Since Jan 1, 2013, all mutual fund schemes now come in 2 variants – a regular plan and a direct plan.

A regular plan is one, which you invest in through a mutual fund distributor and for which a distributor earns a commission. The distributor could be your friendly neighbourhood one or an online distributor.

These distributors receive ongoing commissions, called trail commissions as a percentage of the value of the investments that you have invested through them which is typically upto 1% of the investment value. In return for the commissions, the distributors offer you various services like advice, help with transactions and support with reviewing your portfolio, etc.

The cost of such commissions is inbuilt into the expenses of the mutual fund and is paid by the mutual funds directly to the distributor. Typically, you don’t have to shell out anything separately.

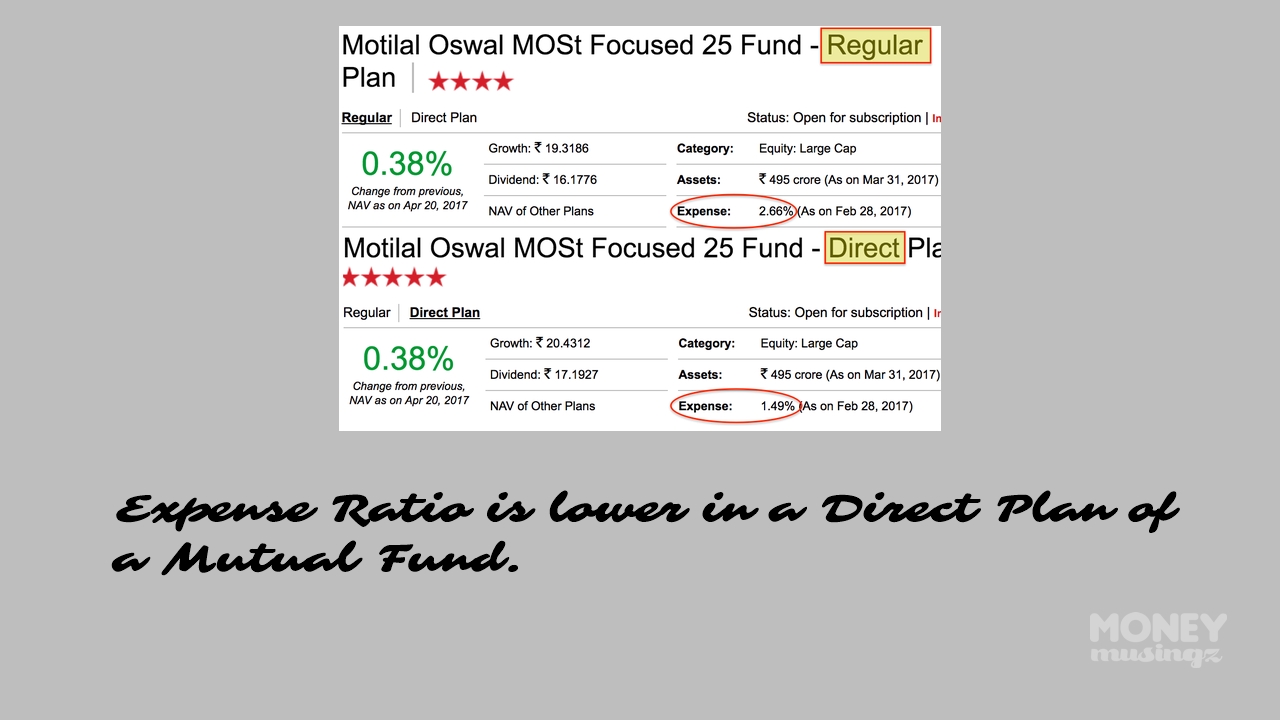

In case of direct plans, the investor can bypass the distributor, basically NO distributor, and invest directly with the fund house. In the bargain, the investor saves all the brokerage and commission that are otherwise paid to a distributor in a regular plan.

