Let’s take a look at your various insurance options that help save tax, and also take a look at the returns-generating capacity of life insurance plans.

Saving Taxes Under Section 80 (C)

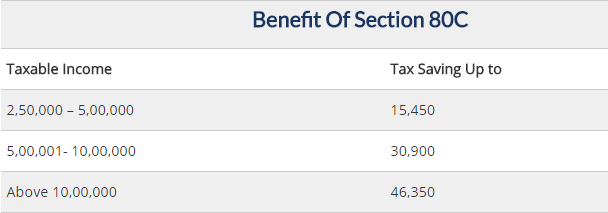

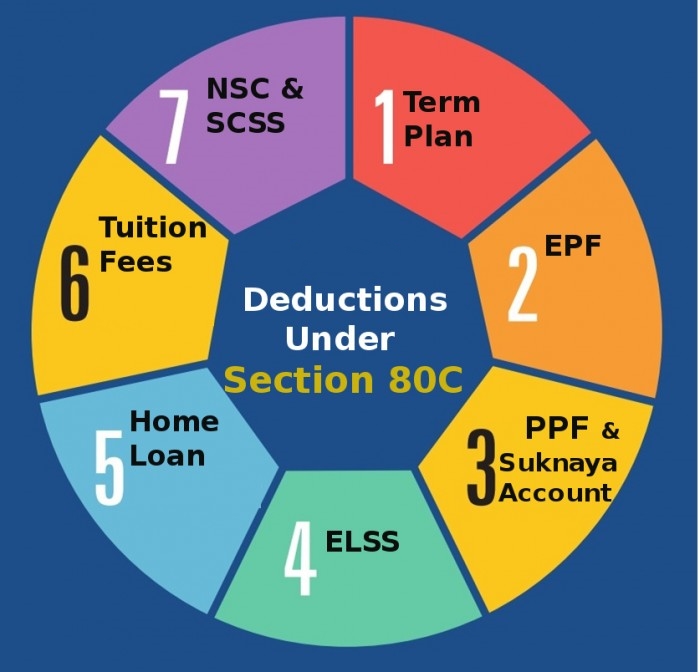

Section 80 (C) is where most people claim the largest part of their tax deductions. Popular investment and savings instruments that allow deductions under this section include Public Provident Fund (PPF), Sukanya Samriddhi Yojna, tax-saving fixed deposits, National Saving Certificates (NSCs), Post Office Deposits, life insurance schemes, principal payments on home loan, equity-linked saving schemes, etc. You can use one or all of these instruments in any combination to claim a total deduction of Rs.1,50,000 in a year.

Saving Tax Through Life Insurance

A policy which covers life risk of self and family members is eligible for tax exemption of up to Rs.1,50,000 under Section 80 (C). The bonus received under such insurance policies is also exempted from tax.

Life insurance policies can be of five types: whole life policy, money back plan, endowment policy (traditional policy), term policy and unit-linked plans (ULIP).

A whole life policy provides cover for the entire life of the insured and guarantees a sum assured to the nominee on the death of the insured person. The return offered, which includes the sum assured and bonuses, is close to 4% to 5% per annum. The maturity age for this policy is 100 years.

An endowment policy apart from offering risk cover for a specific period, between five years and thirty years, helps the policyholder save regularly to ensure a lump sum amount on maturity of the policy. The death benefit associated with this policy is comparatively higher than the whole life policy. There is also a facility of loan against this policy, allowing additional liquidity to the insured. Return from this policy over a period of time is around 5% per annum.

A money-back plan gives the insurers a part of the sum assured in regular intervals instead of a lump sum on maturity of the policy. It works like a regular income product. This plan is suitable for people who want to save through investment and maintain liquidity.

ULIPs are like mutual funds with life risk cover as an additional advantage. It allows high returns and insurance under the same plan. The returns are usually higher than other policies due to the exposure to the equity market.

Term plans are vanilla insurance products that cover the life risk of the insured but do not provide any return on the premium paid. The premium amount is low in comparison to other insurance products.

Saving Taxes Under Section 80D

Premiums paid for medical insurance are eligible for tax deductions.

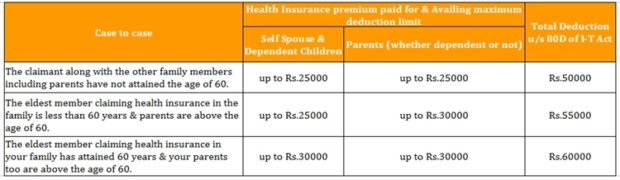

You can claim up to Rs.25,000 a year for yourself, spouse and dependent children. However, if you, your spouse or dependent children are above the age of 60, you claim up to Rs.30,000 in deductions.

Additionally, you can claim tax deductions for insurance premiums for your parents. You can claim up to Rs.25,000 for your parents if they are under the age of 60, or Rs.30,000 if any one or both of them is above 60. This gives you a minimum tax deduction limit of Rs.50,000 and a maximum limit of Rs.60,000 for insurance premiums paid.

Additionally, you can claim Rs.5,000 for preventive health checks each year, giving you a maximum tax deduction of Rs.65,000.

Section 80 (D) also has a provision for uninsured persons above the age of 80. Even if they do not have a health insurance on which they could have claimed deductions for premiums paid, they can claim up to Rs.30,000 a year in medical expenses.

Premiums paid for a variety of health insurance products are eligible for tax deductions under Section 80 (D). The section covers not only the plain health plans, but also for family floater plans, unit-linked health plans, critical illness plans, and OPD plans.