While the markets have been rising steadily, there is scope for enhanced volatility, given the uncertainties surrounding economic recovery and implementation of reforms announced by the government. In such a backdrop, it is best to stay invested in a product which is spread across market capitalisations.

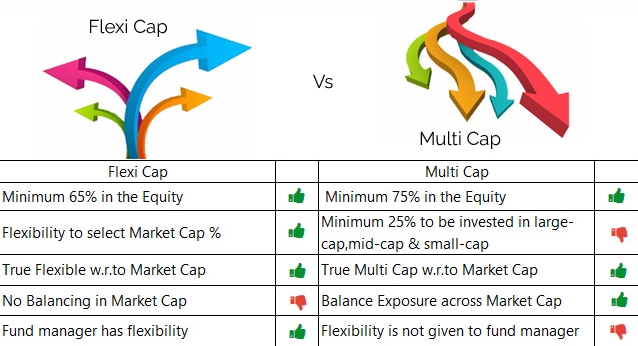

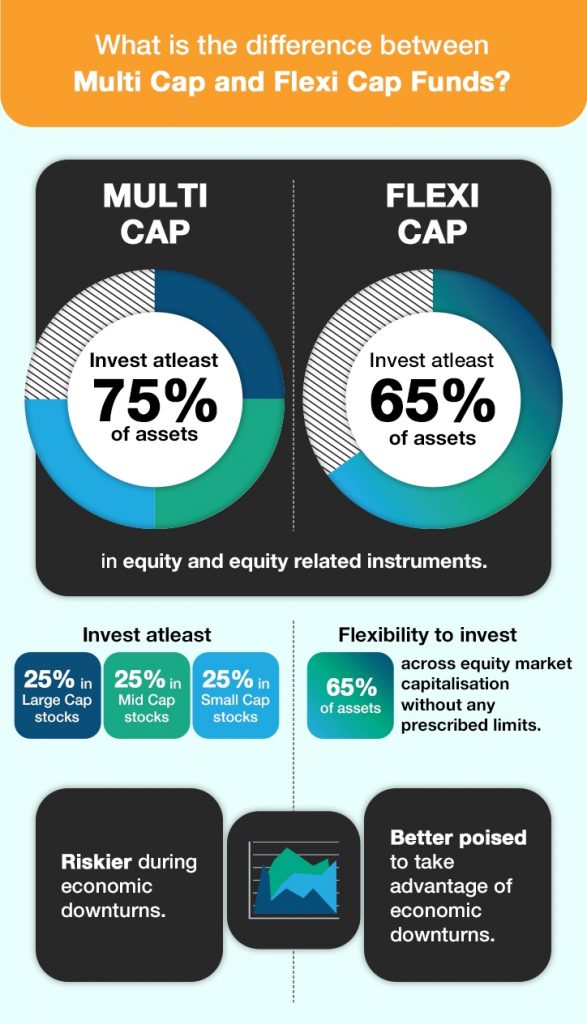

Multi-cap funds are now required to invest at least 25% each in large-, mid– and small-cap segments. While fund managers still have 25% elbow room to give the portfolio an edge by hiking exposure to the segment they believe will do well, it takes away their ability to reduce exposure to a segment expected to do poorly, thus making the fund more stringent in terms of market cap exposure, and hence, the accompanying risk should the fund manager choose to hike allocation to smallcaps. In case you are looking to benefit from the long-term growth prospects of mid- and small-sized companies, you may find this a good way to participate. The fund may also be used to capitalize on an upturn in the mid- and small-cap segments with the allocation to large- caps acting as a safety buffer. The large- cap allocation of multi-cap funds will limit downside risks in volatile markets.

The flexi-cap category of equity funds, on the other hand, will invest at least 65% of the total assets in equity investments without any defined limits in terms of exposure they should take to large-, mid- or small-cap segments. These have the flexibility to change market cap allocations according to the fund manager’s outlook. In bull markets, these schemes would increase mid- and small-cap allocations, while in bear markets these would reduce mid- and small-cap exposure and shift towards large-caps. You might want to explore multiple flexi-cap funds and choose a large-cap oriented flexi-cap fund in case you are looking for a stable ride with mid- and small-caps giving a boost to returns.

Though multi-cap and flexi-cap funds may seem similar, there are important differences in investment mandates. To put it simply, in case you want to invest in different market cap segments, you could invest in multi-cap funds. However, if you are not sure which market cap segments are suitable for your investment needs and want the fund manager to decide in which segments to invest according to market conditions, then you can invest in flexi-cap funds. You must choose based on risk and return expectations from the two strategies.