Direct plans have been around for slightly over 3 years now. If you are an existing mutual fund investor and want to shift to a direct plan, you can make the transition for both incremental and existing holdings.

HOW TO SWITCH: Moving your existing investments from the regular plan to the direct plan essentially involves a switch. A switch refers to a change in the scheme you are holding or just a change in the plan of the scheme. It is valid for transactions done within the same asset management company. When you want to move your existing mutual fund holdings to a direct plan, you must give a switch instruction. Mention your scheme name and regular option as the fund you want to switch from and then enter the same scheme name and direct option as where you want to switch to. The transition happens as soon as the fund house receives the request.

Any switch in a fund is treated as a cash transaction. So, for tax calculation, it is assumed that you have redeemed the money and then reinvested; even though the money does not move out of the fund. A switch means you are exiting from one scheme and getting into another with a different net asset value . Therefore, even though the procedure is slightly different, it is treated like a redemption.

What you need to be careful about is the exit load on the existing scheme and the tax you pay. Depending on the value of your investment and when you started, it may be prudent to wait out any exit load period.

Secondly, check for tax incidence in case of equity funds: if you have been holding the fund for more than a year, then such a switch will have no tax impact. For debt funds, you will have to calculate the short term capital gains tax if you were invested for less than 3 years, and beyond that long term capital gains tax will apply.

For your existing SIPs, you can either simply stop and restart in the direct plan option or you can send a written request to the AMC asking for future SIPs to be in the direct plan.

You can invest in direct plans either through the AMC, or through your registered investment adviser; online or using a physical form.

If you are already invested in a direct plan and want to opt for an RIA, you have to send a letter to the fund house to tag the RIA in your investment. This could take a few days. Where existing portfolios have a large corpus and many funds, switching may not be a simple option.

One reason to go direct could be that the adviser you choose operates as an RIA who charges an advisory fee and uses direct plans for client investments. RIAs get access to direct plan NAVs on behalf of investors mapped to them so that, as advisers, they can track investment details directly.

If you are advised by RIAs, you may want to shift your existing mutual funds from a regular plan to a direct plan. Alternatively, you may already be overseeing your own investments, but through an online distributor who only offers regular plans, and now want to switch to direct.

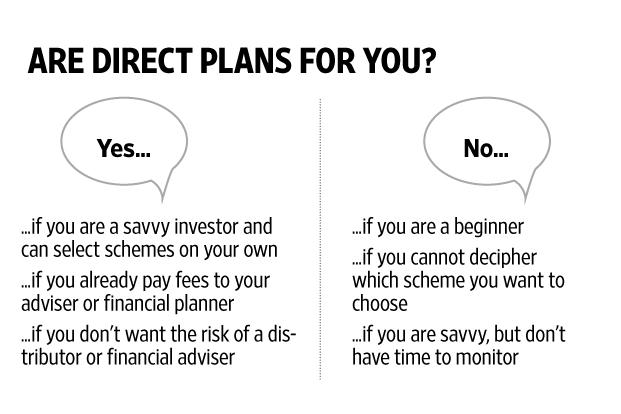

The decision to switch is not always simple. For a lower product cost, you may be forgoing conveniences and advice.

Operationally, the process of moving from regular to direct involves a simple procedure. If you choose to move to a direct plan under the advice of an RIA, the transfer is aided by adviser. But the lower cost of a direct plan should not be the sole motivation for the switch. Other considerations such as value added by the distributor and long-term advice need to be kept in mind.

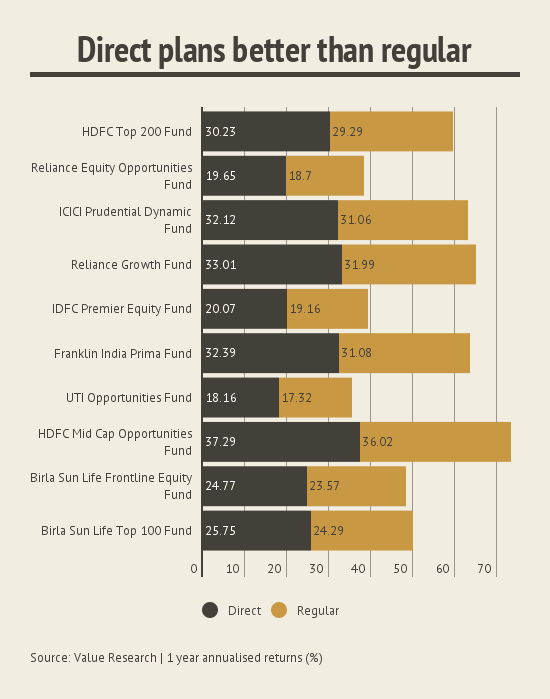

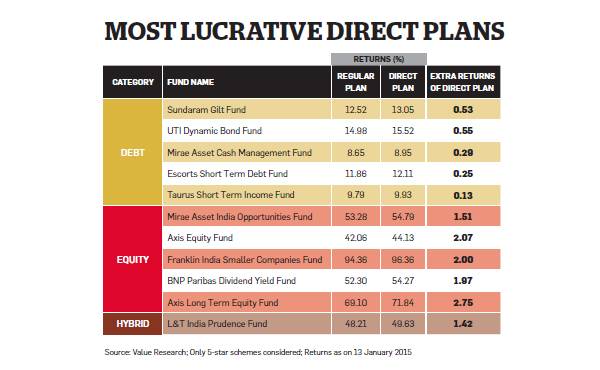

The following examples are just for illustrating the difference in returns between Regular and Direct plans of Mutual Funds: