Indian stock exchanges have decided to implement the T+1 (trade plus one day) settlement cycle in a phased manner from February 25.

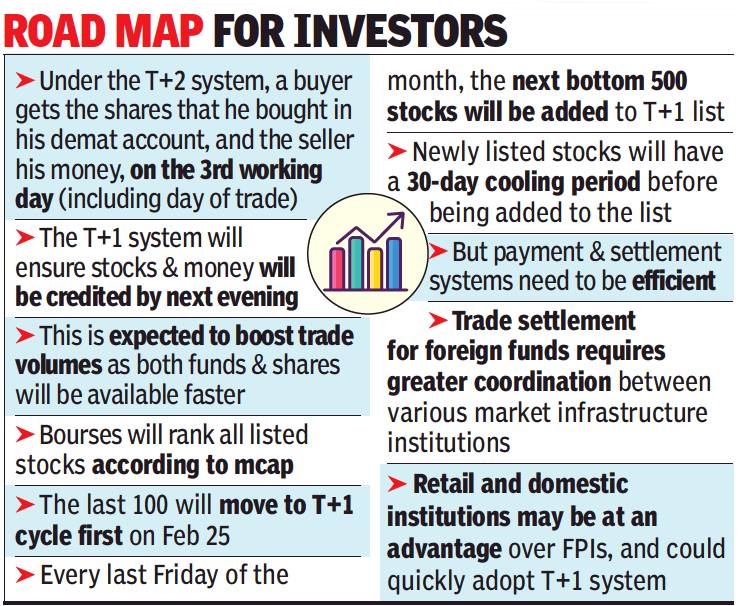

First, the bottom 100 stocks on the basis of market capitalisation will be shifted to the T+1 settlement cycle on that date. Later, 500 stocks from the bottom will be shifted on the last Friday of each month from March onward, the National Stock Exchange said in an order.

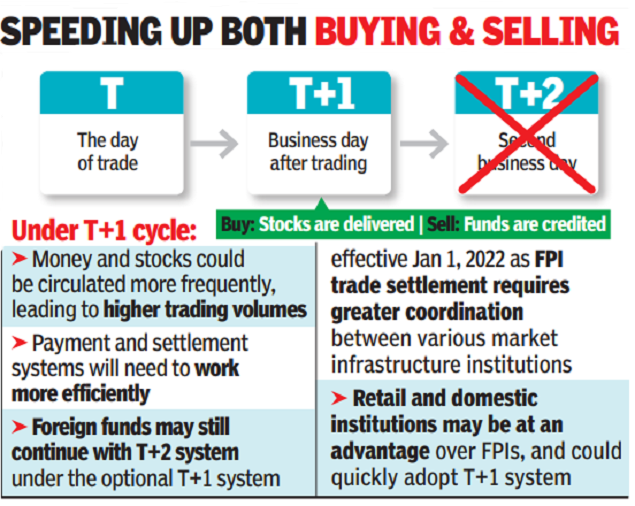

T+1 means settlements will need to be cleared within one day of the actual transaction. It would allow the buyer of stocks to receive securities in a demat account and the seller to receive funds in a bank account just a day after the trade is executed.

Currently, trades on the Indian stock exchanges are settled in two working days after a transaction is completed (T+2).

Stock exchanges will consider the average market capitalization for the month of October for ranking the stocks.

Stocks listed after October will be added to the list based on the average market capitalisation calculated 30 days after commencement of trading.

In September, market regulator Sebi introduced an optional T+1 settlement system for the markets to help reduce margin requirements. Sebi gave an option to exchanges to decide whether to implement the T+1 settlement or continue with the T+2 mechanism.

Foreign portfolio investors, top brokers and MNC banks, however, opposed the Sebi move citing operational challenges.

FPIs have been arguing that carrying out multiple activities such as obligation matching, margin collection, handling of mismatches, and arranging funds (by converting foreign exchange into rupees in the evening when liquidity dries up) would be a challenge under T+1.

The move to a T+1 system will be made nearly 19 years after the Indian market had moved to the T+2 settlement cycle from T+3 cycle. Currently, most markets around the world follow the T+2 system, but technological advancements are pushing bourses to shorten the settlement cycles. On September 7 this year, despite strong resistance from some sections of market players, Sebi had decided to move to the T+1 cycle.

The rule that decides which stocks will move to the T+1 cycle, and in what order, will first rank all the listed stocks according to their market capitalisation. The last 100 in this list will move to T+1 cycle first on February 25, 2022. Thereafter, on every last Friday of the month, the next bottom 500 stocks will be added to the list, the release said.

As things stand now, lesser-known stocks like Steel Strips and Coromandel Agro Products will enter the T+1 cycle in the first batch, a list release by the bourses showed. On the other hand, blue-chips like Reliance Industries, TCS and HDFC Bank will move to the shorter trading & settlement cycle in the last (12th) batch on January 27, 2023.

Listed instruments like closed-ended mutual fund schemes, debt securities including corporate bonds, sovereign gold bonds, government securities, treasury bills, state development loans, REITs, InvITs, ETFs, IDRs, etc, will also be moved to the new system from January 27, 2023.

The release further said that the newly listed stocks will have a 30-day cooling period before being added to the list. Preference shares, warrants, right entitlements, DVRs, etc, will be added to the list along with the parent company’s stock.