Financial freedom is the state of having sufficient personal wealth to live, without having to work actively for basic necessities. For people enjoying financial freedom, their assets generate income and/or cash flow from dipping into the assets that is at least as great as their expenses. For example, a person’s quarterly expenses may total Rs. 4,00,000. They receive dividends from stocks they have previously purchased totaling Rs. 5,00,000 quarterly, while also having more money in other assets. Under these circumstances, a person is financially free.

A person’s assets and liabilities are an important factor in determining if they have achieved financial freedom. An asset is anything of value that can be liquidated if a person has debt, whereas a liability is related to debt, in that it is the responsibility of one possessing it to provide compensation. (Homes and automobiles with no liens or mortgages are common assets.)

It does not matter how old or young someone is or how much money they have or make. If they can generate enough money to meet their needs from sources other than their primary occupation, then they have achieved financial freedom. Age is potentially irrelevant with respect to financial freedom. If they are 25 years old and their expenses are only Rs. 10,000 per month and they have assets that generate Rs. 11,000 or more per month, they have achieved financial freedom, and they are now free to do things that they enjoy without having to worry as much. If, on the other hand, they are 50 years old and earn five lakhs a month but still have expenses above five lakhs a month, then they are not financially free because they still have to generate the difference each month just to stay even.

However, this needs to take into consideration the effects of inflation. If a person needs Rs. 10,000/month for living expenses today, that figure will be Rs. 10,600/month next year and Rs. 11,236/month in the following year to support the same lifestyle assuming a 6% annual inflation rate. Therefore, if the person in the above example obtains their passive income from a perpetuity, there will be a time when they lose their financial freedom because of inflation.

Freedom comes with knowledge – knowledge of what you have, what you want and how you can get it.

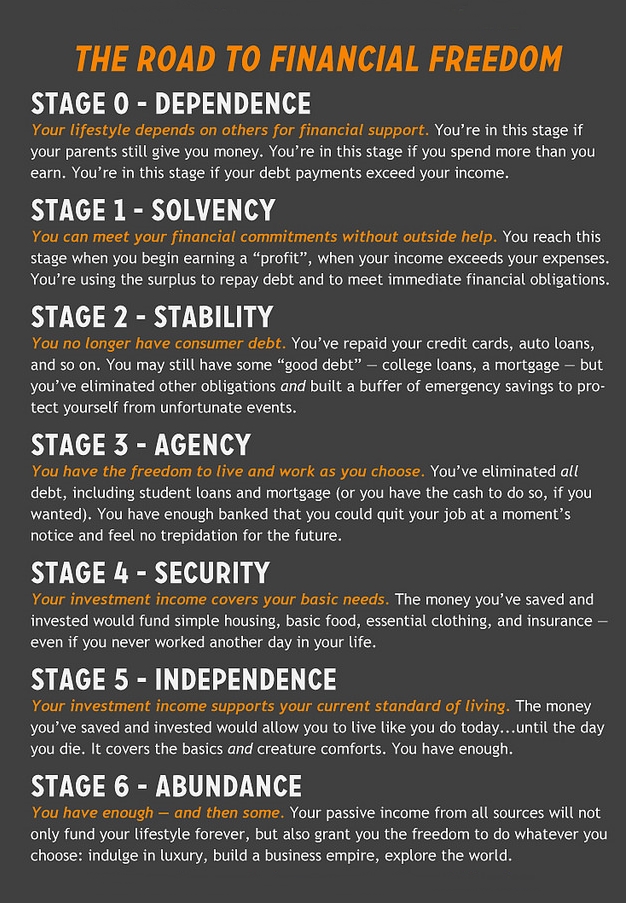

Came across this, @Moneyboss.com – Six Stages of Financial Freedom :

Define the Freedom which you are looking for, clear off the restrictions which may stop you from achieving your goal, plan for the responsibilities you have, and strive for the life that you want to live.