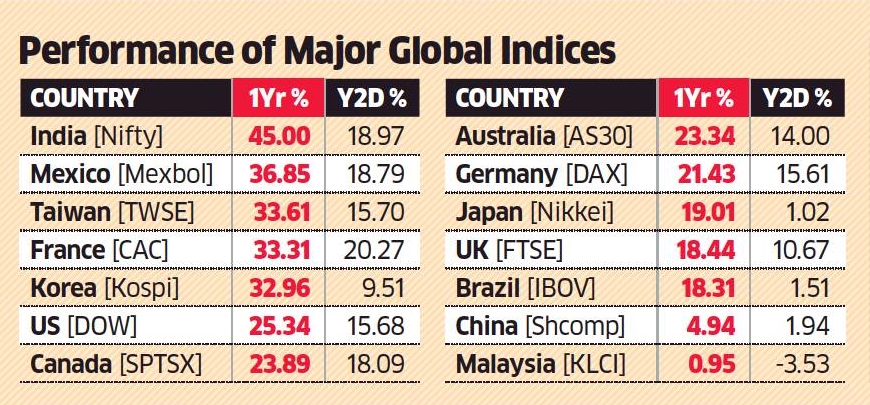

Indian’s equity market has emerged as the top performing among major economies year-on-year as well as in the year-to-date period, helped by strong retail and institutional flows amid relatively better earnings prospects.

According to data from Bloomberg, benchmark Indian indices gained 45% and 19% in the past 12 months and year-to-date, respectively.

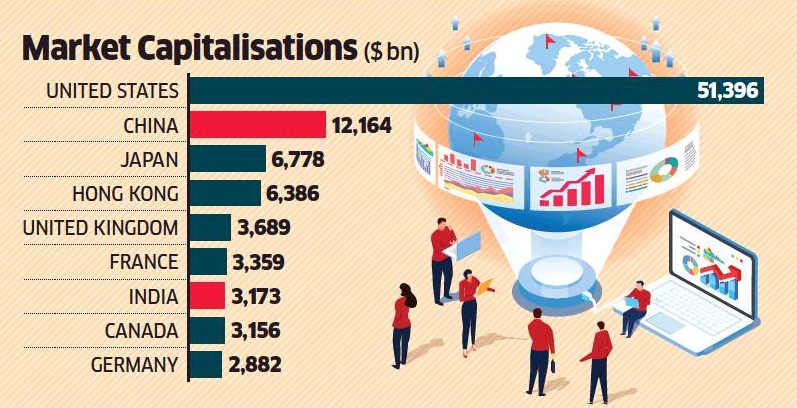

India has outperformed the MSCI World index, a gauge for the developed markets, and MSCI Emerging index, a measure of performance of equities in the developing economies, by 15% and 29%, respectively in the past 12 months. India’s return correlation with global equities has dropped to 61% from over 80% a few months ago. Indian equities have added about $1 trillion to the country’s market capitalisation in the past one year, taking it to $3.12 trillion Indian equities trade at 23 times FY22 expected earnings, the most expensive valuation among the top global markets. While the consensus earnings growth for the current fiscal year is trimmed by 2.7%, the FY23 consensus has been upgraded by 2.1% due to improved rate of economic recovery.

Institutional flow from overseas as well as domestic sides aided the equity market returns. FPIs have invested close to Rs 2.2 lakh crore ($31 billion) in the past one year, while retail flow through systematic investment planning (SIP) is at Rs 1 lakh crore.

Morgan Stanley said in a recent report that Indian equities make a strong relative case and an improving growth environment, mean reversion in margins, lower tax rates and falling interest costs set the stage for strong relative fundamentals which could lead to India’s re-rating.