Most investors can’t see the macro future better than anyone else. Thus trying to predict the future won’t make them successful investors.

Neverthelsess, most investors act as if they can see the future. Either they think they can, or they think they have to pretend they can. That’s dangerous if it turns out they can’t, as usually is the case.

Once in a while someone receives widespread attention for having made a startlingly accurate forecast. It usually turns out to have been luck and thus can’t be repeated.

One of the main reasons for this is the enormous influence of randomness. Events often fail to materialize as they should. Improbable things happen all the time, and things that are likely fail to happen. Investors who made seemingly logical decisions lose money, and others profit from unforeseeable windfalls. Nothing is more common than investors who were “right for the wrong reason” and vice versa.

Investors would be wise to accept that they can’t see the macro future and restrict themselves to doing things that are within their power. These include gaining insight regarding companies, industries and securities; controlling emotion; and behaving in a contrarian and counter-cyclical manner.

While we can’t see where we’re going, we ought to have a good sense for where we are. It’s possible to enhance investment results by making tactical decisions suited to the market climate. The most important is the choice between aggressiveness and defensiveness. These decisions can be made on the basis of observations regarding current conditions; they don’t require guesswork about the future.

Superior results don’t come from buying high quality assets, but from buying assets – regardless of quality – for less that they’re worth. It is essential to understand the difference between buying good things and buying things well.

A low purchase price not only creates the potential for gain; it also limits downside risk. The bigger the discount from fair value, the greater the “margin of safety” an investment provides.

Sometimes there are plentiful opportunities for unusual return with less – than – commensurate risk, and sometimes opportunities are few and risky. It’s important to wait patiently for the former. When there’s nothing clever to do, it’s a mistake to try to be clever.

The price of a security at a given point in time reflects the consensus of investors regarding its value. The big gains arise when the consensus turns out to have underestimated reality. To be able to take advantage of such divergences, you have to think in a way that departs from consensus; you have to think different and better. This goal can be described as “second-level thinking” or “variant perception”.

Superior performance doesn’t come from being right, but from being more right than the consensus. You can be right about something and perform just average if everyone else is right, too. Or you can be wrong and outperform if everyone else is more wrong.

Any time you think you know something others don’t, you should examine the basis for that belief. “Does everyone know that?” “Why should I be privy to exceptional information or insight?” “Am I certain I’m right and everyone else is wrong; mightn’t it be the opposite?” If it’s the result of advice from someone else, you must ask,”Why would anyone give me potentially profitable information?”

Over the past few decades, investors’ timeframes have shrunk. They’ve become obsessed with quarterly returns. In fact, technology now enables them to become distracted by returns on a daily basis, and even minute – by – minute. Thus one way to gain an advantage is by ignoring the ‘noise’ created by the manic swings of others and focusing on the things that matter in the long term.

It isn’t the inability to see the future that cripples most efforts at investment. More often it’s emotion. Investors swing like a pendulum – between greed and fear; euphoria and depression; credulousness and skepticism; and risk tolerance and risk aversion. Usually they swing in the wrong direction, warming to things after they rise and shunning them after they fall.

Most investors behave pro-cyclically, to their own detriment.When economic indicators, corporate earnings and asset prices have been rising, people become more optimistic and buy at cyclical highs. Likewise, their pessimism grows when the reverse is true, causing them to sell (and certainly to not buy) at cyclical lows. It’s essential to act counter-cyclically.

Cyclical ups and downs don’t go on forever. But at the extremes, most investors act as if they will. This is a big part of the reason for bubbles and crashes.

There are three stages to a bull market:

the first, when a few forward – looking people begin to believe things will get better,

the second, when most investors realize improvement is actually underway, and

the third, when everyone concludes that things can only get better forever.

It’s important to practice ‘contrarian’ behavior and do the opposite of what others do at the extremes. For example, the markets are riskiest when there’s widespread belief that there’s no risk, since this makes investors feel it’s safe to do risky things. Thus we must sell when others are emboldened (and buy when they’re afraid).

The efficient market hypothesis holds that thanks to the combined efforts of thousands of intelligent, informed and motivated investors, the market price of each asset accurately reflects its underlying or intrinsic value. Thus market prices are fair, and if you pay the market price, you can expect to earn a risk-adjusted return that’s fair relative to all other assets – no more and no less. This is the reason for the assertion that “you can’t beat the market.”

While not all markets are efficient – and none are 100% efficient – the concept of market efficiency must not be ignored. In more-developed markets, efficiency reduces the frequency and magnitude of opportunities to out-think consensus and identify mispricings or ‘inefficiencies’.

