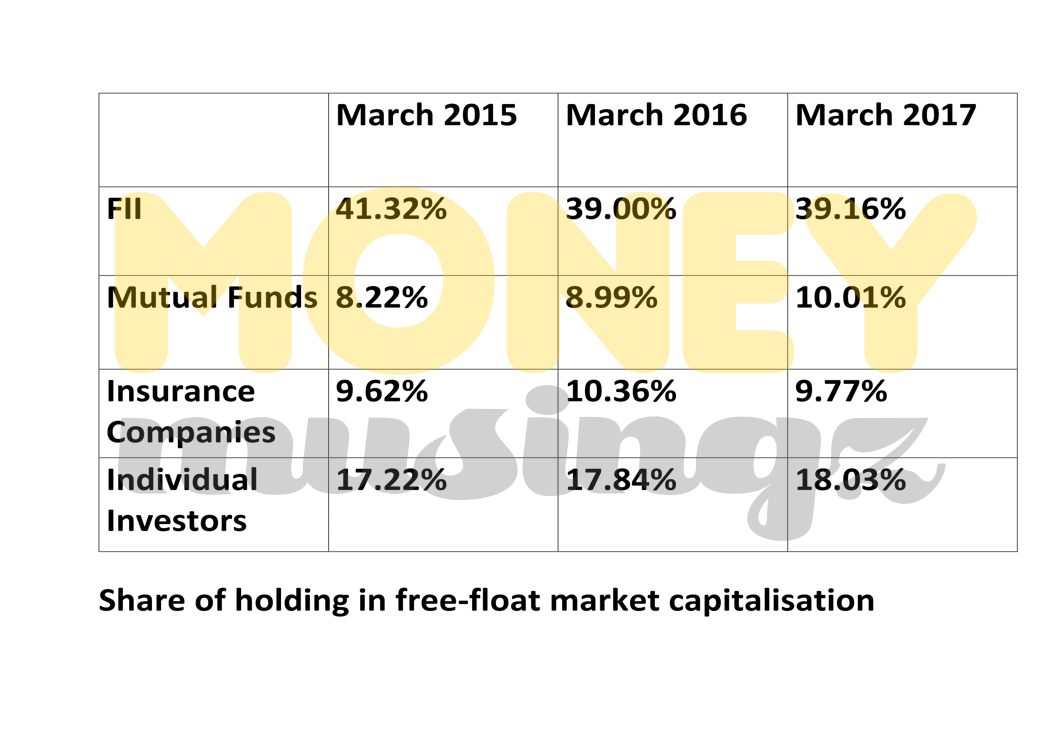

FIIs still hold a big chunk of Indian Equity….

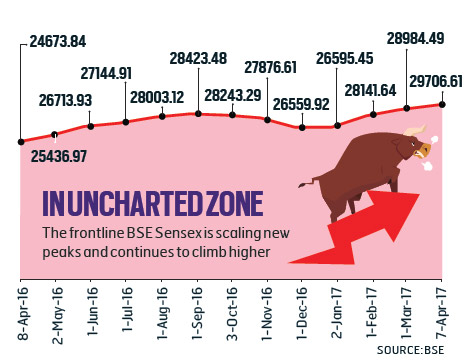

By all accounts, this is a crazy bull market, fuelled by the vast domestic inflows to the market. If the demonetisation has done something right, it seems to have channelled more money in the direction of stocks.

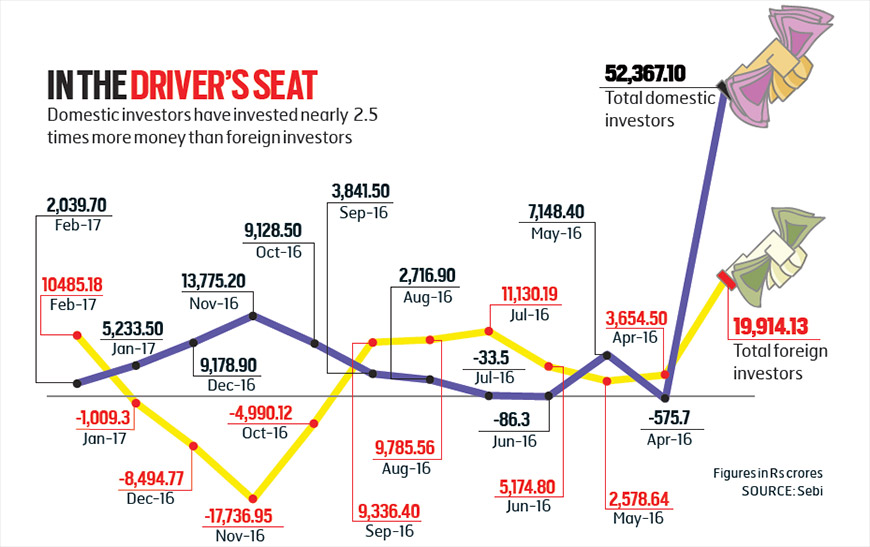

Domestic institutional investors -DIIs are increasingly pouring money into the stock market. Regular investments in the form of SIP are the new rage. At current value, more than Rs.4,000 crore of hard cash is making its way into the stock market every month through SIPs.

To give a perspective, this used to be the kind of sums foreign institutional investors -FIIs put in Indian markets a few years ago. In 2008, FIIs sold stocks worth Rs.60 crore-70 crore; now DIIs alone are pouring in sums nearly equal that in a year.

By 2018 or so, the amount of money coming through the SIP route is expected to comfortably rise by 50 per cent. This means a cool Rs.6,000 crore-plus is expected to flow into the markets via SIPs.

For a long time now, the Indian markets have been dominated by the FIIs, and their sheer size meant that they dictated market’s direction. If they withdrew, domestic stocks would most certainly get whipsawed.