Theories like Phillips curve which links inflation to economic activity have gone for a toss in the post Covid world posing a challenge for policy makers, a report by SBI economists said.

According to an econometric analysis of the link between inflation and output gap over a 15-year or 60-quarter period, the link was strong between 2016 and 2018 but started weakening since then. “The link is completely lost during the Covid period implying the irrelevance of output gap in explaining inflation in the post-Covid world, even in India,” said the report by SBI’s research team. “The results do not change if we use core inflation in place of headline inflation”.

According to the Phillips curve theory, inflation is partly due to economic activity deviating from its potential and is popularly known as output gap. Central bank monetary policy statements, including that of the Reserve Bank of India, always identify this output gap as a significant determinant of inflation.

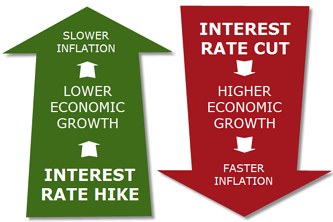

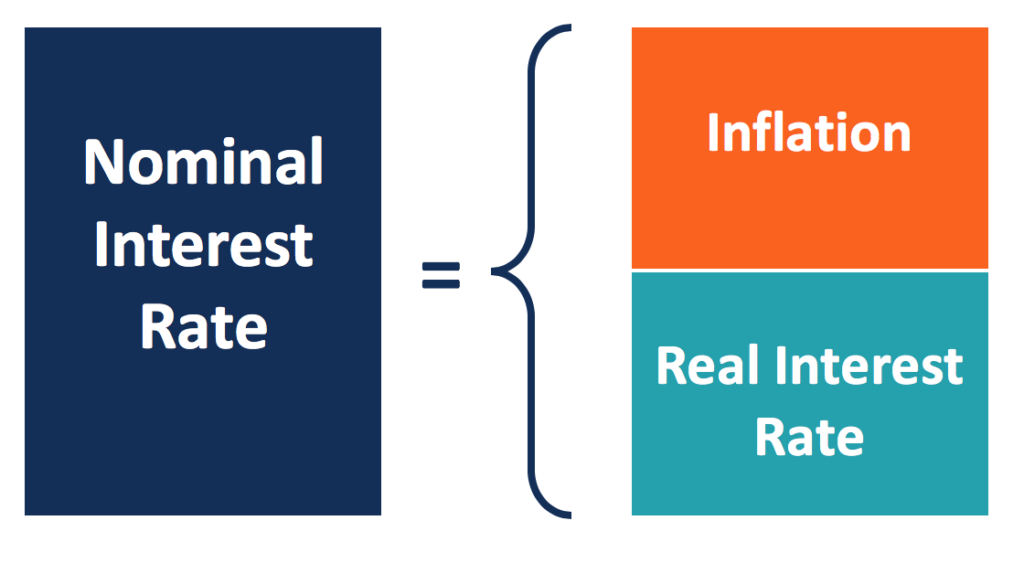

“Milton Friedman’s popular dictum, ‘inflation is always and everywhere a monetary phenomenon’, possibly might not pass the test of scrutiny in this post-Global Financial Crisis and pandemic world,” said the report. To face the challenges thrown by the Global Financial Crisis of 2008, central banks started monetary easing. But inflation was not a major threat then and hence pushed interest rates down. As interest rates declined, debt-to-GDP ratio climbed up and the economy is now more vulnerable to higher interest rates.

“This in turn makes it very difficult to raise them in future lest markets could disorient,” the report said. “In other words, low rates beget lower rates.

This is a big risk that even RBI is currently facing as low rates in the system are fuelling inadequate risk recognition with irrational pricing of credit risk.”

Central banks, including the RBI, face many challenges to the current analytical background of monetary policy formulation. “The main challenge is intellectual challenge. Certain ingrained economic beliefs at the core of the prevailing analytical paradigms may have facilitated the loss of policy headroom and may complicate the quest to regain it to the extent that they influence policy,” the report said.

SBI economists, however, expect the RBI to hold rates and focus on liquidity stabilisation.