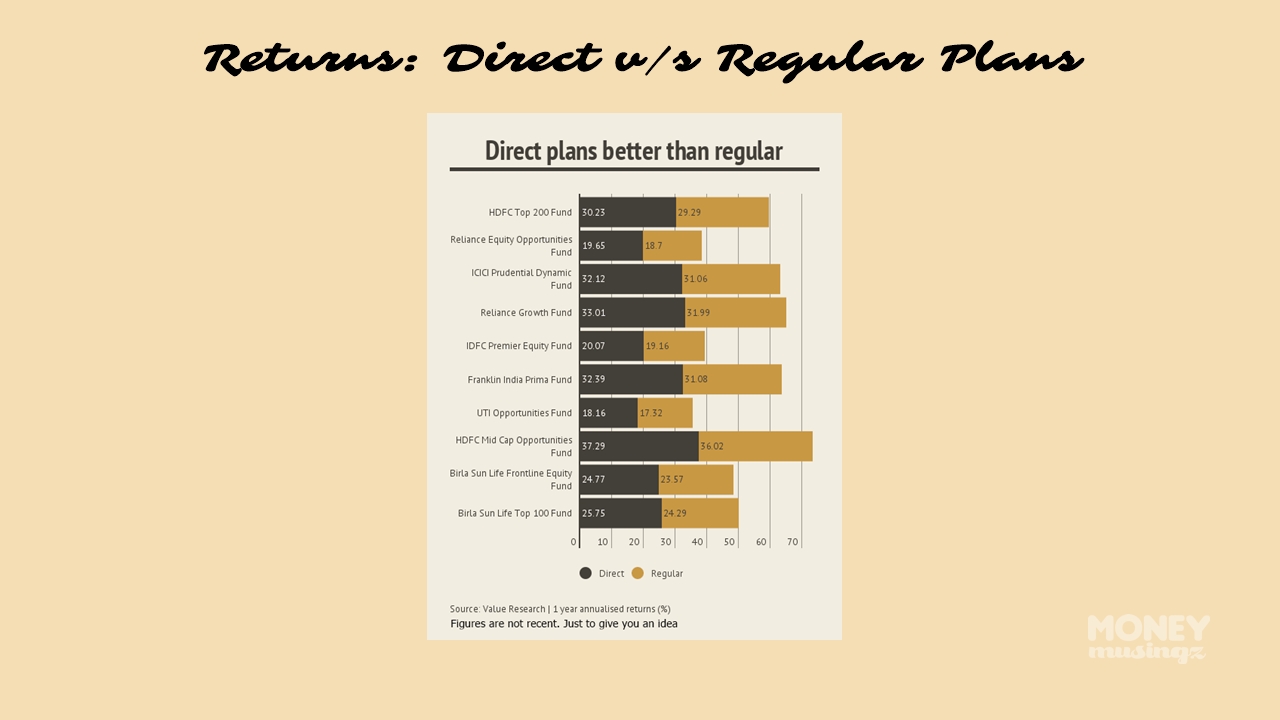

Since there is no distributor involved in a direct plan, you straight away save on distribution expenses. Hence, the direct plans are able to deliver higher returns purely on the basis of these savings.

Equity Funds in their direct avatar deliver on an average additional 1% return, every year. The additional return for Debt Funds is lower at approximately 0.5%.

