The Union Budget 2017 was presented in Parliament yesterday.

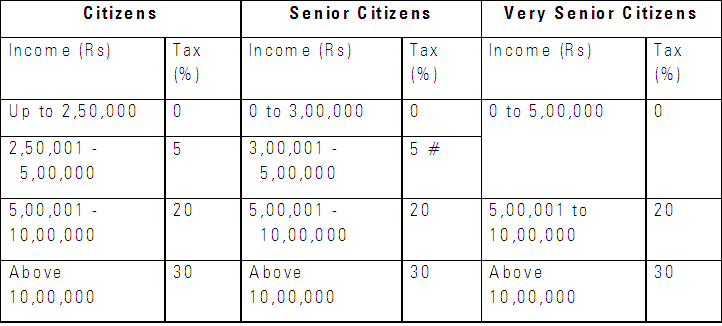

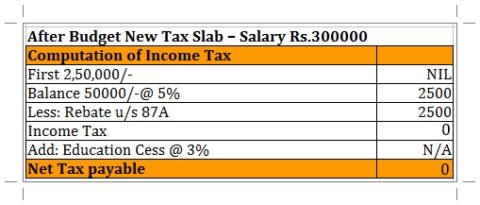

Personal income tax rate slashed from 10% to 5% for individuals earning between Rs 2.50 lakh and 5 lakh per annum.

A surcharge of 10% will be levied on individuals earning between Rs.50 lakh and Rs.1 crore.

Consequent to the combined effect of the new Section 87A rebate and the reduction in tax rate for those earning Rs.2.5 lakh to Rs.5 lakh, the tax burden for those with income up to Rs.3 lakh would be zero.

Since even individuals falling in the higher tax bracket will also be eligible for the reduced 5% for income between Rs.2.5 lakh and Rs.5 lakh, therefore individuals falling in higher tax brackets will pay lower tax by Rs.12,500 per person.

Post-Budget Income Tax Slabs

Surcharge on income between Rs 50 lakh and Rs 1 crore: 10%

Surcharge on income above Rs 1 crore: 15%

Education Cess: 3%

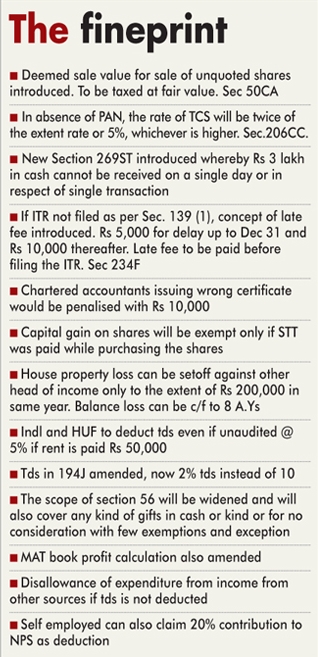

# While it would be commonly assumed that senior citizens too would avail of the lower rate, the Budget text did not explicitly make a mention of the Rs.3,00,001 to Rs.5 lakh bracket of this age group.

• A big announcement was the limit of Rs.3 lakh on cash transactions. This is stricter than it seemed in the Budget speech, because the limit is not only per day, but per transaction and per event.

• The FM has eliminated the loophole of interest on property let out. This will now be restricted to Rs.2 lakh, against other income. Additional loss allowed to be carried forward for 8 years.

• Self-employed individuals shall be eligible for deduction of up to 20% of their Gross Total Income for contribution made to National Pension System trust, within the overall limit of section 80C.

• Everyone has to deduct TDS @5% if rent of more than Rs.50,000 per month is paid to someone. This is expected to eliminate the practice of fake rent receipts.

• The budget has also increased the accountability of professionals who tend to collude in tax evasion. If a chartered accountant or a merchant banker or a registered valuer furnishes incorrect information in a report or certificate, under any provisions of the Act or the rules made thereunder, he could be liable to pay Rs.10,000 as penalty for each such report or certificate.

• Any delay in filing of income tax return will also attract a penalty Rs.5,000 or Rs.10,000. The budget also proposes to grant interest in case of refund of excess payment of TDS.

• The budget makes it mandatory for all entities exempt from paying tax to file income tax returns. This is a much-needed clarification of what was a grey area until now.

• The budget has plugged a big loophole of evading tax through manipulation of share prices and claiming Long term Capital Gain on shares. The FM has said that LTCG exemption will only be available if the STT was paid at the time of purchasing shares. This will apply to all shares acquired after October 1, 2004 (will not include bonus shares or those acquired through initial or follow- on public offerings).

• The tax rate for SMEs with a turnover of less than Rs.50 crore has been reduced to 25%, which will significantly help smaller businesses.

• The budget has also raised the requirement of a tax audit for income above Rs.2 crore.

• Base for indexation in case of long term capital gain has been shifted from 01.04.1981 to 01.04.2001.

• After this budget, builders will be forced to sell house within one year of receiving an occupation certificate or they may have to pay tax on notional rent. Until now, there was dispute with regard to taxability through notional rent, if the builder claimed to hold the apartments as stock in trade.

• In a move aimed at curbing use of tax and anonymous donations, the FM has announced that any donation above Rs.2000 in cash will not be eligible for tax deduction under Sec 80G of the income tax act. Donations have to be digital or by cheque to qualify for tax breaks.

• The limit on cash expenses claimed by a person has been reduced from Rs.20,000 to Rs.10,000 per day.

• Insurance agents will be able to submit form 15G/15H for non-deduction of TDS from insurance commission.

• The TDS rate for call centres has been reduced from 10% to 2%.

• Type of transactions for domestic transfer pricing reduced substantially. This will ease burden on domestic companies.