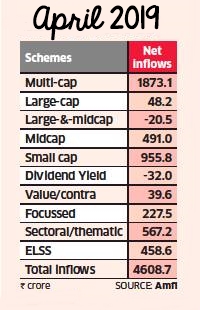

Net inflows into equity mutual funds fell a whopping 57% to a 30-month low in April but SIP investors kept the faith with a 17% rise in flows over the year-ago period. AMFI data shows equity inflows for April at ₹4,608 crore, down 42% when compared with March 2019’s inflows of ₹9,014 crore.

Retail investors stayed steady with SIP inflows growing 2% over March and 17.8% over April last year to ₹8,238.28 crore.

Temporary profit-booking due to uncertainty over the outcome of the general elections is one reason.

AMFI data show 40% of equity flows in April found its way into multi-cap schemes, 20% in smallcap schemes and 10% in mid-cap schemes. Investors appear to have shifted some of the money from large-cap schemes to multi-cap, mid-cap and small-cap schemes.

Hybrid schemes too saw inflows, when most categories saw outflows. Arbitrage schemes recorded inflows of ₹1,529 crore.

Analysts also said rising flows in small-cap schemes reflect a belief among investors that the general elections will be a decisive mandate. Secondly, higher inflows in multi-cap schemes reflect a time tested strategy of protecting the downside when it becomes difficult to ascertain earnings’ growth in companies across market capitalisation.