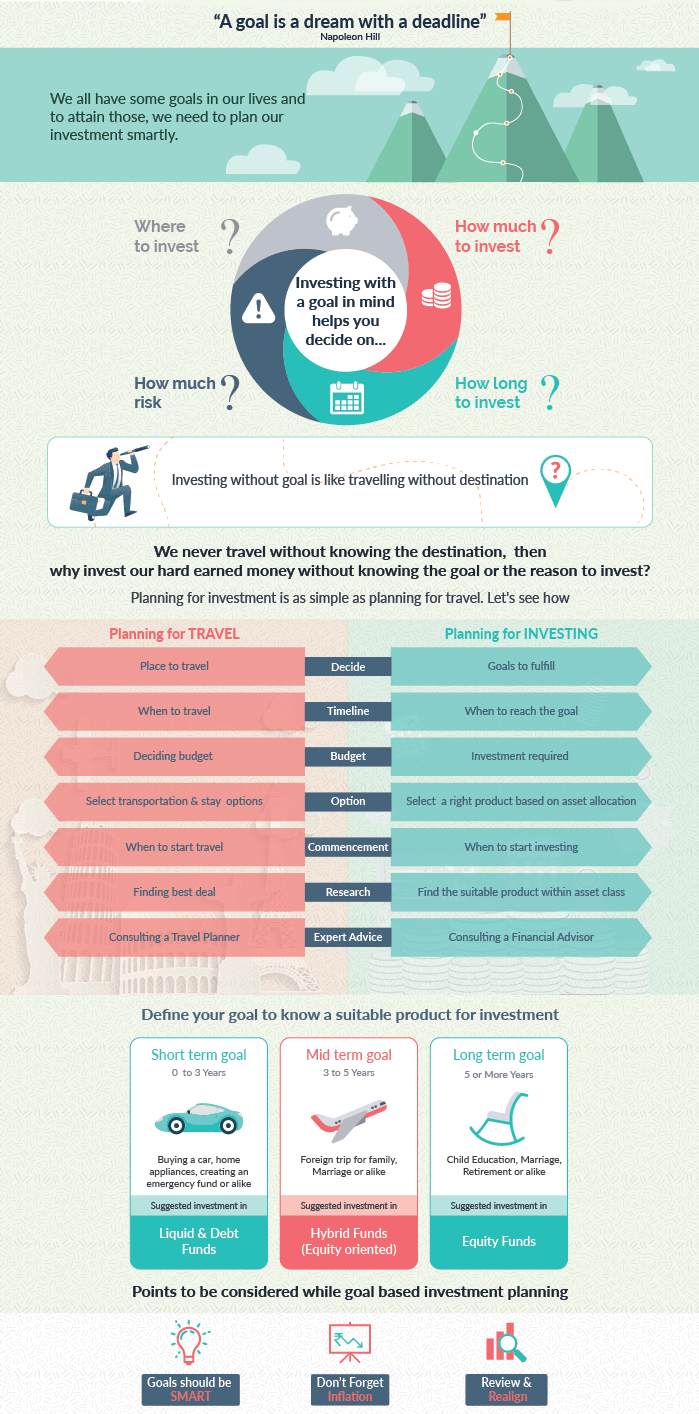

Every individual has several life goals: both long term and short term. Investing in a planned manner to achieve these goals is called goal-based investing. For example, if you want to plan a foreign holiday with your family in mid-2018, which is about 18 months away , it is a short-term goal. On the other hand, saving for the higher education of your child who is five now is a long-term goal.

The first step is identifying the goal for which you wish to invest and assessing the time you have to reach it. Once that is done, it is important to find how much the goal costs today . Add a reasonable amount of inflation to that, and then you would know what the goal would cost you in the year you wish to accomplish it. The next step would be to understand how much you can save or invest for that goal. You could then use the systematic investment plan or go for a lump sum investment, or even a combination of both, to achieve that goal.

Identify funds based on your risk profile. For example, if you plan for a foreign holiday 18 months from now, which will cost you about Rs.5 lakh, debt funds (ultra short-term or dynamic bond funds) will be ideal to reach that goal. Since it is a near-term goal and the time is less than three years, investment advisors suggest you should go for a combination of debt-oriented funds, which could give you anything between 7% and 9%. Do your math and decide whether you wish to opt for a lump-sum investment or want to stagger it. Also keep the tax implications in mind, as debt investments for less than three years will attract short-term capital gains tax. Similarly , for your child’s higher education, which would be more than 10 years away , you could invest in equity mutual funds. If you do an SIP of Rs.5,000 every month for 15 years, at a 12% return you could accumulate Rs.23.79 lakh.

Goal-based financial planning helps you invest in a systematic and disciplined manner to achieve your goals. It helps you remain focused and unaffected by the short term volatility in the equity markets.