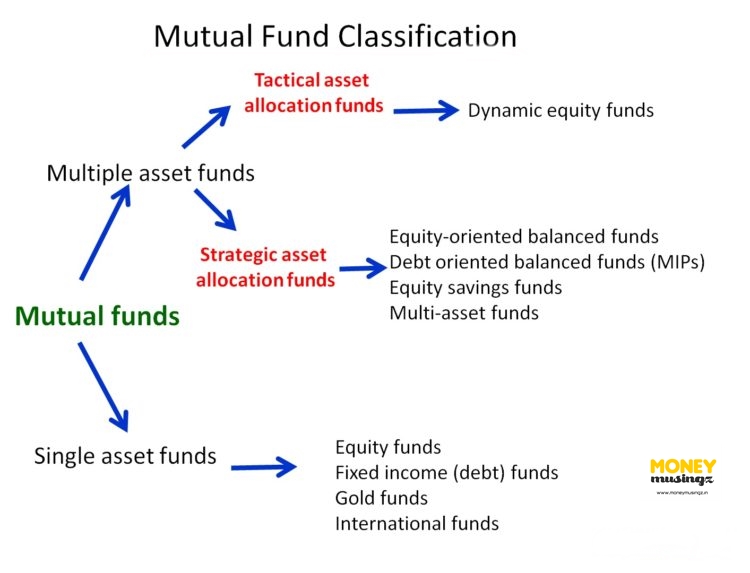

Dynamic Equity funds dynamically manage their equity portfolios, investing more when markets are down and less when they are up. These funds have a mix of debt and equity in their portfolio.

They allocate less to equities when market valuations appear expensive, and increase allocation when market valuations appear cheap. The equity portion of the portfolio would vary depending on the method of calculation. Each fund house uses a different method of calculation, which is either based on the simple Nifty PE or an in-house proprietary model to assess valuations.

Since dynamic equity funds tend to hold higher cash in prolonged rallies, they may under perform during strong market conditions. Dynamic equity funds automatically re-balance portfolios and hence it is recommended for first-time equity investors with a low risk appetite. If the market was to enter a corrective mode, dynamic funds with a lower allocation to equities could see a lower erosion in their NAV as compared to a pure equity fund. The volatility of returns in these funds is lower than that in diversified funds and even their returns could be lower. In the current scenario, dynamic equity funds have under performed compared to diversified equity funds over time. Dynamic equity funds may be suitable for those who are very conscious of market valuations and are wary of over-valued markets.

A big advantage of these funds is that they are structured in such a way that they are taxed as equity funds for investors. Most funds when they lower their exposure to equities ensure that equity plus arbitrage component of the scheme is at least 65% of the corpus, which helps it qualify for equity taxation. When the fund qualifies for equity taxation, investors who hold the fund for one year, need need not pay long-term capital gains tax, making the investments tax free.

Given their flexible structure, dynamic asset allocation funds should be best suited to capture market opportunities, but the aggressive re-balancing sometimes acts as a handicap for the funds as they cannot capture the market upside effectively. That is why experts say balanced funds are a better choice for managing risk for most investors.

Most dynamic and asset allocation funds don’t have a long-term track record. The oldest of the lot was launched in October 2003. Few others had different avatars earlier. L&T Dynamic Equity Fund was earlier a children’s education focused hybrid scheme. Kotak Asset Allocator Fund used to invest only in equity funds and in other fund houses’ equity schemes. In September 2014, it changed strategy to also include debt funds, and only in-house schemes.