Lauren Solberg, data journalist at Morningstar, on what made the Indian stock market stand out in 2021.

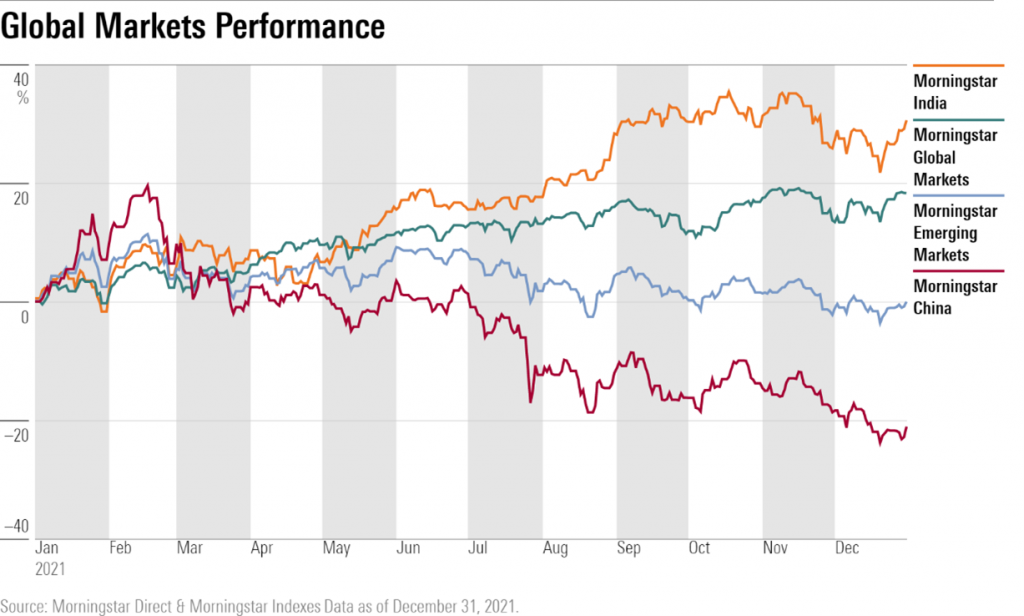

After lagging for two years, India’s stock market staged a powerful rally in 2021, topping the charts among major Emerging Markets, benefiting from the woes hitting Chinese stocks.

By how much?

2021: The Morningstar India Index rose 30% to a new all-time high (Morningstar Emerging Markets Index was flat).

Past 5 years: The Morningstar India Index is up 16.3% per year on average (10.7% for the Morningstar Emerging Markets Index).

What gained in 2021

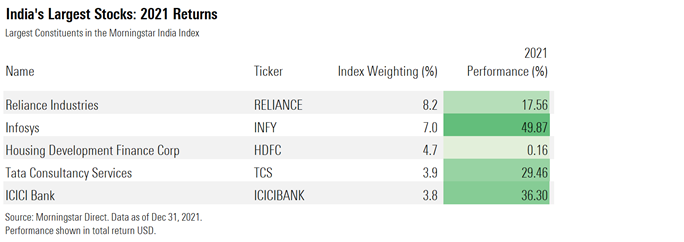

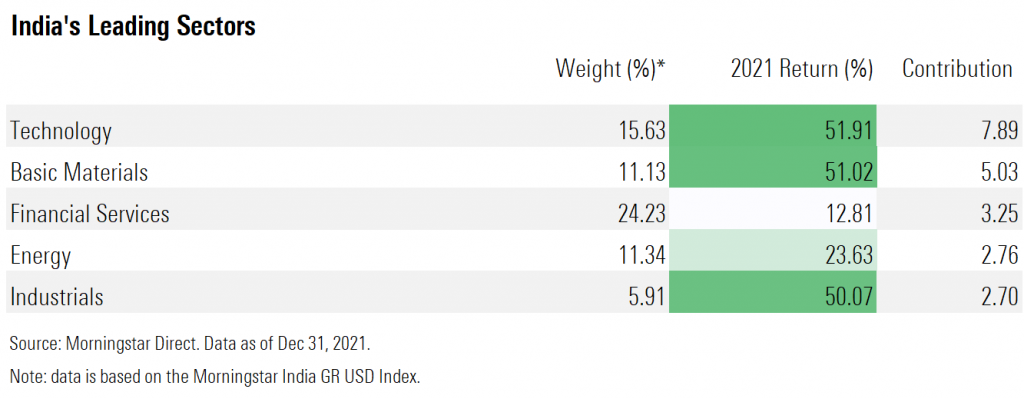

The rally in India’s stock market was led by technology names such as Infosys, along with the basic-materials and industrials sectors.

India’s technology, basic-materials, and industrials sectors all returned over 50%.

Financial services and energy also made strong contributions.

Adani Total Gas and Adani Transmission saw outsize returns of 350% and 290%, respectively.

Infosys was the leading contributor for the year, gaining 50%.

Banks such as ICICI Bank, which returned 36%, also made the top contributors list.

The strong market performance was multifaceted.

A strong recovery from the coronavirus downturn was helped by stimulus programmes, a record number of initial public offerings, and foreign investor rotation out of China and into India.

