Central Public Sector Enterprises ETF, which functions like a mutual fund scheme, comprises scrips of 10 bluechip government firms—ONGC, Coal India, IOC, GAIL, Oil India, PFC, Bharat Electronics, REC, Engineers India and Container Corporation of India. The Further Fund Offer FFO, which will close on January 20, is part of the government’s disinvestment programme.

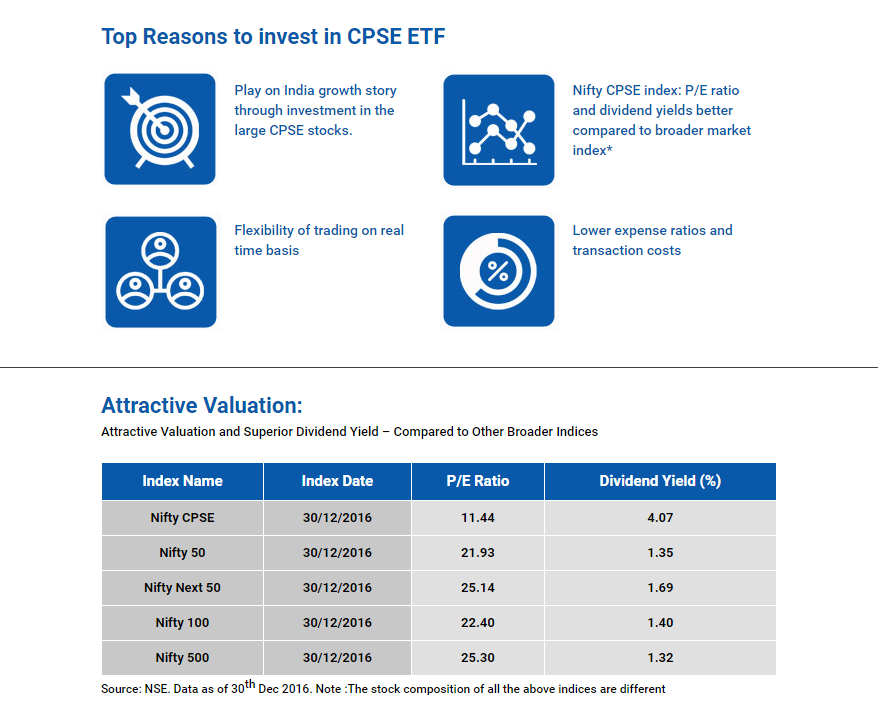

The issue will offer 5% discount to all investors. One of the major advantages of CPSE ETF is the lower expense ratio of 6.5 basis points as compared with up to 250 bps for other non-ETF products.

The government had launched its first CPSE ETF in March 2014, taking the ETF route to disinvestment for the first time. The first CPSE ETF has given an annualised return of 14.2% since inception, outperforming the Nifty CPSE Index which gave a return of 6.25%. The ETF has an energy-biased portfolio and the performance would depend on the price of crude, coal, etc.

As ETFs are passively managed funds like index funds, they replicate performance of a benchmark index by holding securities in the same ratio as the underlying index. CPSE ETF is benchmarked against Nifty CPSE Index. The minimum amount of investment for individual or retail investors is Rs.5,000 and the maximum amount is Rs.2 lakh. If one invests more than Rs.2 lakh, then he will not be considered a retail investor. The units will be listed on BSE and NSE on or before February 10, 2017 and one can exit in the secondary market. CPSE ETF gets tax treatment of equity shares or equity mutual fund units. So, capital gains resulting from sale of ETF units within one year will attract capital gains tax of 15%. Long term capital gains, on holding the units for over one year, will be exempt from income tax.

Remember that buying or selling an ETF involves brokerage.

One of the main advantages of investing in an index ETF is that you can sell and buy at real-time prices rather than waiting for the closing of the day to determine the price. Also, one can get access to the equity market but with limited risk. Moreover, the risk of the fund manager’s discretion is eliminated.