It’s that time of the year when my premium is due on a product, that I didn’t really need…. but got stuck with. It was sold to me as a highly recommended product, but turned out to be quite a dud!

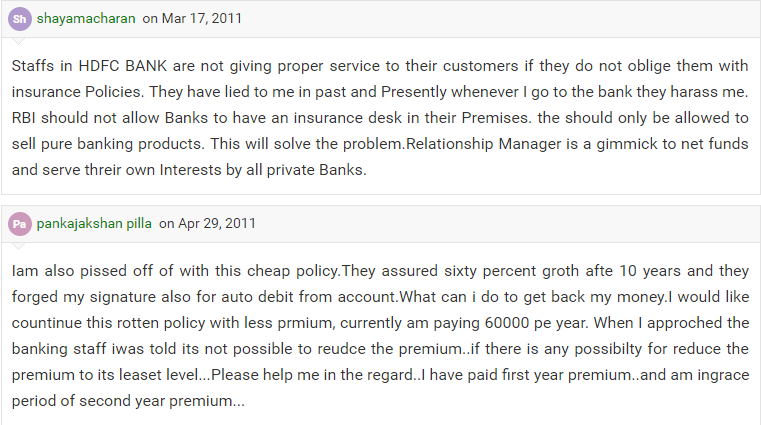

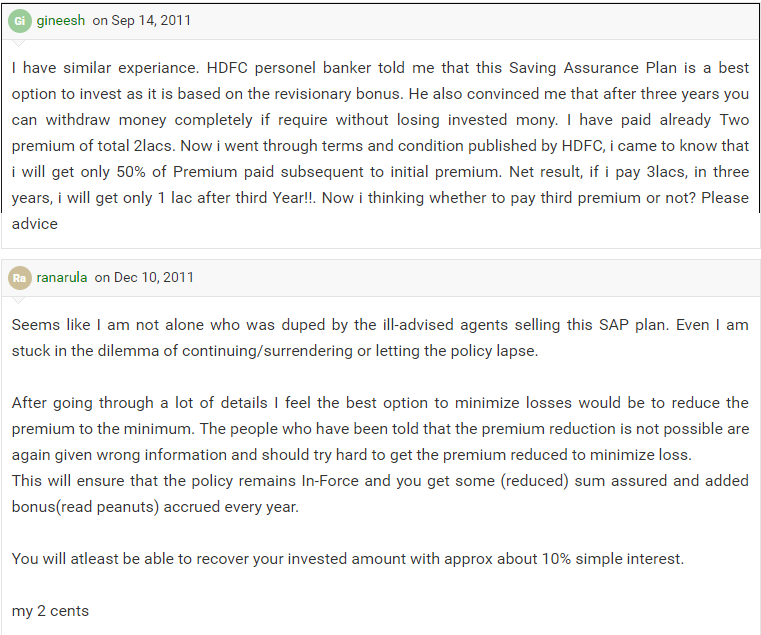

Googling the product, I came across quite a few people who have had a similar experience. Have a look!

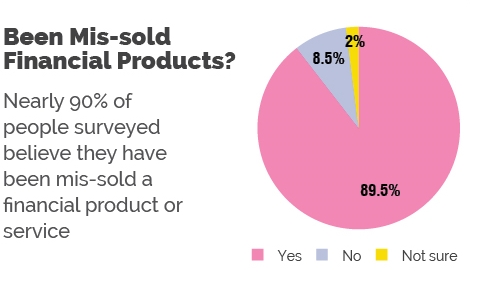

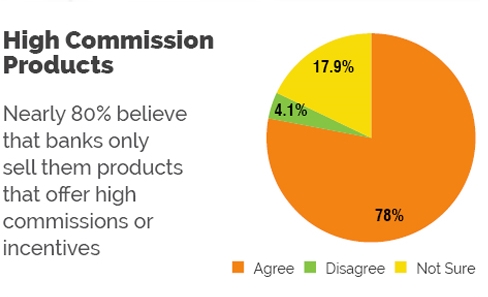

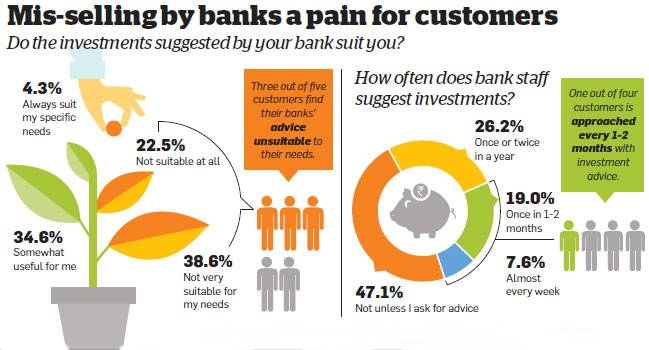

Anybody who has walked into a bank branch in a metropolitan city would have been pushed towards a financial product that he or she didn’t want. Worse, they may have been forced, cheated into or otherwise pushed towards buying life insurance policies. This advice may not be backed by a need analysis but by the commission the bank will earn if you buy the product. There is widespread belief that some bank branches are mis-selling insurance and churning mutual fund portfolios to get more commissions.

Mis-selling of financial products is difficult to catch because products are sold through a verbal sales pitch. In the case of banks, the sales are to existing bank customers who, because of the relationship with the bank, believe the sales pitch of their trusted bank official. Once the verbal spiel is over, the customer simply signs the documents pushed across the table by her own relationship manager.

You, as a customer, need to be careful when dealing with your bank. You should understand a product before buying it—ask as many questions as you want to fully grasp all the details. And do not take a hasty decision. Simple way to avoid being sold products you don’t need is to make your investments goal-based. Start with analysing your needs and buy products that will efficiently help you reach these goals.