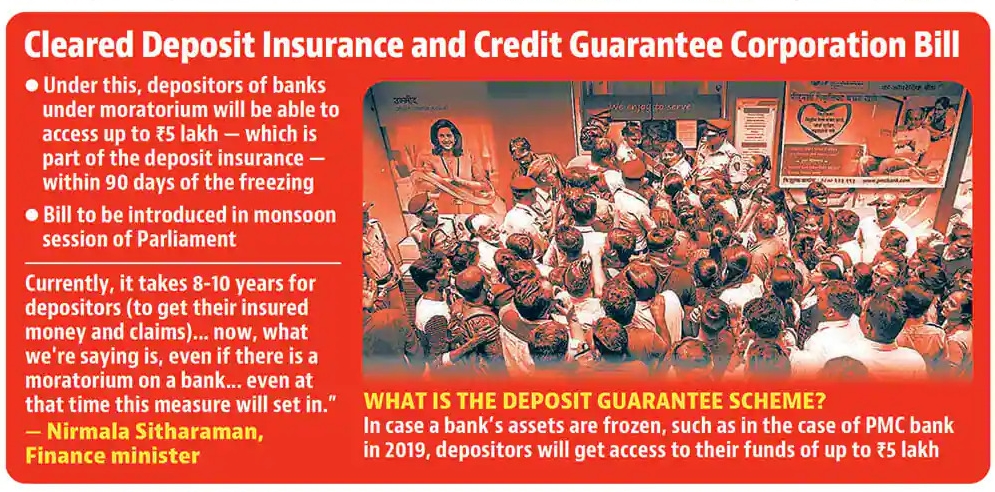

The Cabinet approved amendments to the deposit insurance law to ensure that the guaranteed amount of up to ₹5 lakh is paid within 90 days of the Reserve Bank of India placing a bank under moratorium.

The amendments, aimed at providing quicker relief to depositors of stressed banks, will cover lenders currently under moratorium such as the Punjab and Maharashtra Cooperative Bank. The RBI action against PMC took place in September 2019.

A depositor is covered up to ₹5 lakh, including principal and interest across all accounts in a bank through the law. The limit was raised from ₹1 lakh on February 4, 2020.

All commercial banks including public sector banks, private banks, branches of foreign banks, local area banks, cooperative banks and regional rural banks are covered. All kind of deposits — savings, fixed, current and recurring — are insured.

Under the current law, the official liquidator appointed by the RBI has to make a claim on behalf of depositors within three months of assuming charge while the DICGC has to pay valid claims as soon as possible, or within two months of receipt of the claim. In practice, it takes longer as the process only starts when the failed bank’s licence is cancelled and a liquidator is appointed.

The distressed bank will collate details on accounts for which claims are admissible within the first 45 days, passing on the information to the DICGC to assess claims over the next 45 days.

The cost of this insurance, which is borne by the banks, has been raised to12 paise per ₹100 insured from 10 paise earlier. This is paid by the bank and is not a burden on the customer, the FM said.

DICGC, a wholly-owned subsidiary of the RBI, provides insurance cover on bank deposits.

The finance minister noted that with the increase in the insurance deposit amount, 98.3% of all deposit accounts and 50.9% of deposits by value will be covered.

Sitharaman said the Deposit Insurance and Credit Guarantee Corporation Bill 2021 will be introduced in the current session of Parliament for consideration and passing.

Other banks placed under moratorium by the RBI include Yes Bank (March 5, 2020) and Laksmi Vilas Bank (November 17, 2020).