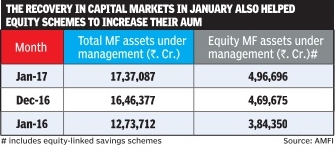

The assets under management of the mutual fund industry touched a record high of Rs.17.37 lakh crore during January on the back of strong inflows into equity , income and money market schemes. The AUM of equity MFs (including ELSS) surged to an all-time high of nearly Rs.4.96 lakh crore during the month.

The AUM of the MF industry has risen at a sharp pace in 2016-17 -assets have jumped 40.9% or by Rs.5.04 lakh crore since the end of March last year. The assets managed by equity schemes have increased by about Rs.1.1 lakh crore during the period. Incidentally , the AUM of the MF industry crossed the Rs.10 lakh crore mark only in May 2014 and the Rs.14 lakh crore mark in May 2016.The recovery in capital markets in January also helped equity schemes to increase their AUM.

The benchmark Sensex and the broader Nifty indices increased by about 3.9% and 4.6% respectively during the month

Overall net inflows into MF schemes has nearly doubled so far in 2016-17 -to about Rs.3.68 lakh crore at the end of January. The surge has been led by income and liquid funds. While net inflows jumped more than 5.5 times to around Rs.1.66 lakh crore for income funds, it zoomed 84.5% to about Rs.1.03 lakh crore for liquid funds.

Net inflows into equity schemes however has slowed down in 2016-17. Total inflows into equity MF schemes (including ELSS) fell 23.6% in the first ten months of 2016-17 to Rs.55,689 crore ($8.4 billion). Inflows into income schemes, which invest in government securities among others, rose by Rs.28,588 crore during January .

Liquid money market schemes, which invest in debt instruments such as certificate of deposits and commercial paper among others, attracted inflows of Rs.10,541 crore during the month. Only gilt funds and gold exchange traded funds saw outflows during January .