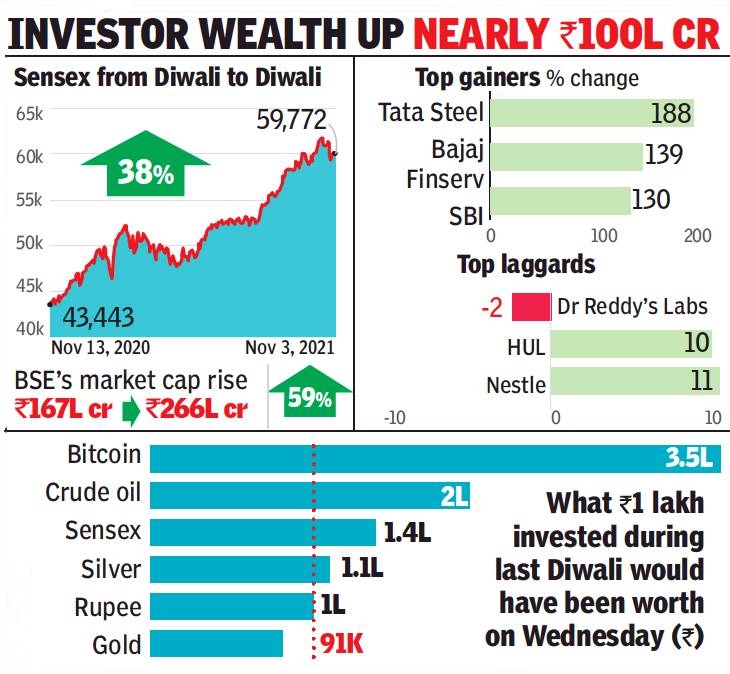

Investors on Dalal Street were richer by about Rs 99 lakh crore during Samvat year 2077 that ended on Tuesday, riding on strong across-the-board buying that also led to a 38% jump in the sensex to its current close at 59,772 points. The rise was the best in the last 12 years while the gain in investors’ wealth was the best ever. BSE’s market cap at Rs 266 lakh crore ($3.6tn) elevated India to the sixth largest market spot in the world in terms of market value.

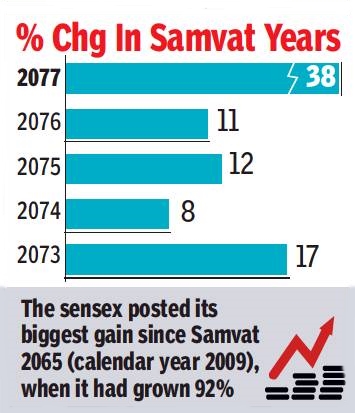

Samvat 2077—the calendar followed by mainly the trading community on Dalal Street—will go down as one of the best years in terms of returns and the regularity with which the leading indices hit new all-time highs, even though the economy struggled due to the ongoing Covid-induced pandemic, market players said.

Metals, banking & financial services, and software exporters led the rally while pharma and FMCG stocks witnessed muted gains in prices. The gains came on the back of nearly Rs.1.25 lakh crore worth of net buying of stocks by foreign institutional investors, while domestic institutions, which include mutual funds, insurance companies, banks and others financial companies, were net sellers at about Rs.34,700 crore, CDSL and BSE data showed.

The year will also be marked as the year when new age consumer-facing tech-enabled companies, for years being privately held by a handful of funds, started getting listed. The trend, often called private going public by merchant bankers and analysts, was led by Zomato and followed by Car-Trade. A host of such companies are in various stages of going public in Samvat 2078. Samvat 2077 could be termed as the year of unicorns and tech companies.