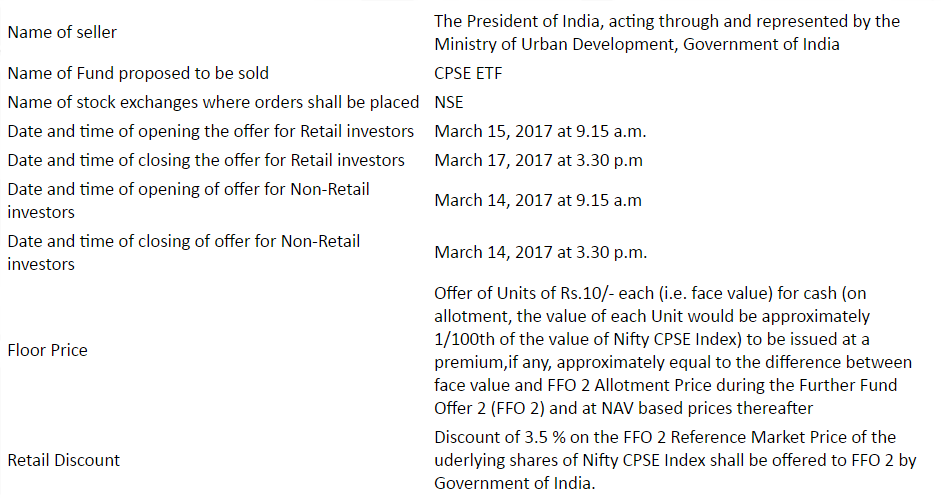

CPSE ETF Further Fund Offer 2, managed by Reliance Mutual Fund, will open for three days for retail investors from March 15. This is the third tranche on offer through which the government aims to garner Rs.2,500 crore. Prior to this, the government raised Rs.3,000 crore in March 2014 and Rs.6,000 crore in January.

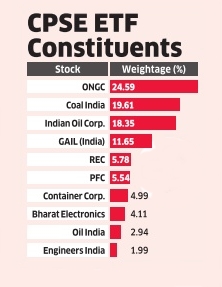

The CPSE Exchange Traded Fund consists of shares of 10 public sector units Oil & Natural Gas Corp., Coal India, Indian Oil, GAIL (India), Oil India, PFC, Bharat Electronics, REC, Engineers India and Container Corporation of India.The minimum amount that retail investors must put in is Rs.5,000.

The government has lowered the upfront discount to 3.5% in this tranche and this will be offered to all categories of investors. The earlier two series offered a 5% discount to retail investors. The second tranche in January was oversubscribed three times.

The fund has a low expense ratio of 6 paise, 3.5% discount, 4% dividend yield and PE ratio of 12.