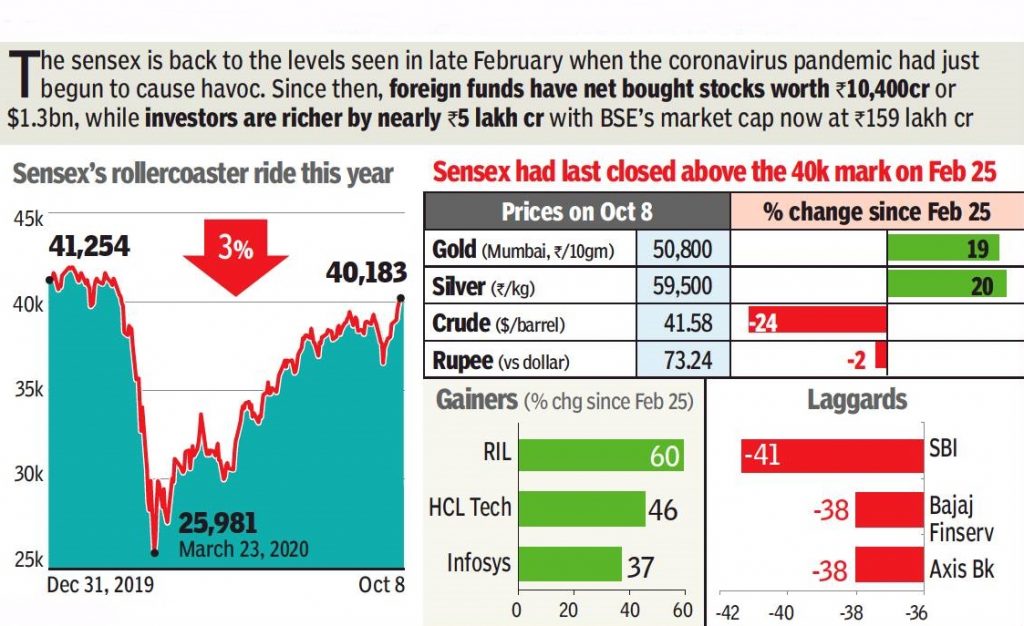

The sensex managed to nearly reach the same level seen in late February this year, just before the global pandemic started to impact Indian markets. Within a month of closing a tad above the 40k mark on February 25, the benchmark index had lost about 15,000 points — or 40% — to sink below 26k in intra-day trades on March 24.

However, despite a never seen-before slide in the economy due to one of the strictest lockdowns in the world, the sensex has since rallied.

In the last couple of weeks, financial stocks had seen some gains. These came after the government said that it would pick up the tab of the six-month interest burden on all small borrowers (with loans of up to Rs 2 crore), market players said. These borrowers are struggling to meet their payment obligations due to the pandemic.

As a result, the recent trend of news-driven sectoral rotation of stocks continued.

Some traders feel that the market is decoupled from the economy in the sense that it rallied despite a massive 24% de-growth during the April-June quarter. However, there is another group that believes the recent surge has mainly been backed by unprecedented liquidity and investors are ahead of the economic curve.