After a spate of bad news, debt fund investors have reason to cheer. Last week, some funds with segregated portfolios containing Vodafone Idea bonds received the full value of the principal due, with interest. The recovery meant money tied up in units in the segregated portfolios was returned to unitholders immediately. In another development, Zee Learn also repaid all dues to UTI MF after the fund house segregated its bonds a few days ago.

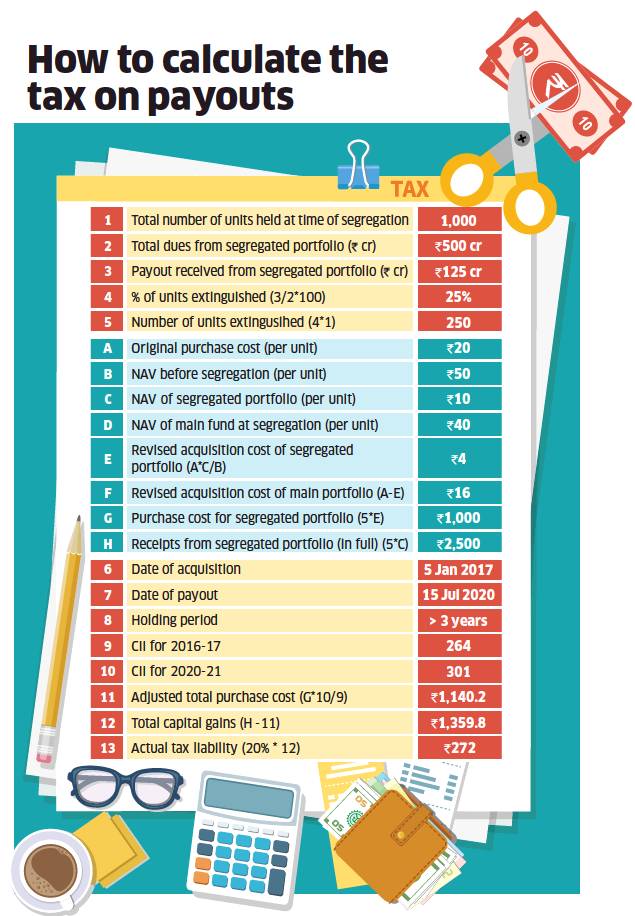

While this is welcome news, it does mean some tax headaches for investors. There are two things to be figured out: the cost of acquisition of units in the segregated portfolio and the holding period of the units in the same. Any amount recovered from the segregated portfolio will be considered as capital gain for tax purposes. When a fund carves out a segregated portfolio from the main scheme, these reflect in the investor’s account statement as a separate portfolio with equal number of units as held in the main portfolio.

First, investors have to ascertain the holding period of the units in the segregated portfolio. As per a recent amendment to the Income Tax Act, the date of acquisition of units in the segregated portfolio is the same as when you purchased the original units in the main portfolio. If the units were purchased in a staggered manner over time, the relevant date of acquisition will be applicable for corresponding units in segregated portfolio. For instance, if the unitholder had 500 units in the main portfolio before segregation, with 300 units acquired in January 2016 and another 200 units in January 2019, the same dates will apply for the 500 units in segregated portfolio.

Depending on the holding period, the capital gains will be short or long term. Holding period less than 36 months is treated as short term capital asset and the gains are taxed at marginal tax rate. Any holding beyond three years will be considered as long term capital asset and taxed at 20% with indexation benefit. Taking the above example, if you received payout from the segregated portfolio on 15 July 2020, the first 300 units will qualify as long term capital assets and the remaining 200 will be treated as short term capital asset.

Franklin Templeton investors will note that they received payouts from the segregated portfolios on two different dates. The first payout on 12 June was for 7.58% of the total amount due. Assuming the same example, 7.58% of the units (7.58%500 = 37.9) held in the segregated portfolio were redeemed first. Of these 37.9 units, 22.7 units (37.9300/500) will qualify for long term capital gains while 15.2 units (37.9*200/500) fall under short term capital gains. Similarly, of the remaining units (500 – 37.9 = 462.1) redeemed later on 13 July 2020, 277.26 units will be treated as long term capital assets and the rest 184.84 as short term.

The cost of acquisition of units in both the main and segregated portfolios will be taken as the proportionate cost as determined on the date of segregation. Let us suppose that the NAV at the time of original investment on 1 January 2018 was ₹10. On 25 January 2020, when the NAV of the scheme was ₹20, a credit event hit bonds worth ₹5, leading to creation of a segregated portfolio. The main portfolio carries an NAV of ₹15 and the segregated portfolio an NAV of ₹5 (if transferred at full value).

Since the ratio of NAV is 3:1, the revised cost of acquisition of units in the main portfolio and segregated portfolio is taken as ₹7.5 and ₹2.5 per unit respectively.

Now, here is where things get a bit tricky. The cost of acquisition would essentially be a function of the value determined by each fund house for the troubled assets. Different fund houses may value the same bonds differently during segregation. For instance, at the time of segregation of Vodafone Idea bonds, schemes of Franklin Templeton holding these bonds had already marked down their value to zero. As such, the cost of acquisition of units in the segregated portfolio is nil. For FT investors, the entire receipts from segregated portfolios are taxable as capital gains. Meanwhile, cost of acquisition for main portfolio remains at original purchase NAV. Since the cost of acquisition of segregated portfolio is zero, there would not be any change in the cost of acquisition of the main portfolio as well.

However, some fund houses may have only partially marked down the value of the bonds. Wherever bonds are transferred to segregated portfolio at a residual value, the acquisition cost of units in the segregated portfolio is the proportionate cost as determined on the date of segregation. Meanwhile, the cost of acquisition of the original units in the main portfolio is reduced by the amount so arrived for the units of the segregated portfolio. In the above example, if the value of the segregated bond worth ₹5 is marked down to 20% (20%*₹5 = ₹1) before the segregation, the ratio of main portfolio NAV to segregated portfolio NAV will become 15:1. Hence, the acquisition NAV of ₹10 will be split as ₹9.375 for main portfolio and ₹ 0.625 for segregated portfolio. This NAV multiplied by the number of units will be considered as purchase cost. The difference between the payout from the segregated portfolio and the revised purchase cost will be your capital gains. This will be taxed as per the applicable holding period for the units.

Investors finding it hard to decode the tax liability need not worry. They will be provided with an account statement by the fund house in a few days. This should reflect their exact capital gains, holding period and tax liability from the payout.