Gold prices have been on a roller coaster ride ever since the pandemic hit the world. Financial experts have always liked gold for its ability to provide diversification to the overall portfolio. It is often considered as a hedge against inflation.

While the investment experts and fund managers have been advocating for paper gold instead of gold in the form of jewellery, many investors in our country possess a special love for gold in its solid form.

Though, its value keeps on appreciating as per the market movement, unlike Sovereign Gold Bonds, it does not pay you any interest.

RBI’s SGBs are considered as the most preferred paper form of gold as it offers an interest along with price appreciation in the yellow metal.

Moreover, you have to pay locker charges if you prefer to store your gold jewellery in the bank. There’s a way you can make your idle lying gold jewellery earn more for you.

You can deposit the idle gold in an RBI designated bank and earn interest on the same. This facility is available under RBI’s Gold Monetisation Scheme and is just like a bank fixed deposit where you deposit your idle gold with the bank and at maturity, you get gold or the value of gold (your capital) back along with the interest earned on the same.

HDFC Bank tweeted “You can earn interest on idle lying gold jewellery. HDFC Bank Earn high interest on your idle gold. Invest in HDFC Bank Gold Monetisation Scheme earn 2.50% on Long Term Deposit and 2.25% on Medium Term Deposit.”

Under the scheme, the gold value will be based on the price prevailing at the time of maturity. The interest will be computed on the deposit value of gold.

RBI’s Gold Monetisation Scheme or Revamped Gold Deposit Scheme may also be referred to as a fixed deposit in gold. A resident Indian individual or an institution can invest in this scheme. Gold FD can be opened in joint names as well. The banks accept raw gold in the form of gold bars, coins, jewellery excluding stones and other metals under the scheme.

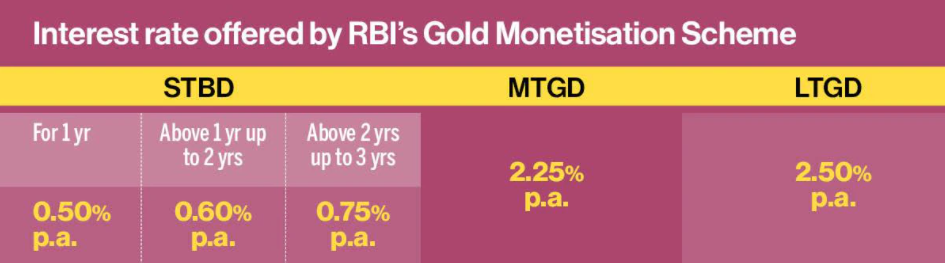

An investor can deposit a minimum of 10 grams of raw gold. There is no maximum limit on investment. Investors can choose any term between 1 and 15 years. Different tenure options are as below:

- Short Term Bank Deposit (STBD): Tenure 1 to 3 years

- Medium Term Government Deposit (MTGD) : Tenure: 5-7 years

- Long Term Government Deposit (LTGD) : Tenure 12-15 years

At the time of maturity, the depositor does not get the gold in the same form which he/she had deposited. The gold jewellery or ornaments deposited would be melted and assayed by the PVC.

The principal and interest on STBD shall be denominated in gold. At present, in the case of MTGD & LTGD, the principal will be denominated in INR. The interest shall be paid in Rupees annually on 31st March or cumulative interest on maturity.

The depositor will have the option to receive payment of simple interest annually or cumulative interest (compounding annually) on maturity. The option is to be exercised at the time of deposit.

Premature withdrawal options

- STBD: Allowed after a lock-in period of 1 year with a penalty on applicable interest rate.

- MTGD: Allowed to be withdrawn any time after 3 years with penalty on interest

- LTGD: Allowed to be withdrawn any time after 5 years with penalty on interest

Taxation

Earnings under the Gold Monetisation Scheme are exempt from the capital gains tax, wealth tax and income tax. There will be no capital gains tax on the appreciation in the value of gold deposited, or on the interest you make from it.