Post demonetisation, the government has been trying various means to enhance the digital payment experience of customers at retail merchant locations. Along with Unified Payments Interface or card swiping on point of sales machines, the government has introduced QR code based payment which can be done through the customer’s smartphone.

QR Code stands for Quick Response Code which is a matrix bar code designed specially to contain information about the thing on which it is placed. It might be used as a sticker on a product which contains the details of it or might be stuck on a shop window which can contain account details about the specific merchant.

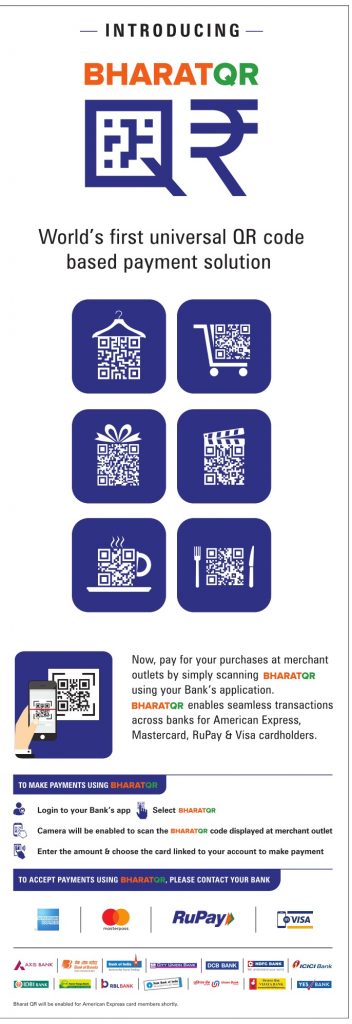

BharatQR is a matrix of bar codes that has been developed by leading payment companies of the country: Visa, Mastercard, National Payments Corporation of India (RuPay), and American Express-to develop a complete digital payments infrastructure at retail merchant outlets.

The QRCode would be printed on a placard at merchant outlets for customers to scan and pay .

The main reason for BharatQR is, it is ideal for small roadside merchants who find it tough to invest in point-of-sale terminals for card payments. For them, BharatQR is an asset-light and cheap payment solution. There is no need to invest on a terminal hardware, the merchant just needs a smartphone and a QR code printed sticker to accept digital payments.

The RBI has instructed the payment companies to develop the solution and then pass it on to banks which are expected to hand over printed QR codes to merchants who are current account holders with the bank. This ensures there’s inter-operability and customers will not have to bother which mobile wallet app to use or which bank’s app to pay with.

The consumer after buying an article will need to open his bank’s mobile banking application, put the pin number of his debit card, switch on the camera, scan the QR code, and pay instantly to the merchant’s account. The only thing that the customer needs to do is to map the bank’s debit card with that mobile banking application to ensure instant recognition.

BharatQR has gone live with 14 banks. All the major ones like SBI, ICICI Bank, HDFC Bank, Axis Bank and others will start enrolling its merchants on BharatQR so that they can start accepting payments. Customers with any of these banks will be able to make as well as collect payments via scanning of QR codes. In the second phase, NPCI is planning to introduce payment means through IFS code, Aadhaar Pay and even Unified Payments Interface.