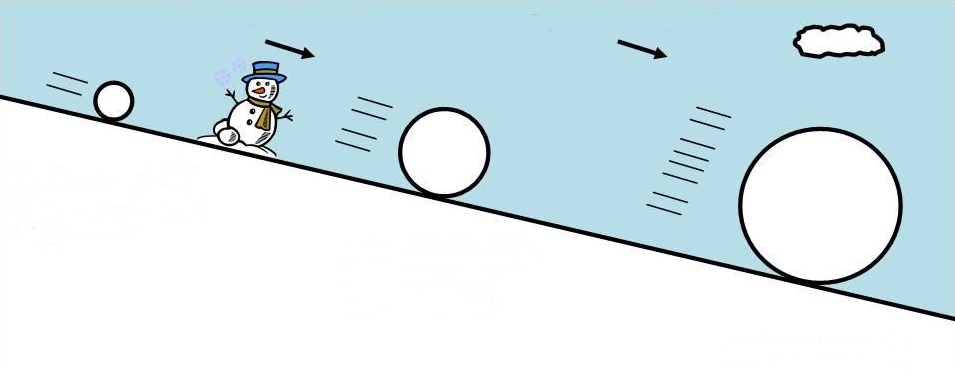

Definition of “a snowball effect” in the Cambridge Dictionary is a situation in which something increases in size or importance at a faster and faster rate.

When you push a small snowball down a hill, it continuously picks up snow. When it reaches the bottom of the hill it is a giant snow boulder. The snowball compounds during its travel down the hill. The bigger it gets, the more snow it packs on with each revolution.

The snowball effect is a metaphor for compounding. It explains how small actions carried out over time can lead to big results.

The concept is this. When you invest money you earn interest on your capital. The next year you earn interest on both your original capital and the interest from the first year. In the third year you earn interest on your capital and the first two years’ interest. You get the picture. The concept of earning interest on your interest is the miracle of compounding.

It’s very much like a snowball effect. As your capital rolls down the hill it becomes bigger and bigger. Even if you start with a small snowball, given enough time, you can end up with an extremely large snowball indeed.

Keep in mind that compounding is not a get rich quick scheme. It takes time – and lots of it.

The earlier you start investing, the more time you leave for the miracle of compound interest to take effect.

Small differences in return matter. A lot! The difference between investing at, say, 7% and 8% is enormous.

Over time, regular saving of quite small amounts can build up an astonishing sum of money.

Time and patience are the friends of compounding and, therefore, of investing.

Compounding interest at its core is best served by conservative investing. Someone who chases speculative investments won’t see the power of compounding interest. An investor whose primary concern is compounding interest will instead look for an investment that is growing slowly and surely. Like the tortoise who plods along at a painstakingly slow pace, an intelligent conservative investment will beat out any high flying investment trend of the day.

One of the best pieces of investment advice you can get is simply this: “Invest the same amount every month and be consistent/diligent over a long period of time.” The name for this investment strategy is Rupee Cost Averaging. Compounding interest is best pursued when you are rupee cost averaging. Use this system to your advantage. It builds on the snowball effect. You keep getting interest on interest and your invested amount continues to grow.

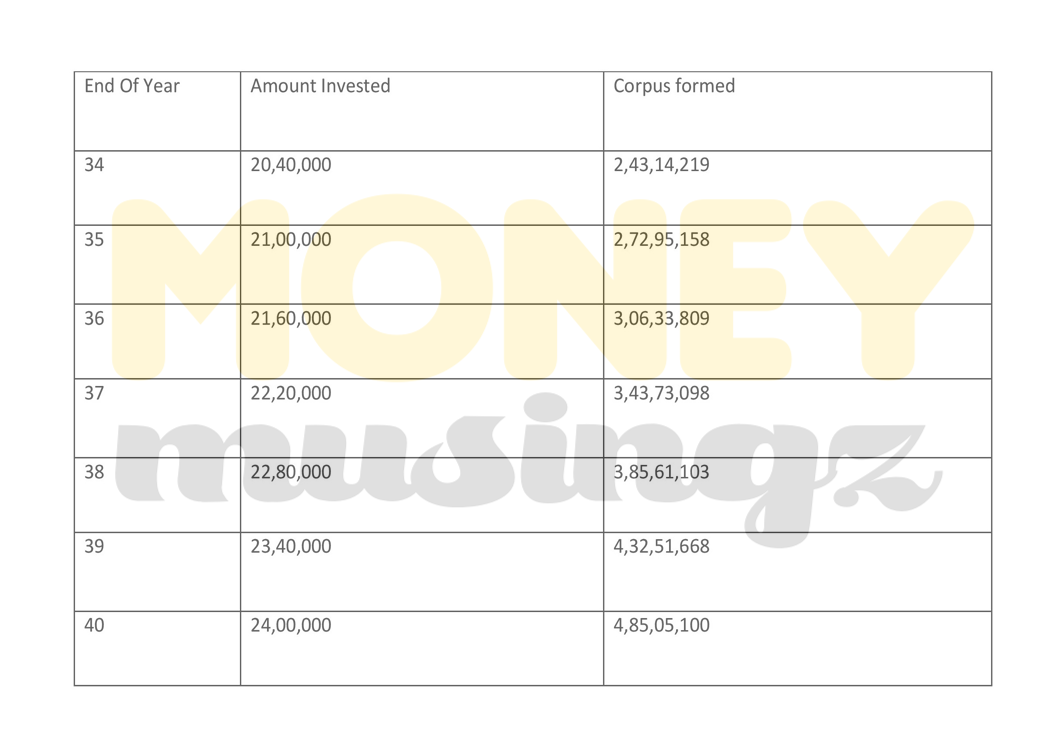

If a person invests Rs.5,000 a month for 35 years and his investment fetches a return of 12% pa….his investment would grow to a whopping Rs.2.72 crores. If he keeps investing for another 5 years, his investment would grow to Rs.4.85 crores for an addition of just Rs.3 lakhs !!