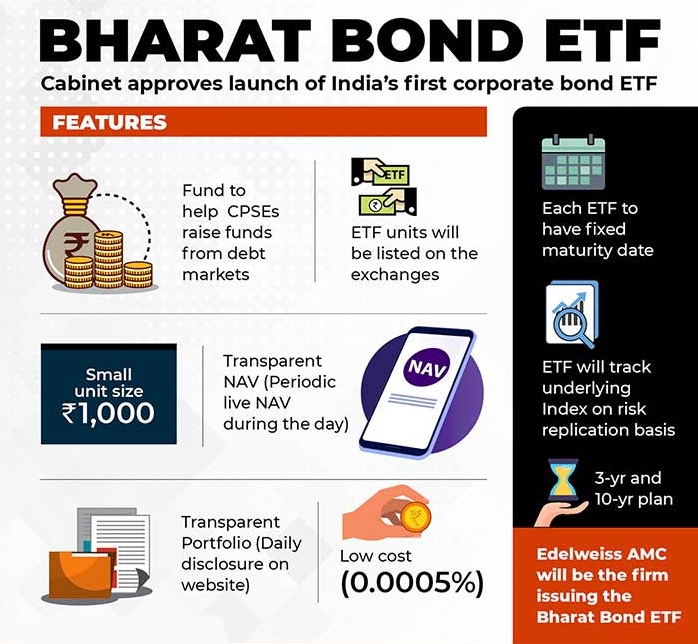

The Union cabinet has cleared Bharat Bond ETF, India’s first exchange traded fund that will consist of corporate bonds issued by state-run companies. This will be managed by Edelweiss Mutual Fund. The fund will have a defined maturity date and once the product matures, the investor will get back investment proceeds along with returns. Also, investors can buy or sell their units of this fund on the exchange anytime during the tenure of the fund.

The New Fund Offer of this ETF is expected to be launched in December, with the fund house also likely to launch a fund of fund for retail investors, without demat accounts. To being with, Bharat Bond ETF will have two maturity series — 3 years and 10 years. One scheme will mature in April 2023 and the other scheme in April 2030.

The first series will hold AAA-rated government owned companies. The top three holdings in the three-year scheme are REC, NABARD and Power Grid while the 10-year scheme has NHAI, IRFC and REC as its top three constituents.

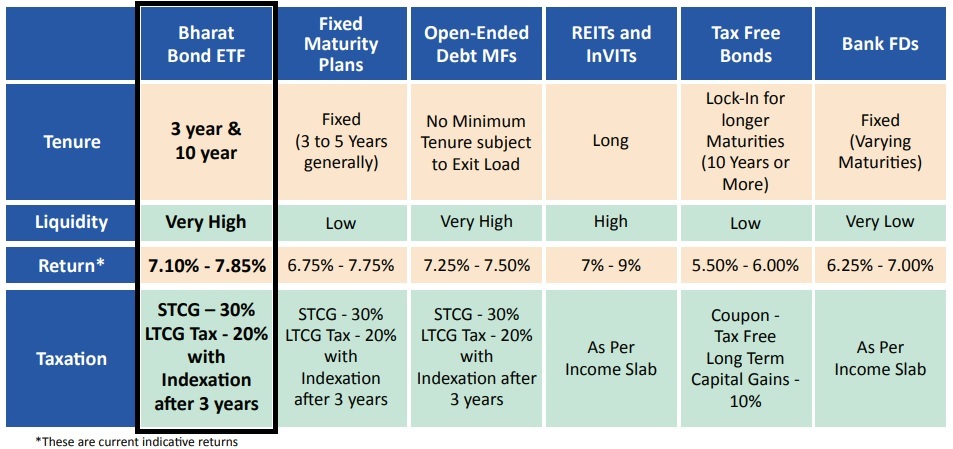

Like a debt mutual fund, an investor holding a bond ETF for more than three years will get indexation benefits, that significantly lower capital gains tax. Since the bonds will mature in April 2023 and April 2030, investors will get the benefit of an additional year for indexation. Long-term capital gains for those holding over three years will be taxed at 20% after indexation.

Bharat Bond ETF will invest in bonds of AAA-rated government-owned companies, which lowers credit risk. The fund will be managed at a very low cost – 0.0005%. The ETF will have a fixed maturity date, lower interest rate risk and provide predictable returns if held till maturity. The units will be liquid as the instrument will be listed on the stock exchange. Big investors including institutions will be able to buy and sell units with the fund house directly.

Investment Strategy: The ETF will have a fixed maturity date like a bond. It will hold bonds till their maturity and coupons received will be reinvested. Since this is an ETF, investors wanting to participate will need to have a demat account. The fund house is also likely to launch a fund of fund which will enable retail investors without demat accounts to invest and also take care of their liquidity needs. Investors can set up systematic withdrawal plan to get monthly income through this fund of fund.