The 10 character alpha-numeric Permanent Account Number (PAN) is a unique ID that every tax paying body in India needs to have.

Recently the government made it mandatory to provide both Aadhaar card number and PAN number while filing for taxes. “Mandatory quoting of Aadhaar/ Enrolment ID of Aadhaar application form, for filing of return of income and for making an application for allotment of Permanent Account Number with effect from 1st July, 2017,” a press statement said.

To link both the identifications, taxpayers first need to register on the Income tax website. Once registered, follow the steps listed below to link the two IDs.

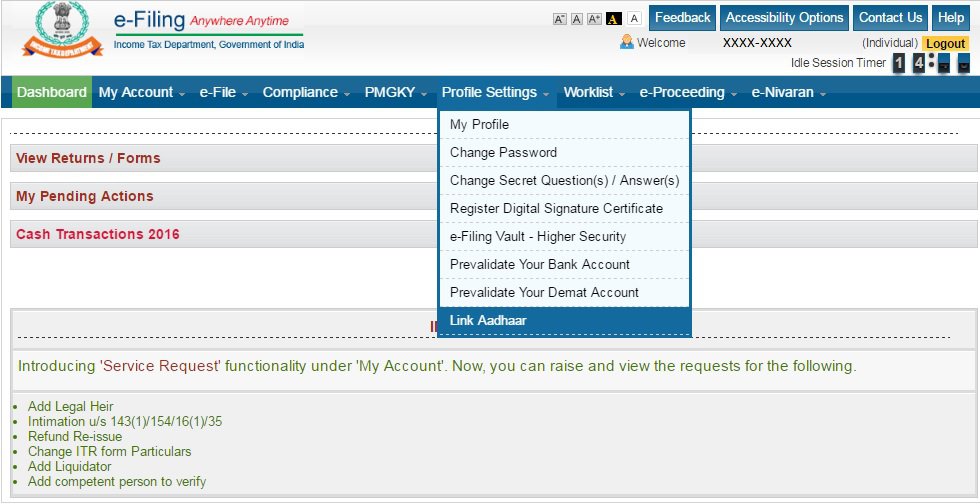

Step 1.

Log in to the e-Filing portal with your user id and password.

STEP 2.

In the various tabs on top of the page, click on profile settings. In the drop down, click on link Aadhaar.

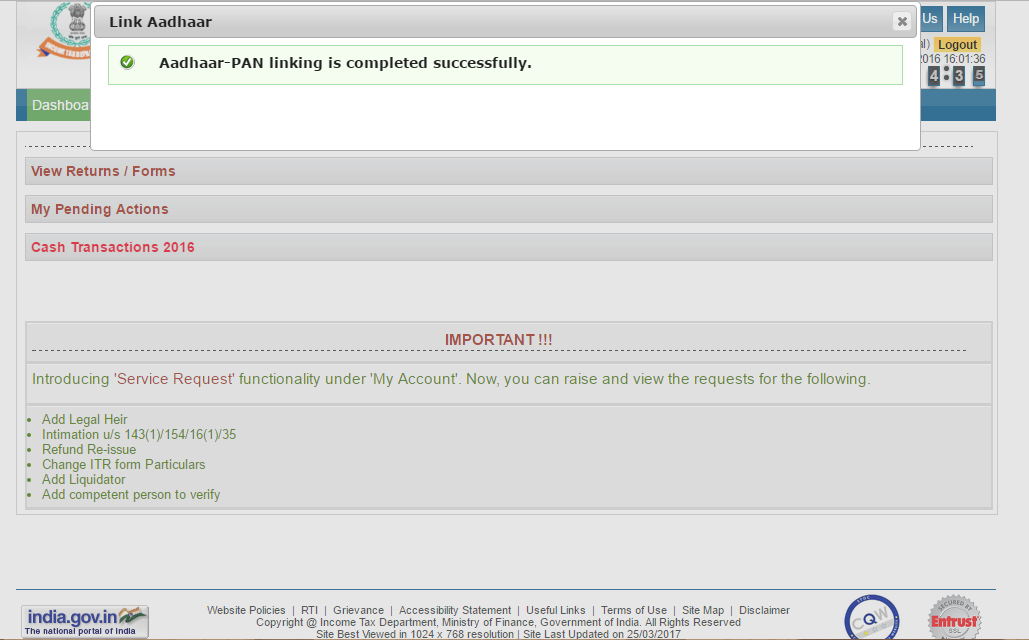

Step 3.

In the new page, you will see your personal details like name, date of birth etc. Verify the details on the screen with your Aadhaar card.

If they match, enter Aadhaar number and click on the ‘link now’ button.

You will receive a pop-up message saying – “Aadhaar-PAN linking is completed successfully”.