In the search for market inefficiencies, it helps to get to a market early, before it becomes understood, popular and respectable. There’s nothing like playing in an ‘easy game’ – an inefficient asset class – where the other investors are few in number, ill-informed or biased negatively. That’s far easier than trying to be the smartest person in a game that everyone understands and is eager to play.

What the wise man does in the beginning, the fool does in the end.

In investing, the behavior of the participants alters the landscape; this is what George Soros calls ‘reflexivity’. Thus markets should be expected to become more efficient over time. When investors who bought early show big gains, others will rush in and bid things up. It makes no sense to assume a market that offered bargains in the past will always do so in the future.

To be a successful investor, you have to have a philosophy and process you believe in and can stick yo, even under pressure. Since no approach will allow you to profit from all types of opportunities or in all environments, you have to be willing to not participate in everything that goes up, only the things that fit your approach. To be a disciplined investor, you have to be able to stand by and watch as other people make money in things you passed on.

Every investment approach – even if skillfully applied – will run into environments for which it is ill-suited. That means even the best of investors will have periods of poor performance. Even if you’re correct in identifying a divergence of popular opinion from eventual reality, it can take a long time for price to converge with value, and it can require something that serves as a catalyst. In order to be able to stick with an approach or decision until it proves out, investors have to be able to weather periods when the results are embarrassing. This can be very difficult.

Being too far ahead of your time is indistinguishable from being wrong.

Those who invest the money of others, rather than their own, have to worry about losing their jobs or their clients. Fear of embarrassing performance can make them excessively risk-averse and cause them to over-diversify and shy away from bold commitments.

To succeed you have to survive, and in particular that means avoiding selling out at market bottoms. It’s not enough to survive “on average”; you have to survive on the worst days. Selling out at the bottom – and thus failing to participate in the subsequent recovery – is the cardinal sin of investing. The ability to persevere requires consistent adherence to a well-thought-out approach; control over emotion; and a portfolio built to withstand declines.

Risk is an inescapable part of investing. You shouldn’t expect to make money without bearing risk. Any approach, strategy or investment that promises substantial gain without risk is simply too good to be true.

But you also shouldn’t expect to make money just for bearing risk. Many people believe riskier investments produce higher returns, and thus the way to make more money is to take more risk. That can’t be right.

