PMS (Portfolio Management Services) is used by high networth investors to invest in stocks. While there are products that also bet on fixed income instruments, most are equity-linked.

It is offered by brokerages and mutual funds registered with Sebi. There are two types of PMS: Discretionary and Non Discretionary. In discretionary , the fund manager takes

investment decisions on behalf of the investor. In nondiscretionary , the fund manager suggests investment ideas, while the decision is taken by the client.

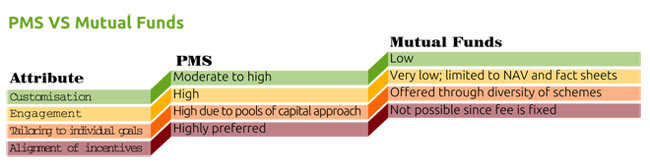

The biggest similarly between PMS (discretionary) and mutual funds is that the manager handles the money on the behalf of the clients. But, the key difference is that investors in MF get units that represent stocks. In a PMS, the investor holds the stock in a demat account owned by him, but the fund manager has the power of attorney to operate it.

Investors need to bring in at least Rs.25 lakh to invest in a PMS. Alternatively , they can give shares worth Rs.25 lakhs to the fund manager.

When you opt for a PMS scheme, a bank account and demat account are separately opened in the your name and all investments are made in your name only. Accordingly , any income or dividend coming out of the investment made will also be credited in your bank account and the shares will be held in the demat account in your name. As per the PMS agreement, the Power of Attorney for operating the bank and demat account will be with the portfolio manager. Most portfolio managers give a username and password which can be used to login into their website and see the portfolio statements. As per market regulator Sebi’s instructions, a portfolio manager is required to furnish performance report to their clients every 6 months

Portfolio management schemes have been one of the preferred routes for the wealthy individuals taking exposure to equities over the last year. That drove a sharp increase in equity PMS schemes, with the number of investors in such schemes growing 24% to 63,311 from 51,000 in the past one year. In the same period, assets under management grew 33% to Rs.62,563 crore from Rs.47,000 crore.

Both domestic and NRI investors are pouring money into PMS.

The changing mutual fund regulation landscape has also led many distributors to sell PMS schemes over mutual funds to the rich. Many believe that a new set of informed investors, who have inherited stocks and do not find time to manage their investments, is turning towards portfolio management.

PMS scores over mutual funds as they run concentrated portfolios with higher risk and as little as seven stocks in a portfolio. In comparison mutual funds, which are seen as safer, restrict exposure to individual stocks and generally have more than 30 stocks in their portfolio.

The investor can negotiate the fee with PMS providers, unlike in mutual funds. Most PMS charge a 2% annual fee and get 20% profit beyond a hurdle rate. The hurdle rate determines at which level profit-sharing will take place. For example, a 12% rate means the PMS provider will get 20% profit above 12%. If the hurdle rate is not met, one may end up paying less than what mutual funds charge. However, investors negotiate for a lower fee if the assets to be managed are big. Mutual fund fees are fixed in percentage terms.

While many PMS providers offer standardised portfolios, some offer investments tailored to clients’ goals. For instance, a client may want to invest a large amount in a single stock. This is not possible in mutual funds. While this spreads risk, a big disadvantage is that mutual funds cannot hold a big stake in a company even if it is a very good investment. PMS do not have this limitation.

The performance of mutual funds is in public domain. For PMS, you will have to take the provider’s word. This is because different PMS clients have different objectives and want different strategies. However, it is easy to get a performance report card in case of a model PMS portfolio.

Unlike mutual fund managers, PMS managers are directly accountable to the client, who can seek clarifications, especially in the discretionary portfolio.

