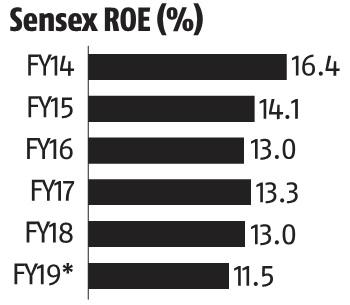

The return on equity (RoE) for Sensex is now on a downward trajectory. Since 2013-14, the average RoE of the index has consistently come down from 16.4 per cent to 11.5 per cent at the end of the first half of 2018-19.

RoE, the ratio of net profit to total equity capital, is an important metric to gauge a firm’s performance. Higher the RoE, the better it is as it denotes that the firm is able to generate more bang (profits) for the buck (shareholder equity).

The decline in Sensex is a worrying trend for investors.

Falling profitability of state-owned and corporate-focused banks due to bad loan issue and that of telecom companies due to intensifying competition are among the key reasons for the decline in RoE during this period.

Experts say the RoE remain soft for a few more quarters. Huge losses at Tata Motors, regulatory issues at pharma companies and slower growth at technology companies could weight on the index RoE. Further, “some companies have raised equity funds and the invested monies are taking a bit longer to generate sufficient returns”