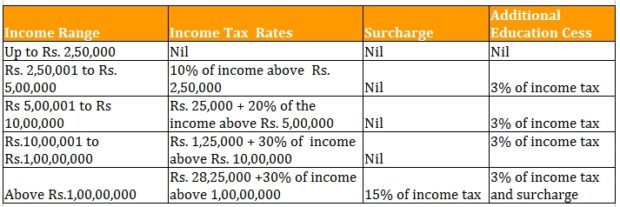

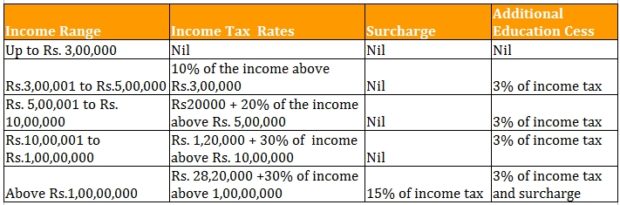

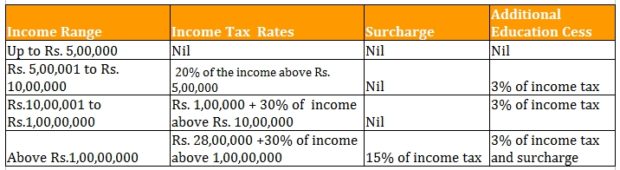

The tax rate applicable for calculating liabilities of tax for the FY 2016-17/ AY 2017-18:

Individuals who are below the 60 years of age and are born after April 1, 1957:

Resident senior citizen who are 60 years of age and less than 80 years of age at any time during the FY 2016-17 and born after April 1, 1937, and before March 31, 1957:

Resident super senior citizen who are above 80 years of age or more at any time during FY 2016-17 and born before April 1, 1937:

Deductions of section 80 are covered under the chapter VI of the Income Tax Act. 80C for investment, 80CCD (IB) for NPS, 80CCC for pension funds, 80D for health insurance, 80E for education loan, 80EE for interest on the loan for buying house property, 80G for donations, 80U for disability, 80TTA interest on deposits in bank accounts and much more.

Rebate is offered under section 87A of the Income Tax Act. The rebate is 100% applicable for a person earning not more that 5,00,000 p.a. The maximum rebate that can be claimed under the Act is Rs.5000. If someone is falling under such criteria, he/she can claim for the rebate before applying the education cess.

The rebate amount has been increased from the previous FY which was Rs.2000 only.