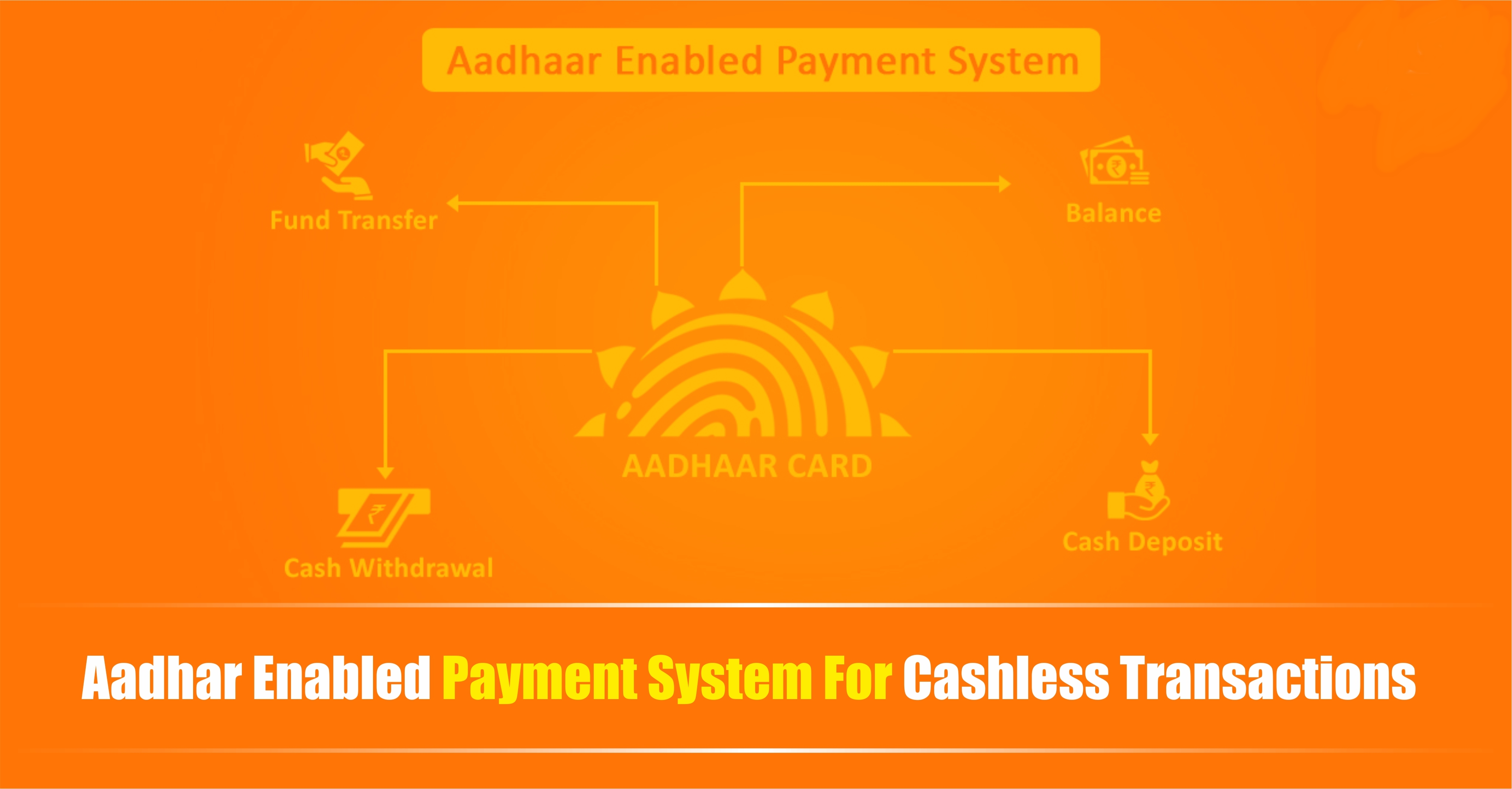

Payments that can be done with the help of authentication and identification through the Aadhaar database is referred to as the Aadhaar Enabled Payment Systems. This is the new form of payment that is being promoted by the government to push for digital payments instead of cash transactions.

Major types of Aadhaar Enabled Payments:

The first type of payment is Aadhaar Bridge Payment System which is meant for direct benefit transfer and subsidy payments from the government to the beneficiaries. The second is AEPS which is used at the level of the business correspondent or `bank mitras’ where bank customers can use Aadhaar to access various services like cash withdrawal, account opening and fund transfer even without going to a bank branch.

The third is Aadhaar Pay wherein merchants can accept payments through Aadhaar identification of their customers.

These forms of payments are being promoted by the government specifically for the under privileged sections of the society and the rural poor who are not comfortable using cards or mobile wallets for payments.Instead of a mobile phone or a plastic card, in these forms of payments, the mode of authentication becomes the Aadhaar number and biometrics.

National Payments Corporation of India is the nodal authority for all Aadhaar-enabled payments in collaboration with banks. The payment company is trying to get as many banks to seed their customers’ accounts with their Aadhaar number so that payments can flow smoothly .

Aahdaar Bridge Payment (ABPS): This is meant for recur ring payments done by the government to its customers for various subsidies as well as direct benefit transfer. Here the beneficiary is identified through an Aadhaar number, then NPCI manages an Aadhaar Mapper where the Aadhaar number is mapped to a specific bank account and the money flows to the connected bank account.

Aadhaar Enabled Payment (AEPS): Here the customer has to approach a business correspondent (BC), use his Aadhaar number and biometrics which the BC shares with NPCI, which checks the ID with UIDAI (Unique Identification Authority of India) to confirm the customer’s identity . It also checks the funds in the connected account and allows the transaction.

Aadhaar Pay: This is for merchant payments where the merchant will download the merchant payments app of his bank, authenticate the customer through his biometrics and Aadhaar number and initiate a pull transaction.