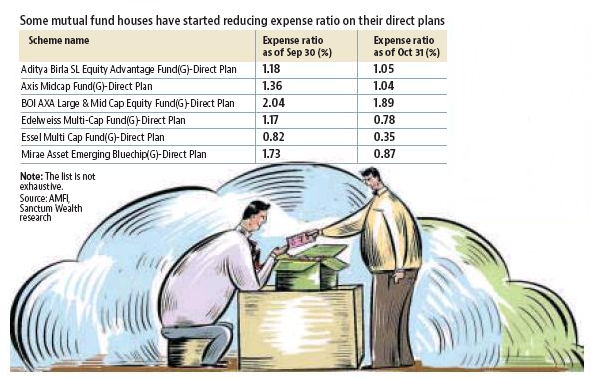

The cost of direct mutual fund is set to come down further by January 2019. After the regulator Securities Exchange Board of India came down heavily on the asset management companies on their total expense ratio, at least five mutual funds have slashed prices of their direct plans over the last few weeks.

TER is the cost of managing your mutual fund, which includes fund management fees, operational expenses, administrative expenses and distributor commission.

Companies, including Edelweiss Asset Management Ltd and Mirae Asset Management Ltd, have reduced their TER after the Sebi mandate in October this year.

Every fund house has a regular plan and a direct plan for the same scheme. The idea behind a direct plan was that the trail commission will get removed and you will get a cheaper plan. Suppose the expense ratio is 200 basis points (bps) and trail commission is 100 bps, then the direct plan should be cheaper by 100 bps. One bps is one-hundredth of a percentage point. However, mutual fund companies began to expand the costs in direct plans by increasing the fee for asset manager. As a result, the difference between direct and regular plans fell from 100 bps to 50 bps or 60 bps.

Meanwhile, several AMCs have still not cut the cost. However, planners believe this is a transition period and the new rates will come into effect soon.

While opting for mutual funds if you are wondering whether you should opt for a direct or regular plan, the answer lies in your understanding of the investment instrument and not the cost of the plan. If you want to opt for the direct plan and need hand holding, it would be prudent to take help from a fee-based financial planner who can give you unbiased advice. If you are a do-it-yourself investor, direct plans may work for you.

But make sure you do your research before investing. If you don’t understand mutual funds well, don’t opt for direct plans just because it is cheaper. It is ideal to consult a financial advisor.