Investors tend to open different demat accounts over a period of time, making it increasingly difficult to keep track of these accounts separately. Consolidating share holdings into a single demat account helps investors to take a single look at all their stocks and provides a comprehensive picture of returns on investment. It is possible to transfer shares from one demat account to another using a simple procedure explained below.

Offline procedure

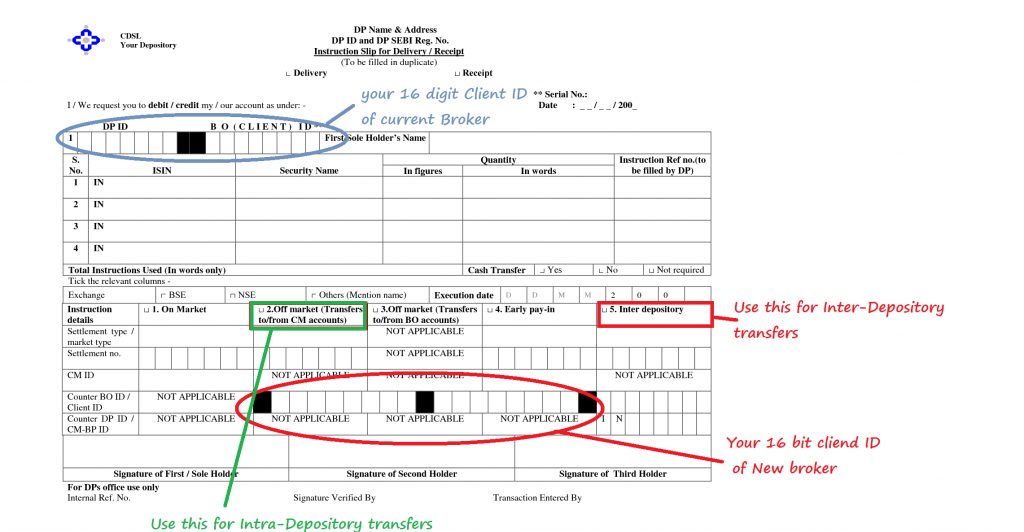

With respect to shares held with NSDL or CDSL depositories, offline procedure for transfer of shares through off market transfer is possible. One needs to fill out a DIS (Delivery Instruction Slip). ISIN number of the shares to be transferred, name of the company (security), demat account and DP ID of the account to which the shares are being transferred must be filled up in the form. The form needs to be submitted at the old broker’s office for further processing.

Online procedure

If shares are held with CDSL, there is an online facility for transfer of shares using the ‘EASIEST’ platform. One needs to register on this platform using the link, https://web.cdslindia.com/myeasi/Home/Login and providing existing demat account details. Next, a trusted account needs to be added which essentially is the demat account where the shares are to be transferred. Once the account is successfully added after 24 hours, one can transfer securities from the old demat account to the new one.

Points to note

This transfer of shares does not amount to change of beneficial ownership and does not amount to capital gains on transfer.

The broker may charge a stated fee for processing the transfer request. However, if the old account is being closed, no fee can be charged.