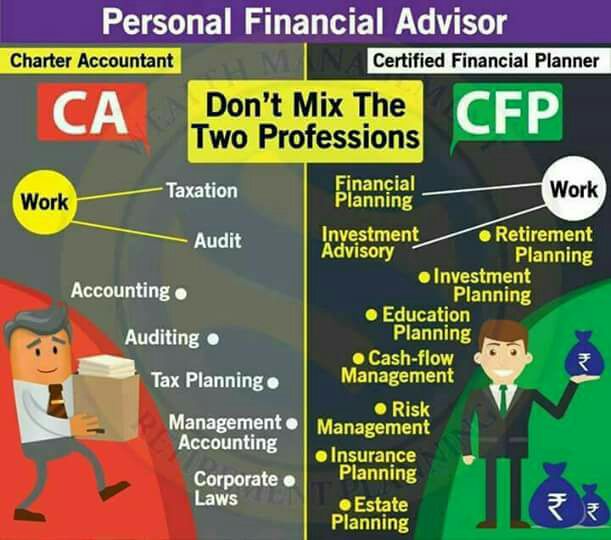

Many people surmise that their Chartered Accountant can do the job of both accounting and financial planning (or vice versa) when in fact, the two roles complement each other. Neither professional can do the entire job of the other.

Role of CA

1) Taxation – A CA is an expert in the areas of taxation, both personal as well as corporate. A CA can help you plan your taxes well and is well versed with the latest tax laws.

2) Auditing – If you have a business/company, a CA can perform an audit on the accounts and certify the same and is is authorized to do so. A CFP cannot perform an audit.

3) Accounting – A CA is brilliant with accounting concepts, making balance sheets, reading the financials of a company, etc.

Here are some of the issues a Chartered Accountant can help you with:

Tax preparation

Financial statements

Depreciation

Breakdown of expenses

Appropriate tax shelter recommendations

Tax laws and how they affect you

Business structure recommendations and advice

Business growth and succession strategy in relation to taxes

Audit representation

If accounting is all about taxes, then financial planning is all about investments — but just as accountants can offer so much more than filing your taxes, so too can financial planners do more than invest your money. Financial planners are also (ideally) focused on the big picture, but the picture in question is a little different from the one accountants look at. Financial planners are very goal-oriented and holistic, with an eye to building wealth in the most effective manner while taking into account the life goals and needs of clients as individuals.

Role of CFP

1) Insurance Planning – A Financial Planner can help you with your insurance needs and would be able to calculate how much insurance you actually need and what type of insurance plan is the best for the said purpose.

2) Retirement Planning – A CFP can calculate how much of a corpus you would need at the time of retirement so that it would suffice for the rest of your life and would also tell you how much you need to invest monthly from now to achieve this.

3) Investment Planning – A CFP can suggest you a suitable portfolio depending on your risk appetite, goals, etc and is also well versed with investment products available and their past returns.

4) Tax Planning – A CFP will not just minimize tax for the year but would help you plan your taxes in advance and will suggest products depending on your tax status.

5) Estate Planning – A CFP will make sure you have a Will in place.

6) Budgeting & Cash Flow – A CFP will encourage you to prepare a budgeting sheet so that you can track your income and expenses and will also check your cash flow from time to time and offer suggestions accordingly.

7) Financial Planning – A CFP can prepare a financial plan by integrating all the above concepts, help you track your past and present investments and would review your portfolio every 6 months – 1 year or whenever there is a major event such as marriage, birth of child, divorce, etc.

Here are some of the things your financial planner will focus on:

Budgeting

Investing (short, medium, and long-term, in a variety of vehicles)

Asset allocation

Estate planning

Insurance planning (disability, life, investment, professional indemnity)

Changes in the industry that affect you

Wealth accumulation and protection

You may find a financial planner or accountant who seems to provide the whole enchilada. For example, increasing numbers of accountants are broadening their expertise to include additional designations in financial planning so they can do just that; separate advisers, financial planners and accountants have many overlapping areas of knowledge and advice.

While it may be appealing to have an adviser who can provide one-stop-shopping for you, your business, and your family, it is recommended that you create a financial team to support you — specifically your Chartered Accountant, Certified Financial Planner, and Lawyer. Each of these experts has a broad base of knowledge and will bring a viable perspective to the table that can also keep the other advisers in check. Each of these fields is an entire degree unto itself and should be respected as such. No one advisor can truly do the job of all three (or even two) without letting something slip through the cracks.