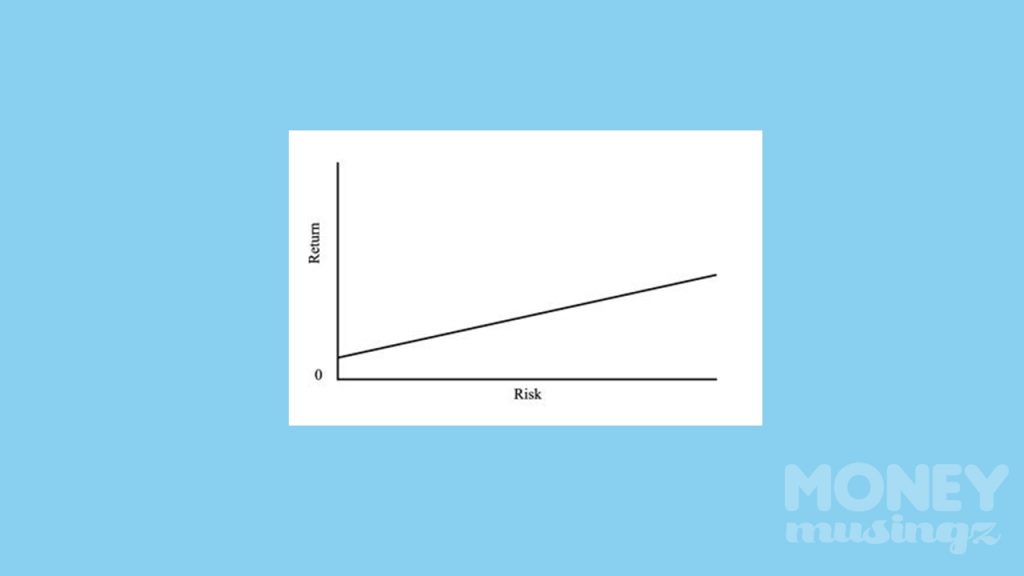

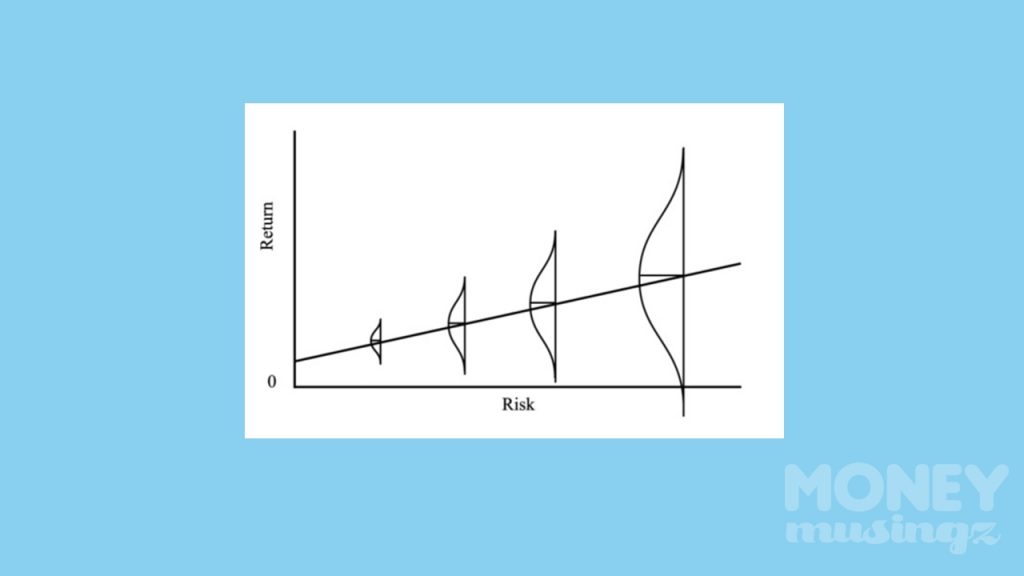

There’s a very popular graphic that purports to show the relationship between risk and return.

Most people interpret it to mean ‘riskier assets produce higher returns’ or ‘the way to make more money is to take more risk’. These are traps into which most investors fall, especially in times when things are going well and risk taking is being rewarded

It’s true that investments that seem riskier must appear to offer higher returns in order to attract capital. But if risky investments could be counted on to produce high returns, they wouldn’t be risky.

As risk increases,

the expected return rises

the range of possible outcomes becomes wider, and

the worst outcome worsens and ultimately becomes negative.

This is the way to think about the risk/return relationship.

Controlling risk is just as important as identifying opportunities for return. For most people a desirable approach strikes a balance between offense and defense.

Investing is more like soccer, where every team has to comprise both offense and defense, and no one blows a whistle to tell you which way to play.

Risk has to be dealt with, but not through quantification. Theory accepts volatility as the indicator of risk, largely because data on volatility is quantitative and machinable. But people in the real world don’t worry about volatility or demand a premium return to bear it; what they care about is the likelihood of losing money. Because that likelihood can’t be quantified, risk is best handled by experienced experts applying subjective, qualitative judgement that is superior.

Investing can’t be reduced to an algorithm or a mechanical process. few people have demonstrated the ability to excel for long via ‘quant’ investing. Superior results generally require insight, judgement and intuition.

To ascertain whether a manager has above average skill, it’s essential to observe performance over many years and in bad markets as well as good. Short-term outperformance and short-term underperformance are ‘impostors’ that say very little about the skill of a manager. Randomness can cause a weak manager to show a good performance for a year or two, but good long-term records are likely to be the result of skill. Absent testing in tough times, aggressive risk-taking in an environment that turns out to be salutary can easily be mistaken for investment skill.

Never confuse brains with a bull market.

In order to deserve ‘incentive fees’ – a share of the profits – managers have to be truly exceptional. Exceptional managers are the exception, not the rule.

Good results will bring a manager more money to manage. If inflows are allowed to go unchecked, eventually more money will bring bad performance. Increased assets under management can shorten the list of potential investments large enough to make an impact; erode a manager’s ability to be selective and agile; and encourage ‘style drift’, under which a manager strays into strategies beyond his core competence in an effort to put money to work.

Not everyone can beat the market averages. By definition, the average investor does average (before fees and transaction costs).

Expenses play a crucial part in determining the success of an investment program. Whatever the gross results, management fees and transaction costs will subtract from them. After expenses, then, the average investor lags the market averages.

By investing passively in a low-cost ‘index fund’ that mirrors a market average, you can be sure to capture the return of the average. People err, however, when they think of such funds as being low-risk. Index funds eliminate the risk of underperforming the market average, but not the risk inherent in the average itself.

Expectations should be reasonable. Aiming for too high a return will either require excessive risk bearing or guarantee disappointment….or both.

No one should expect investing to be easy.

This is an amazing presentation made by Oaktree Capital Chairman Howard Marks for the CFA Society in India on 2nd March 2017.