of mutual fund which has exposure to the two primary asset classes, equity (usually at least 65%) and debt (usually up to 35%).

Balanced funds are treated as equity-oriented funds for purposes of income tax, and offer a better post tax return than combining equity and debt funds in the same proportion.

The equity allocation provides long-term growth and the debt exposure reduces the volatility of the returns thus offering the benefits of asset allocation in a single product .

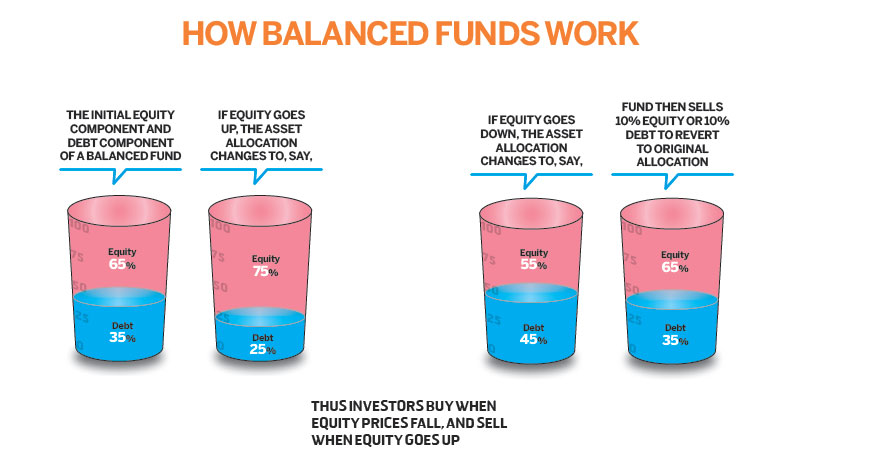

The fund manager manages the allocation to equity and debt in a dynamic manner and so the investor does not need to keep track of the asset allocation of the fund and does not have to carry out the re-balancing at his end.

Re-balancing happens without any tax implication to the investor who would have otherwise paid tax if he managed the asset allocation himself through different funds.