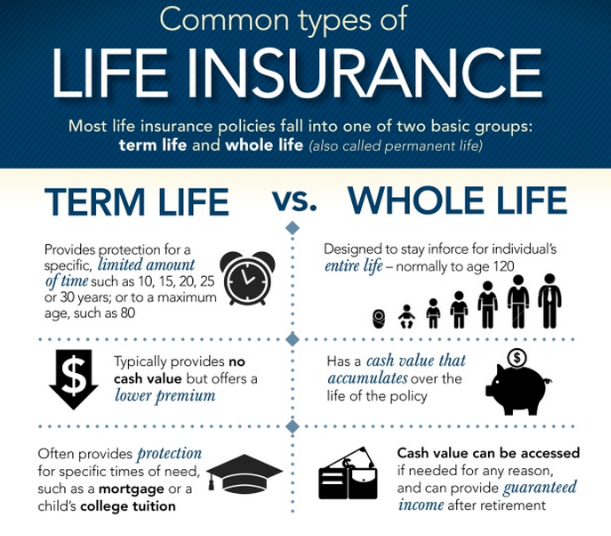

Definition: Term insurance is the most traditional life insurance policy wherein the insured gets death benefit if any contingency happens within the policy term. The insured is, however, not entitled to receive any survival benefit if he outlives the policy term.

Description: Term insurance policies are available in the range of 10-30 years term. These plans are relatively cheaper than endowment policies, money back policies and ULIPs. The benefits in a term insurance policy can be availed only in the event of the death of the insured.

This is a pure protection insurance plan which provides coverage against the risk of death. Any other risk, like surviving till maturity, is not undertaken and no benefits are paid in case of such risks which are excluded.

Term insurance plans are the only type of insurance plans which are designed solely for protection purposes. Since the death risk is covered, the plans present two unique benefits:

High Sum Assured levels: The maximum amount of sum assured which can be opted under a term insurance plan is limitless. If you qualify under the underwriting norms of the company, you can avail very high levels of sum assured. So, whether you want coverage of Rs.50 lakh or Rs.5 crore, a term plan would allow you this coverage. It determines the corpus required for meeting your family’s lifestyle expenses and, therefore, you should choose the sum assured very carefully. There would be no maximum limit curtailing your choice subject to your financial underwriting.

Lowest premiums: A term insurance plan is the cheapest form of insurance available in the market today. Against the high levels of sum assured available, the premiums charged are extremely low and are easily affordable. No other plan of insurance promises such high levels of coverage at such low rates of premiums.

Since term insurance plans only promise a death benefit, the lack of any return on plan maturity is a common dilemma. This, coupled with unawareness of the term plan’s importance, is the main reason why term insurance plans are given a miss by many of us.

However, while the lack of maturity benefit cannot be contested, term plans are very important in the context of the coverage provided. As the plans charge low premiums for higher coverage levels, the common man can easily fulfill his protection needs. Given today’s rate of inflation, the lifestyle expenses are rising progressively. In such a scenario, in the absence of the earning member, a substantial corpus is required to meet such lifestyle expenses of the family. Such a substantial corpus cannot be self-built by a common middle-class individual and a term insurance plan finds application in these cases. By providing the promise of a lump sum corpus contingent on death, the plan takes care of the family’s financial stability in the absence of the bread-winner.

Insurance companies, gauging people’s reluctance in buying the plan, have launched return of premium term plans which promise a maturity benefit.

Term plans are sold by insurance agents or brokers. Insurers also offer direct online plans which eliminate middle men. These term plans can be bought through the website of the insurance company or any other web aggregator. Since middle men are eliminated, the premiums are lower. The purchase is done online and the premium payment is also done online.