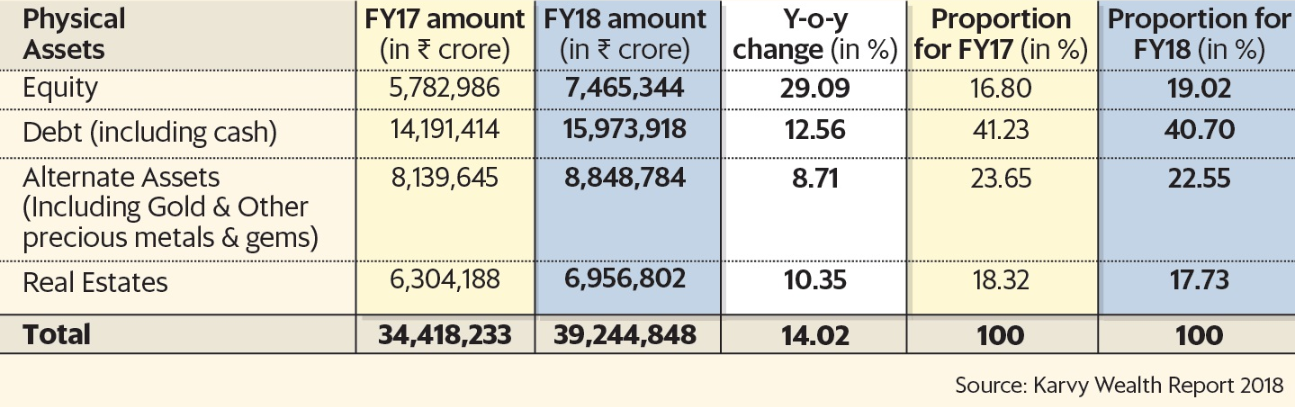

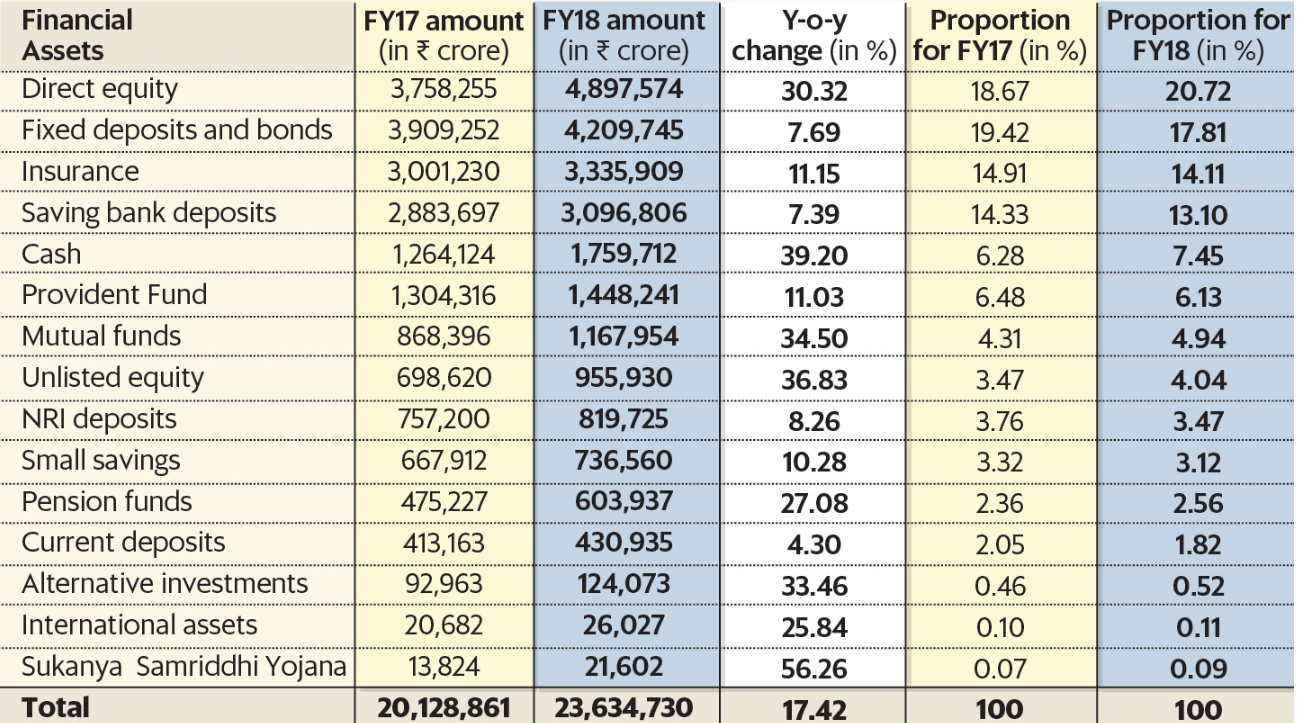

According to the ninth edition of Karvy Private Wealth’s India Wealth Report, total individual wealth, financial and physical assets, grew 14.02% in FY18 as compared to 11% in the previous year. Moreover, the proportion of financial assets increased to 60.2% in FY18 as compared to 58.48% in FY17.

According to the report, the proportion of direct equity at 20.72% for FY18 has overtaken fixed deposits and bonds at 17.81%.

Equity: The cream in returns for individual portfolios will continue to come from equity, predicts the report. The 2025 Sensex forecast in the report is a value of 100,000.

The folks at Karvy Private Wealth expect higher earnings growth of 15-17% in the next five to seven years. At the same time they expect PE re-rating to around 22-24 levels.

The 2013 edition of the Karvy report predicted overall wealth for individuals could grow 103% by FY18, with financial assets accounting for 55.5% of this wealth. The latest report shows the growth in overall wealth for individuals has been slightly more than 94% with financial assets accounting for 60% of the allocation. Equity is perhaps the biggest contributor to the growing allocation for financial assets over physical ones.

Real estate: Despite the gloom around the real estate sector, there is enough investment activity happening. Individual wealth in real estate has grown 10.35% in FY18.

A complementary trend, said the report, is growing assets under management for real estate funds; wealth allocated to these funds has grown 21.5% in FY18. Moreover, one more line item—high yield debt—shows a 26.6% increase and bulk of this pertains to real estate-linked debentures.

Regulatory changes like GST and RERA have brought much-needed transparency in the real estate sector leading to better investment opportunities.