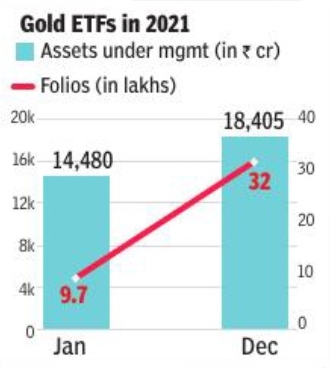

Assets under management of digital gold investments made by Indians in 2021 went up 27% in December 2021 as compared to that in the beginning of the year.

Digital gold investments are in exchange-traded funds where the units represent physical gold which may be in paper or dematerialised form. One gold ETF unit is equal to 1gm of the yellow metal. It is backed by physical gold of high purity. Gold ETFs combine the flexibility of stock investments and the simplicity of purchasing the yellow metal.

From an AUM of Rs 14,480 crore in January 2021, the gold ETF portfolio grew to Rs 18,405 crore at the end of December, according to recent data from the Association of Mutual Funds in India data.

The volume of gold ETF folios surged more than three times from 9. 7 lakh to nearly 32. 1 lakh last year. The folio penetration was boosted by the ease of purchasing gold ETFs. An investor who got initiated into the world of finance has now seen gold as a key part of asset allocation. In 2021, newer investors would have seen merit in buying gold as an asset class in the digital format. Further, there was almost 2x growth in new gold ETF folios. This is largely because many online portals have facilitated ease of purchase of gold as an asset class, as compared to purchasing physical gold during the lockdown.

For December, gold ETFs saw inflows of Rs 313 crore. They also repurchased gold ETFs worth Rs 176 crore in the last month. According to a World Gold Council report, despite considerable outflows for the year, globally gold ETF holdings remain significantly above pre-pandemic levels.

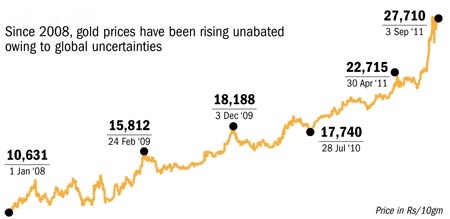

A throwback of prices in the past: