It’s easy to get sick. Anyone can get sick anytime. But who saves for an ailment? We might save for a dream holiday, a dream house or a child’s dream. But rarely do we set aside a chunk of our salaries for a gallbladder removal or a knee replacement. So if you suddenly find yourself in the middle of a medical emergency, you’ll probably have to sacrifice a dream or compromise a fund you saved for something else. That’s where Health Insurance steps in, so that one can have access to the best healthcare without fearing the financial strain.

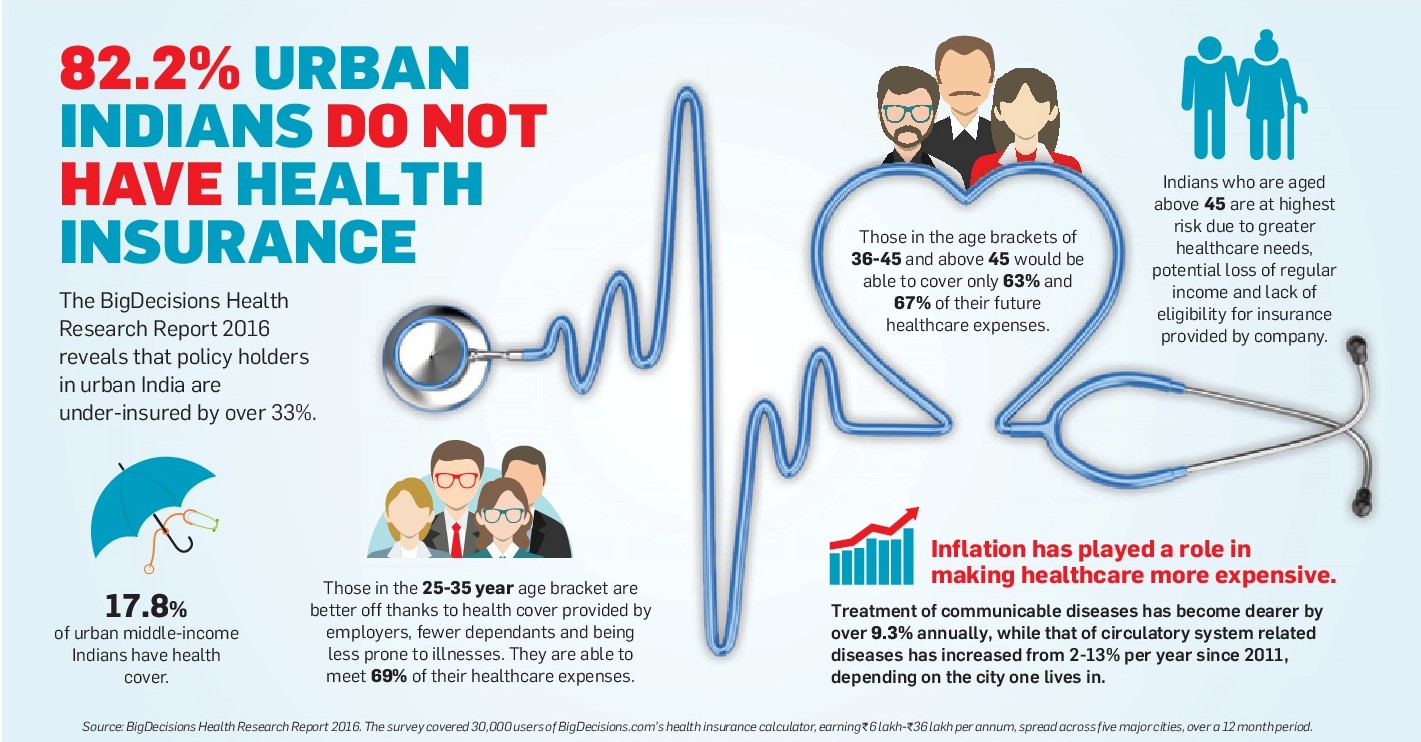

Healthcare, in India, has started giving people more faith in cure today. Today an angioplasty costs between Rs. 2-3 Lakhs. A knee replacement, Rs. 2.9 Lakhs. Hip resurfacing Rs. 3.2 Lakhs and renal failure about Rs. 5 Lakhs. To make matters worse, according to the recent World Bank report, 99% of Indians will have to face a financial crunch in case of a critical illness. That’s why it is imperative that each one of us has a good healthcare plan to take care of all our health needs.

Buying health insurance can be tricky for first-timers. There are tonnes of terms and conditions to navigate through, and then there are riders, top-ups and add-ons as well to be considered.

Look beyond premium: It is essential not to think of health insurance as an optional expenditure but as an absolute necessity. When you want to buy health insurance, don’t let the premium costs deter you. Instead, look at the various ways an insurance plan can cover you financially in case you require hospitalization.

Get a family floater: You can save money by having a family floater health cover where the benefits are shared by all family members.

Network hospitals: Check which hospitals have networked with the insurer. Seeking treatment at a local hospital which has tie-ups with your insurer will help you get cashless treatment.

Hospitalization charges: Any hospitalization is likely to be preceded and succeeded by medical tests, treatment and consultation which entail a significant cost. You can determine the extent to which various expenses would be covered under your health plan. Most health plans will cover at least 30 days of pre-hospitalization expenses and 30 days after.

Exclusions & waiting period: Every health insurance plan has exclusions and waiting periods associated with it. This means that some treatments or illnesses will not be covered under the plan, or be covered after the expiry of the waiting period. Waiting periods also expire in a layered manner. Waiting periods also apply to any pre-existing diseases which may not be covered for a specified number of years. Also, a health plan may not offer coverage in the first 30 days, subject to terms and conditions.

Check co-pay: Co-pay is the percentage of your medical expenses, incurred on hospitalization, that you agree to pay from your own pocket. Co-paying is one way of lowering premium costs. Any health plan with no co-pay will charge a higher premium than one offering the same benefits but with a higher co-pay.

Restoration benefits: Some insurance plans provide you the option of having your coverage amount restored in any year you exhaust it. For example, you may have spent the whole sum assured for the treatment of one disease. In the same coverage period, you may suffer from an illness unrelated to the previous illness and require hospitalization again. Under a restoration plan, your entire coverage is available to you again.

Check for no claim bonus: Some insurance products offer incentives for every year where insurance claims are not made. This is offered in the way of an increased sum assured.

You must take note of the fact that insurance premiums will increase as you grow older. It is recommended that you act early if you want to invest in a health insurance plan.