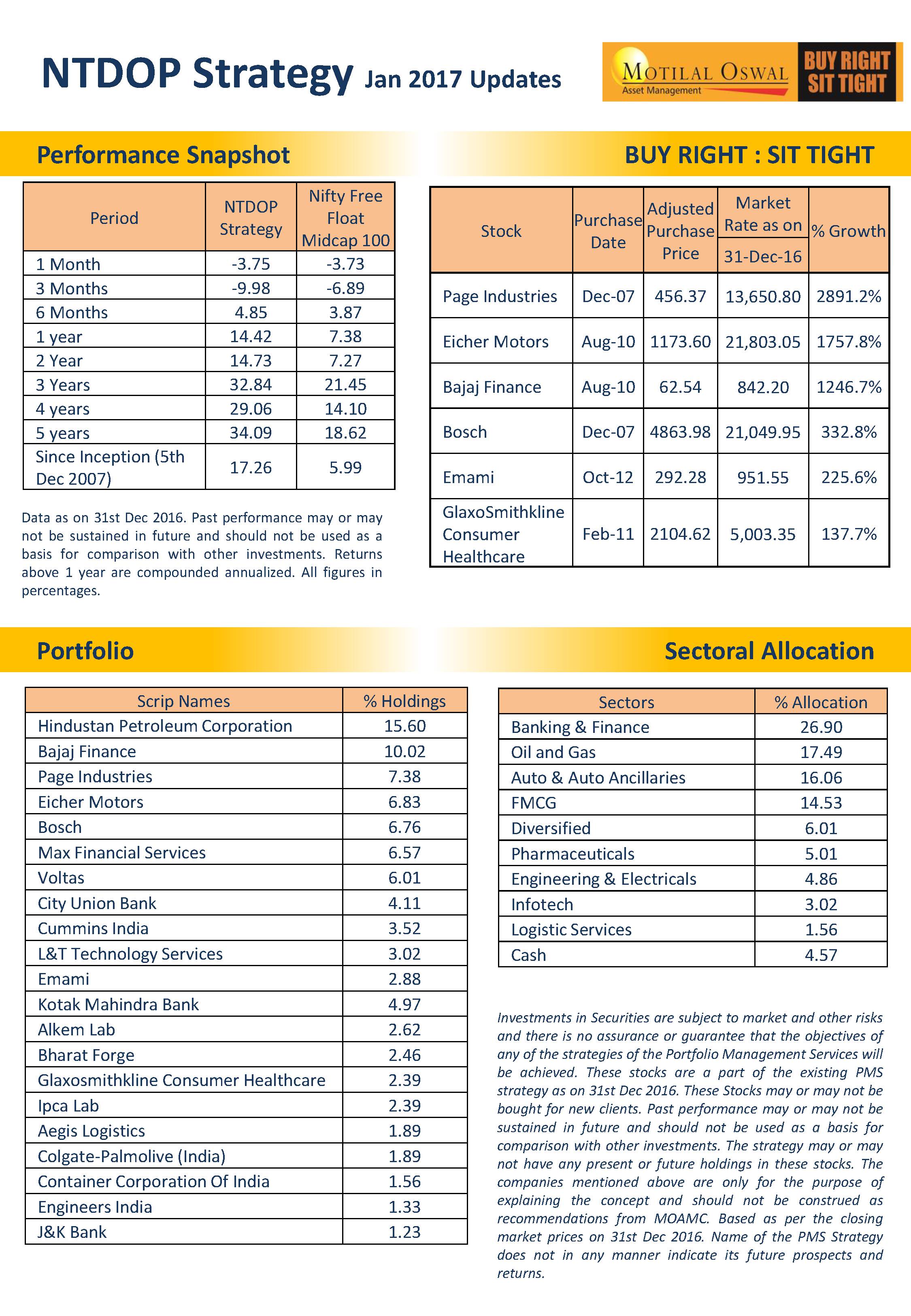

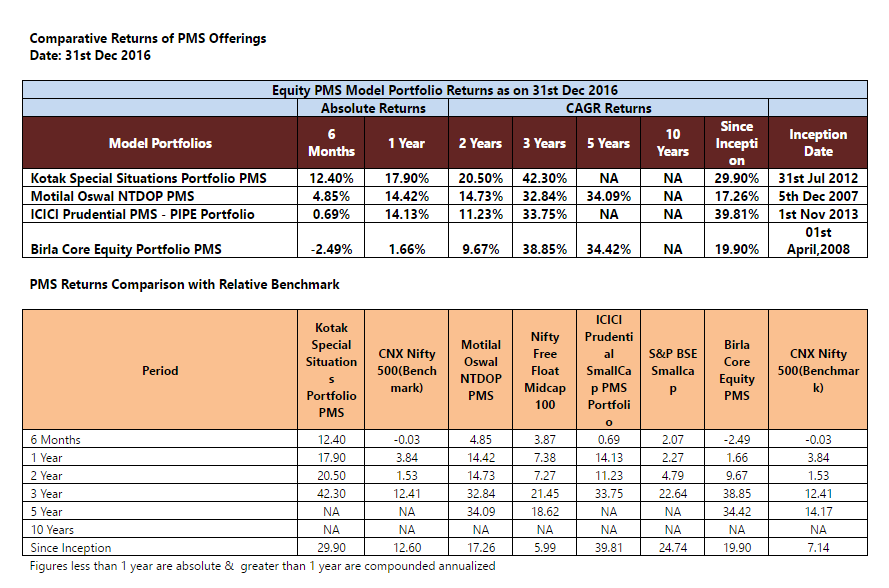

A popular portfolio management scheme by Motilal Oswal Asset Management has decided to stop taking fresh money from investors amid waning investment opportunities in mid-and small-cap stocks. Motilal Oswal Asset has decided not to accept more inflows in its product: Next Trillion Dollar Opportunity (NDTOP) under its PMS business, which caters to its more affluent clients. NDTOP invests in small and midcap stocks and has a concentrated portfolio of not more than 20-25 stocks. The top 5 holdings in the PMS scheme are HPCL, Bajaj Finance, Page Industries, Eicher Motors and Bosch.

As per a communication sent to distributors, the fund said it will not accept any new inflows in the NTDOP PMS post January 31. Motilal Oswal PMS is one of the largest domestic portfolio manager with assets of Rs.7,700 crore, of which Rs.4,000 crore is managed under NDTOP .

Valuations of midcaps have soared in the last three years. The PE ratio of the Nifty Midcap 50 has risen from 12.5 to 34.2 in the period. The Midcap Fund Universe has given annualised returns of 25.4% in the same period, according to Value Research. But, as stock prices rose, fund managers are left with fewer options to pick the next set of winners.

Many HNIs prefer to invest in equities through the PMS route, as the fund manager has the flexibility to build a concentrated portfolio of mid-and small-cap stocks.