The Account Aggregators framework in India has been another revolution in the making. It is part of the larger India Stack.

Just as it was quietly taking shape since 2016, it has also silently started manifesting itself with many participants going live in stages over last few months.

The Account Aggregator System can be used as follows:

a. User Engagement with features like alerts

b. Aggregated picture of assets for Financial Planning & Wealth Management

c. Use cases in Lending like automated information sharing with user consent, credit appraisal, collections, risk etc.

d. User Account Verification

e. Can be embedded to existing apps of financial firms to enrich user experience.

f. More user information on Income Sources, Employment etc.

Eventually all this will lead to faster onboarding, better user experience and value added features.

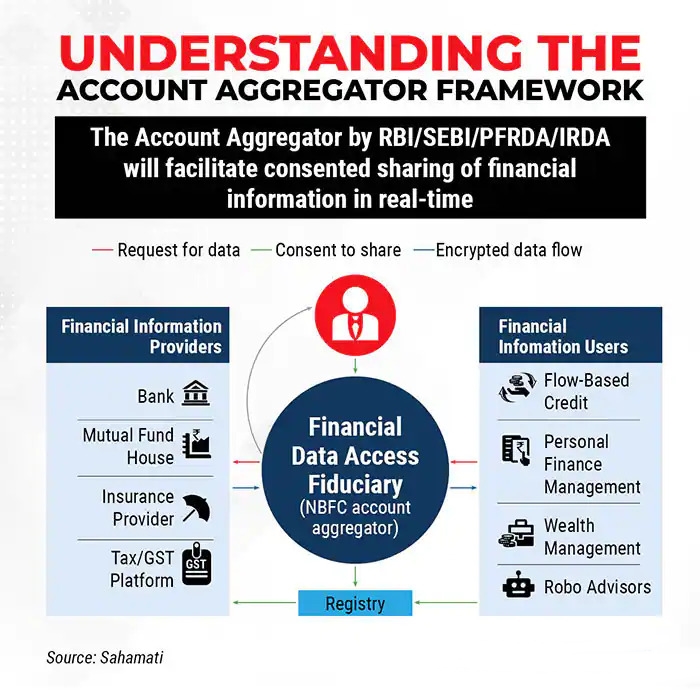

The framework has the Account Aggregators, FIU’s (User of information), FIP’s (Provider of Information) & the Customer. AA’s just authenticate, pull the data from FIP and pass it on to FIU’s based on Customers consent. No data is stored at AA level, and all exchanges happen in an encrypted manner between authorized parties in ecosystem.

The backbone of this is the consent layer API called, Data Empowerment and Protection Architecture. DEPA aims to democratize data access while enabling secure portability of trusted data between service providers.

Of course well begun is half done, we still have long way to go as AA considers only Assets across Bank Accounts, Equity, Demat, MF & Insurance and as I understand not all are live and we will gradually have access.

Walmart-owned PhonePe on August 26 said it has received in-principle approval from the Reserve Bank of India to operate as an Account Aggregator.

The company said that the license permits PhonePe to launch its AA platform that will enable instant exchange of financial data between the Financial Information Users and Financial Information Providers with due consent from customers, in a safe and secure manner. This will help Indian consumers avail financial services in a faster, cheaper and more convenient manner.