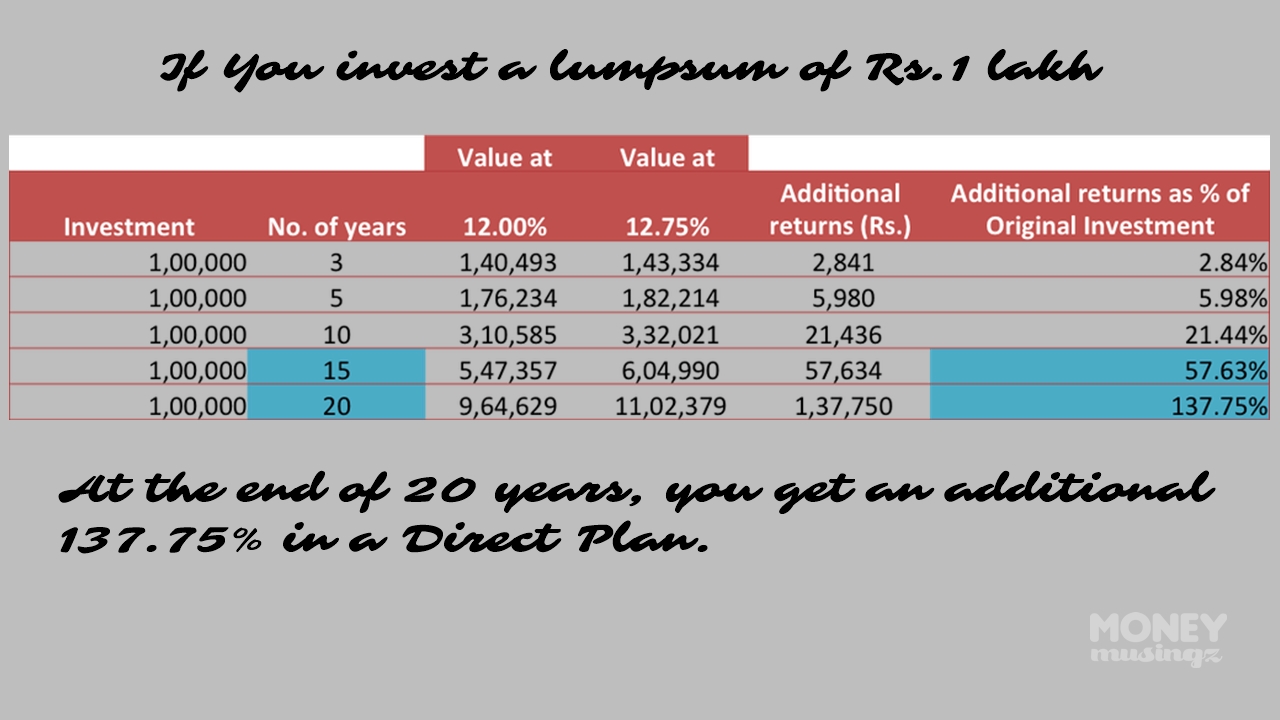

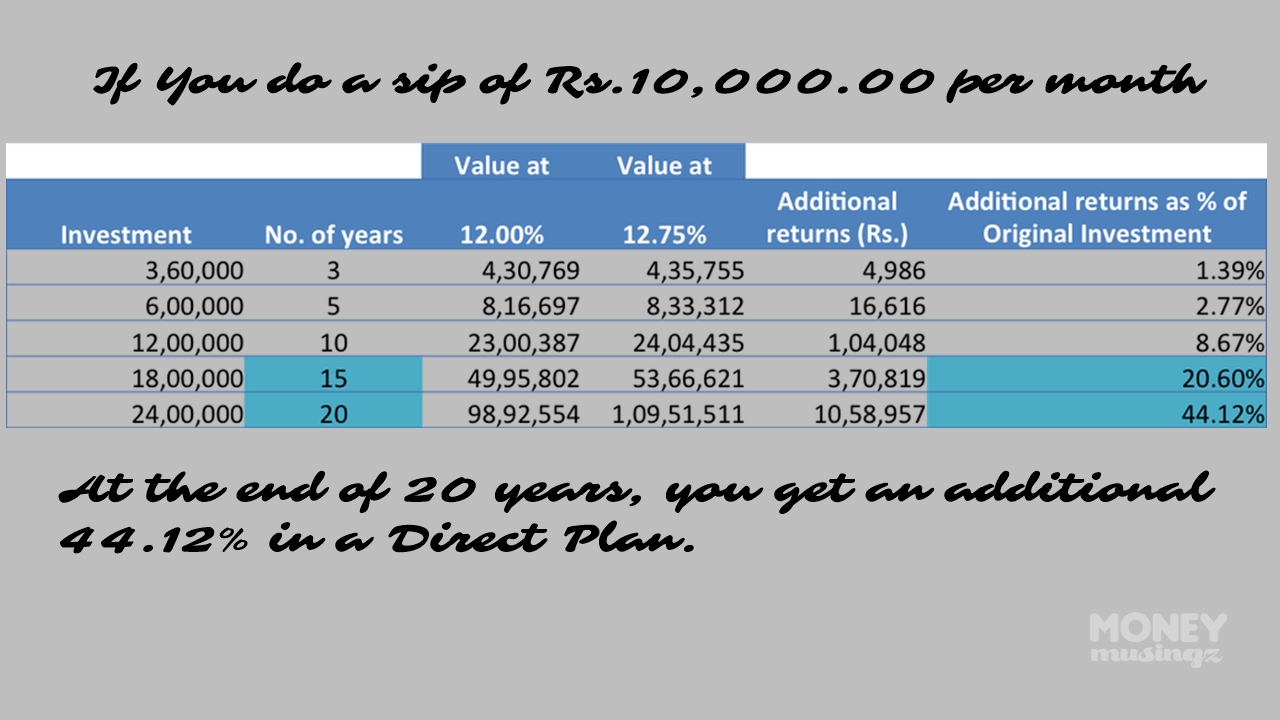

1% doesn’t sound much; but if you look at the impact of it over say 10 years or 20 years on an ever-increasing corpus, the difference is huge. Thanks to the power of compounding.

For example, let’s assume that the regular plan would deliver a return of 12% compounded and the direct plan return to be 12.75% compounded year on year.

Let’s look at two scenarios: In the first, you invest a lump sum and in the second you do a SIP.

While going direct is a great idea, it may not be the best option for a first time investor. Choosing an ideal product from the eight thousand plus options available can be a harrowing task. Also, it is necessary to understand a product that an investor is signing up for. That’s where the role of an advisor comes in. A wrong choice can prove to be much more costly that the money saved by going direct.

If an investor is confident and has sound knowledge in mutual funds and knows when to switch funds in a tax efficient manner etc then such an individual should go direct.