Credit scores play a major role in the approval of credit card and loan applications. They are also being increasingly used for setting interest rates on loans and even for evaluating job applications. However, the lack of awareness about credit reports has led to the rise of several misconceptions and myths regarding credit scores.

Here are some of the common credit score myths that you need to be aware of.

Myth 1: Requesting credit report reduces your score

Whenever you apply for a loan or a credit card, the lender evaluates your credit worthiness by requesting your credit report from the credit bureaus. These enquiries are considered as hard enquiries and each of them shave off a few points from your credit score. However, a self-initiated credit report request is considered as soft inquiry and it does not reduce your credit score.

Myth 2: Defaulters should track credit score

Your credit report may contain wrong information due to clerical error(s) on the part of the credit bureau or lender. These errors may reduce your credit score and adversely affect your future loan or credit card eligibility. Checking your credit report at regular intervals is the only way to detect such errors. Such checks will also allow you to detect identity theft, if any, by fraudsters.

MYTH 3: Paying off delinquent debt will erase history

There is a common misconception that paying off your old delinquent debt improves credit score by erasing the negative information from your credit report. However, in reality, closed loan accounts or credit cards would still show in your credit report for 5–6 years.

Myth 4: Avoiding credit history results in higher credit score

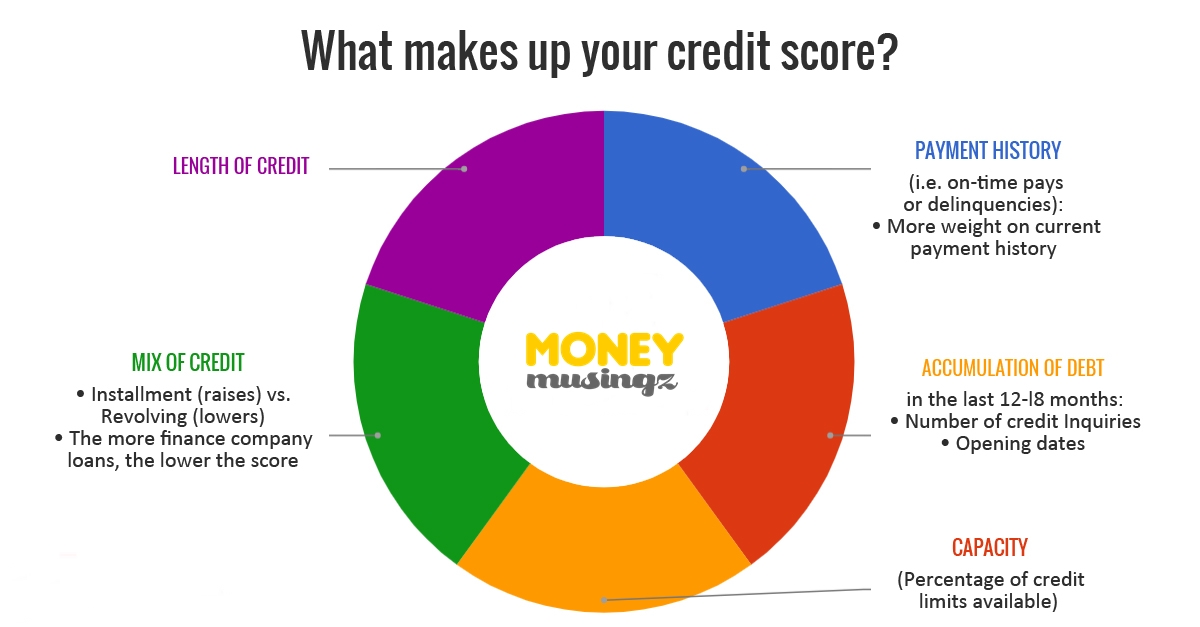

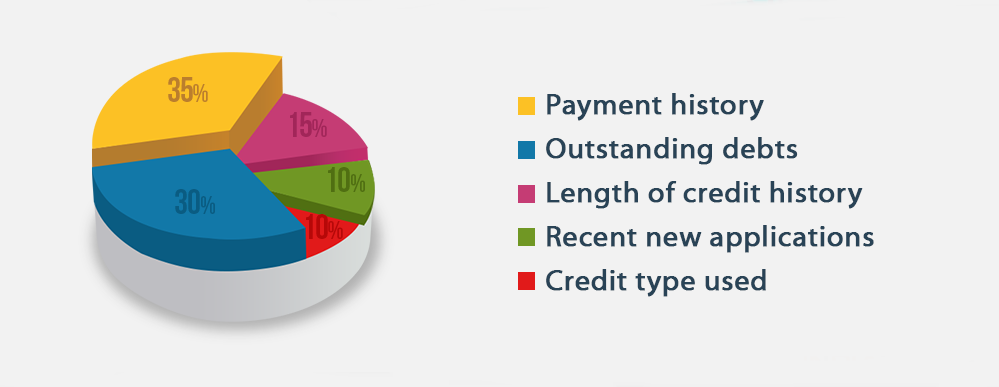

Credit bureaus calculate credit score on the basis of your credit history. As absence of credit history leaves the bureaus without any data for calculating your credit score, it becomes harder for the lenders to assess your creditworthiness. This will lead lenders to classify you as a risky borrower, thereby adversely affecting your future loan and credit card eligibility.

Myth 5: Closing unused credit cards leads to higher score

Lenders prefer to lend to those who have a credit utilisation ratio of 40% or lower. Credit utilisation ratio is the proportion of your availed credit limit against total credit limit available on all your cards. As closing your credit card will bring down your total credit limit, continuing with the same level of credit card spends with reduced credit limit will increase your credit utilisation ratio, and this in turn will reduce your credit score. Apart from preserving your credit limit, old credit cards would also help in maintaining a longer credit history.

Myth 6: Guaranteeing loans do not affect credit scores

Guaranteeing or co-signing a loan makes you equally liable for its repayment as its primary applicant. Thus, any default or late payment by the primary applicant will be recorded in your credit report too, reducing your credit score in the process.