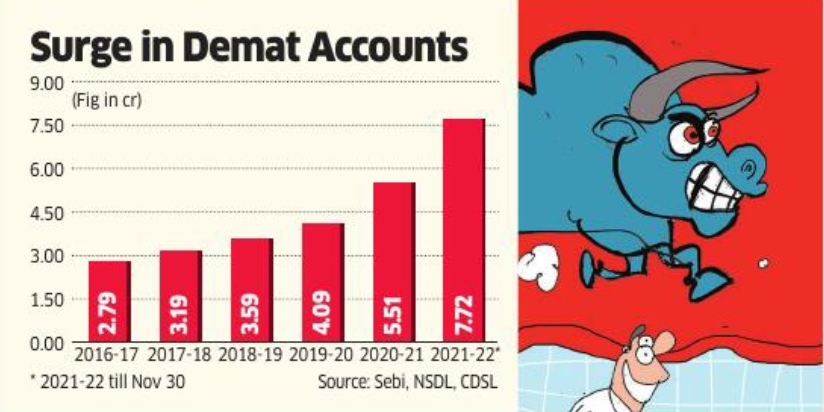

Domestic inflows.

India stocks got off to a slow start in 2021 as COVID-19 swamped the country. But by midyear, the market started to climb. “Liquidity was strong, market participation went up. Investors who were not invested yet wanted to get in. That’s the reason we saw strong inflows domestically,” explains Himanshu Srivastava, associate director of EMEA fund research for Morningstar India.

Stimulus.

At the same time, the government offered relief to industries heavily affected by the coronavirus, including telecom, auto, and banking. “Auto companies were facing severe headwinds like low demand; the government loans helped them stay strong,” adds Srivastava.

The China factor.

India’s recovery was particularly robust in contrast to the struggles of Chinese stocks, a market that had been a major destination for many emerging-markets investors.

“China has been plagued by regulatory titans and fears of economic slowdown,” says Samuel Lo, a Morningstar manager research analyst based in Hong Kong. In addition, geopolitical issues with the U.S. have turned some foreign investors away from China. “People are moving money out of China and into India, and the contrast is stark,” Lo says. In 2021, the Morningstar China Index lost 21%.

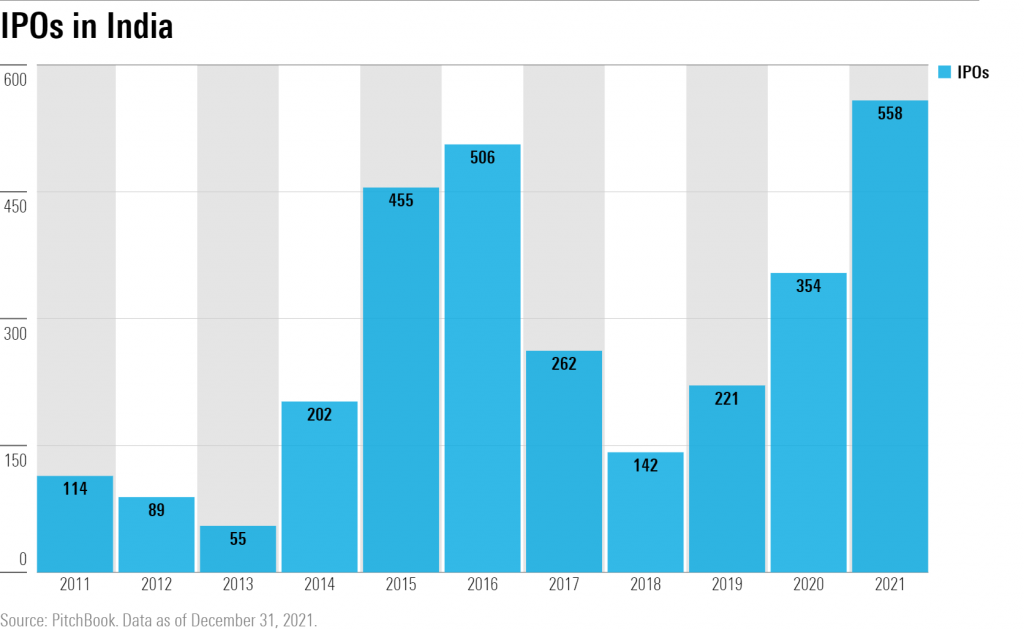

The IPO boom.

A record number of initial public offerings also contributed to India’s market rally. In 2021, the country saw over 550 IPOs, for a total amount of over $70 billion of capital invested. It’s been five years since the IPO count in India rose to similar levels.

Demonetization.

Over the past several years, the Morningstar India Index has outperformed or performed in line with global markets, with the major exception of 2020. “A key contributor was the demonetization effort in India,” says Lo. In 2016, the Indian government demonetized all 500 and 1,000 rupee bank notes. “At the outset, the impact was chaotic. But in 2017, the policy started to have its affects,” Lo notes. “People put their cash into banks and funds, propping up the stock market.”

Going Ahead into 2022.

“The year 2021 isn’t an anomaly. India has a lot of high-quality companies. They’ve got good financials, good governance, and compelling growth prospects, ” says Andrew Daniels, an associate director of manager research at Morningstar

But Srivastava cautions that high IPO counts can also be a sign of overvaluation in the market. A prominent illustration was the IPO of digital payment company Paytm. The stock opened in mid-November with a price of $21.02 but ended the year down over 15%. “The valuation was so high, Paytm couldn’t possibly meet those expectations,” he says.

Signs of overvaluation extend beyond the realm of IPOs, according to Lo, who also points to Reliance Industries, the largest stock in the Morningstar India Index.

“Originally an energy giant, RIL recently ventured into both retail and tech, expanding the scope of its business empire,” Lo says. “People love that–and the stock price has been rewarded. But there’s murkiness to Reliance’s accounting and corporate governance.” Fundamentally, Reliance may not be as strong a company as investors are currently giving it credit for, he says.

From here, Srivastava says mutual fund managers remain bullish. “Regarding long-term sentiment, fund managers were unanimous: The coronavirus will not impact India’s market too heavily going forward,” he says. “India’s long-term upward trend is expected to continue.”