The Union Budget has introduced the much-talked about LTCG on sale of listed securities on gains of over Rs. 1 lakh at the rate of 10% without allowing indexation benefit. Further, it has proposed a 10% tax on distributed income by equity oriented mutual funds. Currently, LTCG tax on debt funds is 20% with inflation indexation benefit, while equity holdings of more than one year did not attract LTCG tax.

However, all gains up to January 31, 2018 will be grandfathered. A bit of good news in this proposal is that the finance minister has allowed exemption of the gains that would have arisen up until 31 January 2018. Only the gains that would arise after 31 January 2018 would be considered. For example, if an equity share is purchased six months before January 31, 2018 at Rs 100 and the highest price quoted on January 31, 2018 in respect of this share is Rs 120, there will be no tax on the gain of Rs 20 if this share is sold after one year from the date of purchase. However, any gain in excess of Rs 20 earned after January 31, 2018 will be taxed at 10% if this share is sold after July 31, 2018.

The securities transaction tax of 0.001%, which unitholders of mutual funds pay at the time of selling and the STT paid at the time of buying and selling of direct equity shares (0.1% paid both at the time of buying as well as selling) will continue to be paid.

To ensure that investors don’t switch to dividend plans, in order to escape paying the new 10% capital gains tax, the Budget 2018 has also introduced a dividend distribution tax of 10% for mutual funds. This is a tax what a fund house pays—from the distributable surplus—before it pays the dividend. Curiously, while the 10% capital gains tax is meant for only those investors whose cumulative capital gains are in excess of Rs.1 lakh, the DDT will be borne by all investors of equity-oriented mutual funds. This will be effective immediately.

The dividend on listed equity shares is taxable at 10% if such dividend income exceeds Rs.10 lakhs in the year (this change was made in the last year’s budget).

According to the budget proposal:

Any person who sells shares after April 1, 2018 will pay a long-term capital gains tax at the rate of 10 percent on gains of more than Rs 1 lakh. For such shares, the notional cost of acquisition will be price on Jan. 31, 2018.

If a person who has held shares for more than one year sells them before March 31, 2018, there will be no long-term capital gains tax.

A person who sells shares after April 1, 2018, at a loss, the cost of acquisition for such shares would be the price on the actual date of acquisition and not the notional cost on Jan. 31, 2018.

No changes have been made to the existing short-term capital gains tax regime. They’ll continue to be taxed at 15 percent.

Now that the long-term capital gain on sale of equity funds and listed shares is taxable, you can expect long-term capital losses on the sale of equity shares or equity mutual fund units to set off capital gains.

ULIPs now have a great tax advantage over equity mutual funds. No new tax has been introduced for insurance policies. ULIPs already had the benefit of tax-free switching.

Rebalancing your portfolio may have an extra tax burden. Shifting from debt to equity always had tax implications. However, shifting from equity to debt may now have an additional cost involved.

No indexation is allowed in case of sale of equity shares. In case of capital gains on jewellery and real estate, the tax department allows indexation on account of inflation. But this will not be allowed in case of share sale.

For existing investors

Let us understand it through an example, if 5 years ago you bought shares of Rs 1 lakh, whose market value has increased to Rs 2 lakh, you will come under LTCG tax regime after April 1, 2018, if you sell your shares and book profits. However, there is no tax as per the new regime if the gains are below Rs 1 lakh.

Suppose, you sell them on April 30, 2018, and the market value of the shares on that particular date is Rs 2.5 lakh, in such case, the cost of acquisition will be Rs 2 Lakh (as on January 31, 2017). Therefore, LTCG tax will apply on Rs 50,000 (Rs 2.5 lakh-Rs 2 lakh).

This is not a retrospective tax. You are paying zero LTCG as of Jan 31.

The cost price for LTCG calculation starting April 1, 2018 is higher of actual cost price or price on 31 Jan 2018. If you now hold and sell post-April 1, 2018, you come under the ambit of LTCG but with cost, the price is January 31 price and not the low-cost price from 13 years ago (if you indeed were smart and have been saving that long). The benefit in selling before March 31 and then buying again on April 1 is minimal as you come under STCG ambit for one year again, pay STT, and run the risk of share price change between your sale and repurchase.

For new investors

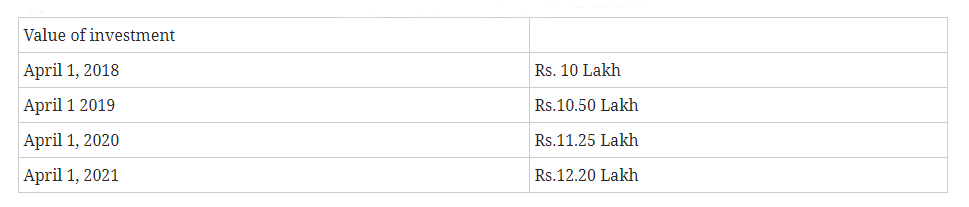

Mr. Khan purchase shares for a total value of Rs.10 Lakh (cost of acquisition) on 1st April 2018. The price of the share appreciates and the value of investment goes up year after year as under:

If Mr. Khan sells the shares on April 1, 2021, his total Long Term Capital Gain would be Rs 2.20 Lakh (Rs 12.20 lakh–Rs 10 lakh) in the FY 2021-2022 (AY 2022-2023). However, LTCG of 10% will be payable on Rs.1.2 lakh (Rs 2.2 lakh less Rs 1 lakh).

Thus, even though the appreciation in each year is less than Rs 1 lakh, still as long as the total gain realized in the year of sale is more than Rs 1 lakh, there would be LTCG implication.