As compared to a single instrument such as a bond, or government security or a non-convertible debenture, debt funds help you diversify. Any portfolio of a debt fund has 8-10 different papers, or even more, which mitigates single party risks. Debt mutual funds invest in instruments like bank CD, commercial paper, government securities, or corporate bonds.

You can get a soft copy of a mutual fund statement.Even if you lose a mutual fund statement, it does not matter. You just need to sign on a redemption slip and submit it to the fund house to get your money back. Compared to this, a bank fixed deposit receipt, if lost, could create a lot of hurdles and paperwork.

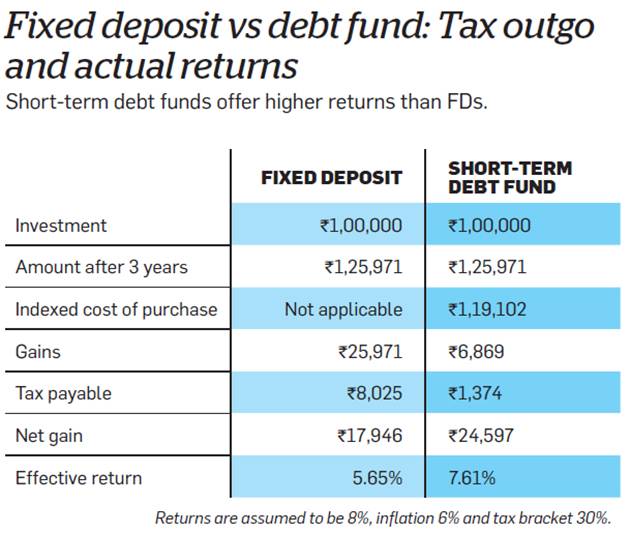

There is no TDS in debt mutual funds and if held for three years, one can avail indexation benefit and minimise their tax outflow. If there is a need to withdraw money ,a debt mutual fund can be broken into units of Re.1 and investors can withdraw only the required amount. In a small-saving product or a fixed deposit, you need to break the entire deposit.

Interest rates typically rise when the economy is growing, and fall during economic downturns. Bond prices and interest rates are inversely related. When interest rates rise, bond prices fall and vice versa. Interest rate risk is present in all debt funds but the degree could vary. Gilt funds with longer maturity carry higher interest rate while it is negligible or very low in liquid funds. A credit risk is the risk of default on a debt security that may arise from a borrower failing to make required payments. If any of the companies, whose paper the fund owns, does not pay up when it comes up for repayment, the funds’ NAV could suffer to that extent. The fund manager also has to ensure the scheme is liquid to the extent that the fund has the ability to move in and out of a scheme without impacting its value or price.