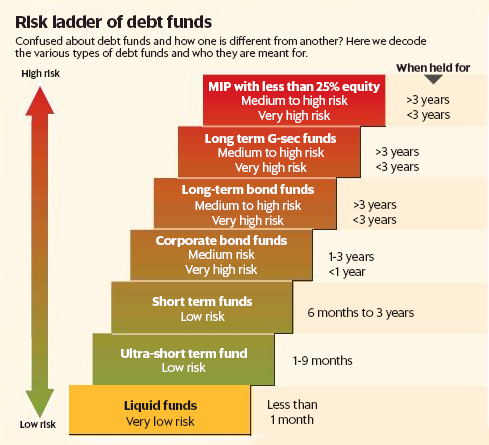

Investing in debt funds needs a different focus from investing in equity funds. Debt funds have various categories and the risk in each is different. You need to consider three basic factors before choosing a fund.

Exit Load: This is a fee you pay to redeem a fund before the specified time frame. There is no industry norms for it and is charged as a percentage of the amount invested. While all debt funds don’t have exit loads, they are meant to align investors to the fund’s intended investment horizon. Given the low liquidity in Indian bond market, this deterrent is also used to better manage expectations of how long one should ideally remain invested in a debt fund. So, ensure that you know the exit load of a fund before investing in it.

Portfolio Credit Rating: As more debt funds invest in corporate bonds, there is a need to be aware of the credit rating of the portfolio. Credit rating is a signal that investors of debt securities use to ascertain the ability of an issuer to pay interest on time and repay the principal. A rating of AAA signifies highest ability to repay, followed by AA, A, BBB and so on, till D; which indicates default by the issuer.

While in-depth analysis goes into assigning ratings, at times cash flows can dry up quickly, leading to a D rating, meaning that there is risk that the issuer would be unable to pay and the fund that holds the bond will not receive payment. As a result, NAV of the fund can fall, resulting in loss for the investors. This is not an interim loss, rather it is a real and often irrecoverable loss.

So, before you choose a fund, make sure you inspect its portfolio for its credit quality. Lower-quality bonds do offer higher yield and there could be further gains if credit rating is expected to improve. So, choose portfolios that invest at least 70-80% of the portfolio in highest-rated bonds, if you don’t want to bear credit risk. If you don’t mind some degree of credit risk, ensure that the portfolio holding in relatively lower-quality bonds is not high. A portfolio that has high concentration in low-rated securities will lose sharply in case of default.

Average maturity: A portfolio’s average maturity tells you the weighted average time taken for all securities in the fund to mature. This figure represents the interest rate sensitivity of the fund: higher the average maturity, more sensitive the fund returns will be to changes in interest rates.

While other measures like modified duration are considered more accurate to determine this, average maturity shows you the direction. If you are looking to benefit from cyclical interest rate opportunities, funds that actively manage maturity should be favoured. However, if you are looking for a less-volatile fund, to park money in for 2-3 years, look at schemes with average maturities matching your investment horizon. It is also important for stable returns that the fund is consistent in maintaining its average maturity at that level.