Mutual fund investments work best over the long term because assets need time to grow, and over a longer period of time, volatility in the markets tend to get smoothed out. You can look at their performance over a longer period of time if you wish, but we have taken an optimum period of five years. Once invested, you should review the performance every year.

Let us, therefore, look at the top 10 best-performing funds over the last five years based on parameters such as their returns over the last five years, fund manager’s track record and investment strategy, etc.

Groww has segregated the mutual fund schemes into equity funds, tax-saving funds and debt funds. These are the 3 most popular categories of mutual funds.

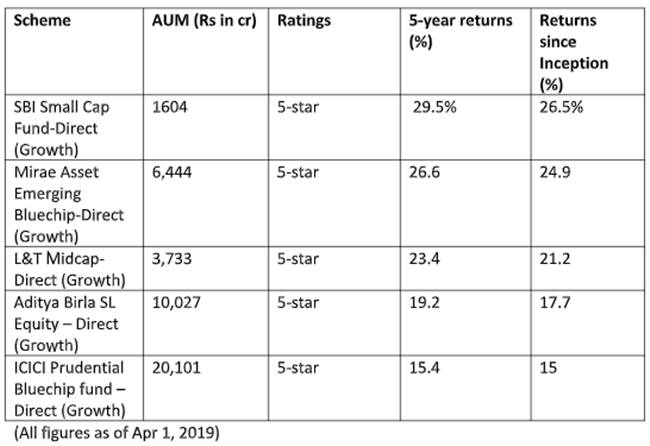

Equity Funds:

All the schemes are the top-performing funds in their category and the returns generated over five years are higher than the benchmark. As expected, the mid-cap and small-cap funds have given better returns compared to the large-caps since over the last five years there was quite a big rally in the small-cap and mid-cap sector.

Investors need to understand that compared to large caps, small and mid-cap companies can grow faster but there is also a higher risk associated with them. When investing in the schemes that we have listed above, investors should spread their investments across the schemes so that their risk is diversified. Small-cap funds perform better over the long term and, therefore, investors need to look at at least a 10 to 15-year horizon when investing in such schemes. Invest small amounts every month in these schemes in order to average out your costs.

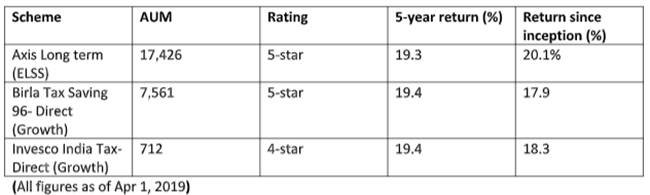

Tax-saving Funds:

Tax-saving funds or equity-linked savings schemes have a lock-in of 3 years, provide tax benefit under Section 80C of the Income Tax Act and investors need to factor this in when making their investments in such schemes. This means that these schemes cannot be redeemed for a period of three years from the date of investment. The positive side of this is it allows for the assets to grow.

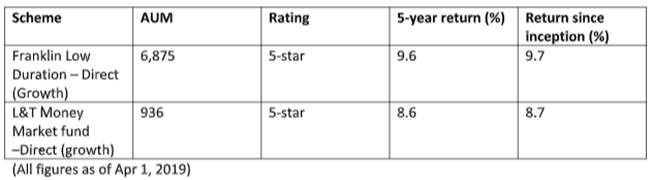

Debt Funds:

Compared to equity funds, debt fund returns will be lower, but they are much more stable – depending of course on the securities in which the schemes have invested.

The scheme from Franklin that we have chosen above invests in low-duration securities. Low-duration debt funds invest in securities which have maturities from a year to three years. The interest risk in short-term funds are much lower compared to long-term debt funds. Investors who are averse to risk can invest in such schemes.

The second scheme in our universe is a money market fund that invests in short-term securities of up to a year. This is ideal for cash management and parking surplus funds in the short term.

Disclaimer: The fund list is not advice from Groww. These are based on historical data. Please consult your financial advisor before investing in any of these schemes.