The SEBI board accepted several recommendations made by the working group appointed by its Mutual Fund Advisory Committee for total expense ratio. “All commission and expenses, etc. shall necessarily be paid from the scheme only and not from the asset management company, associate, sponsor, trustee, or any other route. Further, the mutual fund industry must adopt the full trail model of commission in all schemes without payment of any upfront commission or up-fronting of any trail commission. A carve out has been provided for up-fronting of trail commission in case of systematic investment plans subject to fulfilment of certain conditions,” it said.

The board also took note of the benefits of the proposal made by the working group for sharing of economies of scale, lowering cost for mutual fund investors, bringing in transparency in appropriation of expenses, and reducing mis-selling and churning. The board approved following proposals on mutual fund expenses.

Transparency in Expenses:

All commission and expenses, etc, shall necessarily be paid from the scheme only and not from the AMC/Associate/Sponsor/Trustee, or any other route. Further, the mutual fund industry must adopt the full trail model of commission in all schemes without payment of any upfront commission or up-fronting of any trail commission. A carve out has been provided for up-fronting of trail commission in case of SIPs subject to fulfilment of certain conditions.

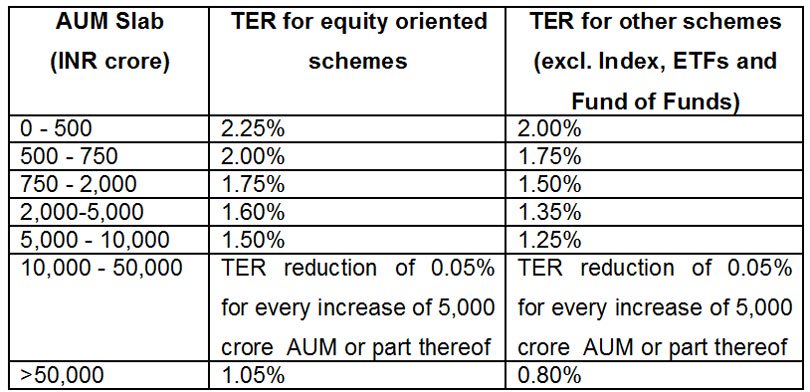

TER for open-ended schemes shall be as follows:

Existing TER is mentioned under Regulation 52(6) of SEBI (Mutual Funds) Regulations, 1996.

TER for Close-ended and Interval Schemes:

TER for equity-oriented schemes shall be a maximum of 1.25% and for other than equity-oriented schemes shall be a maximum of 1%.

TER for Index schemes, Exchange Traded Funds and Fund of Funds:

a) Index Funds and ETFs: The TER shall be a maximum of 1.00%.

b) Fund of Funds (FoFs): The TER of FoF scheme shall be a maximum of twice the TER of the underlying funds.

i) FoFs investing primarily in Liquid, Index and ETF schemes: Total TER (including the TER of underlying schemes) shall be maximum of 1.00%

ii) FoFs investing primarily in active underlying schemes: Total TER (including the TER of the underlying schemes) shall be maximum of 2.25% for equity-oriented schemes, and maximum of 2% for other than equity-oriented schemes.

Additional expenses of 30bps (basis points) for penetration in B-30 cities:

The additional expense permitted for penetration in B-30 cities shall be based on inflows from retail investors. The definition of ‘retail investors’ shall be determined in consultation with the industry. Pending such clarification, the additional incentive shall be permitted for inflows from individual investors only and not on inflows from corporates and institutions. Further, the B-30 incentive shall be paid as trail only.

Performance Disclosure:

Adequate disclosure of all schemes’ returns (category wise) vis-à-vis its benchmark (total returns) shall be made available on the website of AMFI (Association of Mutual Funds of India).

SEBI said, after implementing these decisions, the trustees and AMC boards will monitor the implementation by the respective AMCs and submit a periodic report to the market regulator.

At present, fund houses give upfront commissions from their profits and it is anywhere between 0.75 basis points to 1.25%. While trail commission is around 1%. Several distributors take only trail commissions of 1.5%. Upfront commissions were very high for closed ended equity schemes, and in many cases it went up to 5%. Normally, fund houses pay 3% upfront for close ended equity schemes.

Why is the move so important?

Since TER is charged every year, a high expense ratio over the long term could eat into your returns massively through the power of compounding. For example, Rs.1 lakh over 10 years at the rate of 15 per cent will grow to Rs.4.05 lakh. But if you consider an expense ratio of 1.5 per cent, your actual total returns would be Rs.3.55 lakh, nearly 14 per cent less than what you might have achieved without an expense ratio being charged.

In May, SEBI had reduced the additional expense charged by mutual funds from 20 bps to 5 bps.

Earlier, mutual funds were allowed to charge additional expenses of up to 0.20 percent or 20 basis points of the daily net assets of mutual fund schemes, in lieu of the exit load credited to the scheme.

Mutual fund houses had cut their trail commission after the reduction in total expense ratio or TER, thereby bringing down their costs.

Trail commission, which is paid by fund houses to distributors, had been reduced by 15 to 20 basis points after the rationalisation of TER by the Securities and Exchange Board of India.

TER is the total cost an investor has to bear while investing in a mutual fund scheme.

Costs such as registrar fee, fund management fee, distributor commission, advertising expense, and custodian’s share are borne by investors as a percentage of assets managed by the fund house.