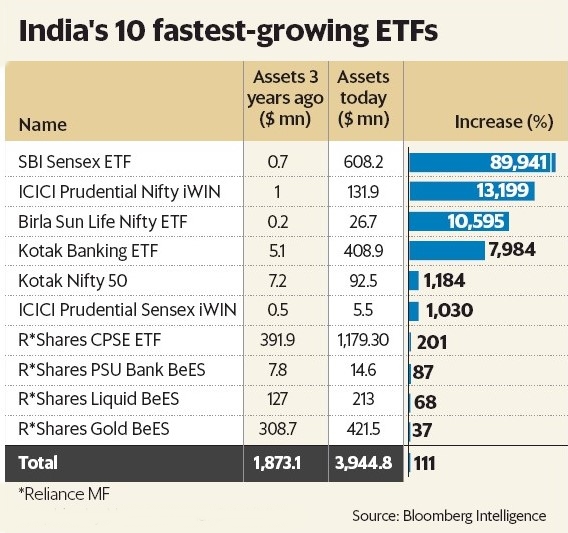

India has the world’s second fastest growing exchange traded funds market, behind only Japan, with assets more than doubling to $4 billion from $1.9 billion in the past three years, a Bloomberg Intelligence report said. About a third of the boost came via the Reliance Mutual Fund’s CPSE ETF.

The CPSE ETF was launched by Goldman Sachs Asset Management India on 18 March 2014, and comprises 10 stocks, which are majority owned by the Indian government: Oil and Natural Gas Corp. Ltd, GAIL (India) Ltd, Coal India Ltd, Rural Electrification Corp. Ltd, Oil India Ltd, Indian Oil Corp. Ltd, Power Finance Corp. Ltd, Container Corp. of India Ltd, Bharat Electronics Ltd and Engineers India Ltd. Currently, Reliance Mutual Fund manages the CPSE ETF after Goldman Sachs exited the mutual fund business in India.

The ETF was tailor-made for the centre to sell its stake in certain firms and has gained 47% last year. The National Stock Exchange’s PSU index has gained 44.6% in the last one year; benchmark 50-share Nifty added 19.5%. Institutions such as Employees’ Provident Fund Organization committing huge investments to this fund.