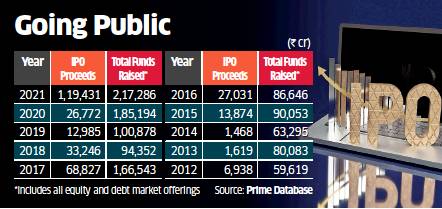

Fundraising through initial public offerings touched a record high in the year 2021. According to data, 63 companies have floated an initial share sale this year, raising ₹1.19 lakh crore from public investors.

This is nearly 4.5 times higher than the IPO fundraising in 2020 and almost double that of 2017 which held the record until now for highest fundraising, data compiled by Prime Database showed. In 2020,15 companies raised ₹26,613 crore from the public market while in 2017, 36 companies raised ₹68,827 crore.

Market participants expect this buoyancy in the primary market to continue despite some lacklustre listing in the recent past. Currently, 35 companies have received a nod from the Securities and Exchange Board of India to float IPOs worth ₹50,000 crore. Another 33 companies have filed their offer documents for raising around ₹60,000 and are awaiting Sebi approval.

The year saw a slew of IPOs from the new age businesses. One 97 Communications — the parent company of Paytm — tapped capital markets to raise ₹18,300 crore making it the largest IPO of the year. Other tech companies including Zomato and Nykaa also made their debuts in 2021.

Market experts anticipate the IPO demand to continue.

However, any adverse moment in the secondary market could spoil the IPO party, experts say. In the last few weeks, the Indian markets have witnessed heightened risk aversion on account of expensive valuations and the emergence of a new variant of the Covid-19 virus.

Even in terms of overall fundraising, 2021 has been a record year for the markets. India Inc raised capital of ₹2.17 lakh crore through public markets against the previous record of ₹1.85 lakh crore in 2020.

Overall fundraising includes both debt and equity such as IPOs, followon offers, qualified institutional placements and bond issuances by statet-owned and private companies.